ETF Stream’sCrypto 2025 event saw ETF industry participants speak on topics including bitcoin versus gold, crypto sectors, multi-asset indices and regulation in the digital assets space.

The space has undoubtedly gone through a period of drastic development in recent years, from no exchange-traded products (ETP) just a few years ago to more than 70 on the market today, according to data from Bloomberg Intelligence.

Despite long-time resistance from the Securities and Exchange Commission (SEC), the first bitcoin ETFs have entered the US market and in Europe, large players such as Invesco, Fidelity and WisdomTree have all thrown their hats in the ring.

The elevator pitch

Evidencing the asset class’s popularity, Matt Hougan, CIO at Bitwise, said the CFA Institute’s crypto guide has been the non-profit’s most downloaded guide in its history.

While acting as a disruptive force like online card payments for fintech and eCommerce or single mail protocol transfers (SMPT) for mail, Hougan argued crypto is still surrounded by false perceptions.

“There is a common misunderstanding of crypto assets as a currency because of the name and people expect to use them like US dollars, pounds, euros or yen,” Hougan said.

“We need to shift from thinking about crypto as a currency to thinking of it as a technology that brings money into the internet era.”

Regarding the blockchain protocols that underly these assets, Hougan said they can be used to make billion-dollar transfers in “a matter of seconds” and would cost around $2, versus the higher cost, more time and a larger staff required at a traditional firm.

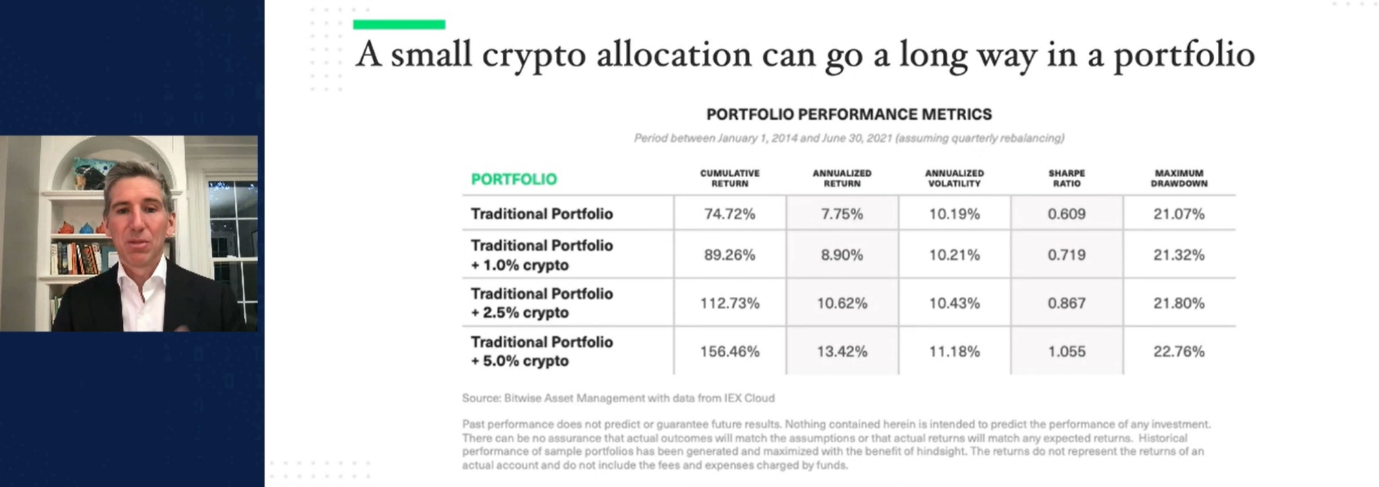

He concluded by illustrating the impact of even a small crypto allocation has had on portfolios since 2014 (see chart below).

Source: Bitwise

Gaining scale

Global X’s research analysts Pedro Paladrani, and Christian Hazim then examined how some of the main cryptos have boomed in recent years.

Hazim noted how more than a quarter of a million bitcoin transactions are now processed each day, with the supply of remaining unmined coins set to half every four years, on average.

Looking at ethereum, he added the token processes around 1.1 million transactions per day, up from fewer than 100,000 four years ago.

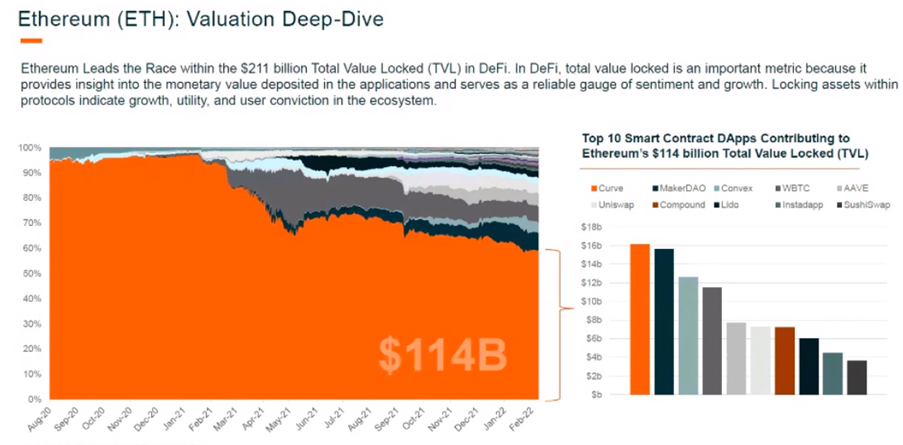

It also leads the way in the $211bn total value locked (TVL) in decentralised finance (DeFi), though its stake is being eroded by the rise of other tokens.

Source: Global X

Reflecting on smart contracts and other uses for crypto, Paladrani concluded: “We are in the very early innings of applications of cryptocurrencies.”

Crypto by sector

Continuing, 21Shares head of distribution EMEA Isabell Moessler said there could be as many as a billion crypto users by the end of the year.

However, the industry’s scale remains comparatively modest. Quantifying this, Moessler said the derivatives market is worth as much as $610trn and global equities come to a total of $125trn – whereas the crypto industry has a market cap of $1.7trn.

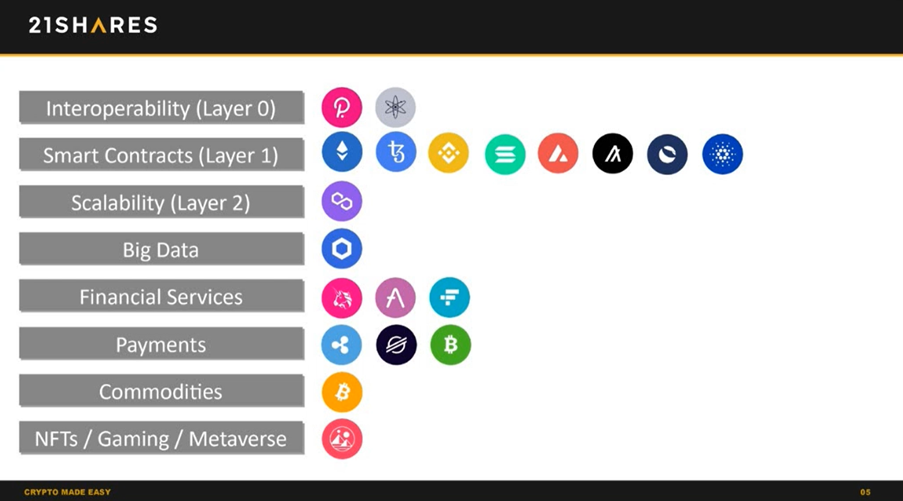

Not only is this sum spread across 18,000 different assets but crucially, Moessler noted, they can be distinguished by their respective functions, including smart contracts, payments, commodities, financial services, big data, scalability, interoperability and Web3 industries.

Source: 21Shares

Bitcoin as the new digital gold?

While both bitcoin and gold have some element of scarcity, the panel at the event felt the comparison between the two assets is at times contrived.

Benjamin Dean, director of digital assets at WisdomTree, said: “Digital gold is an analogy is that sometimes holds and sometimes does not.”

He added while both might be viewed as safe havens to an extent, the ability to access bitcoin across borders and intangibility makes it “more useful than gold”. He also noted the crypto’s volatility is far higher.

“Some institutional clients love the volatility; they know it creates opportunities. Others do not like it and they have small exposures,” Dean said.

Echoing his thoughts, Jacob Hetzel, head of distribution at Scalable Capital, added bitcoin is the new gold, “of some sort”.

He continued, stating that while bitcoin will not replace gold, investors may ask for a percentage or so of exposure in multi-asset portfolios over the next decade.

Charlie Morris, CIO at ByteTree Asset Management, said 17.5% of all ETFs were in gold in 2011 which is down to 3.5% today. Meanwhile, bitcoins held in ETFs recently hit an all-time high.

He added: “Bitcoin is exciting, it is here to stay and it should be a bigger part of wealth management.”

Diversified crypto

Martin Leinweber, digital asset strategist at MVIS Indices, then discussed a way of having crypto exposure without having to pick winners.

“Diversification is the only free lunch in finance. It works in other assets, so why would it not work in crypto?

“As bitcoin’s dominance has fallen from an 80% market share to around 40%, investors should also include other protocols in their allocations,” Leinweber argued.

While a global market portfolio of 50% equities, 45% bonds and 5% commodities offered annualised returns of 4.2% over the past seven years, as at January, the same portfolio with a 5% bitcoin allocation returned 8.5% a year.

Even more impressively, a global portfolio with the same exposure to the MVIS Top Ten Crypto basket would have booked annualised returns of 10.1% over the same period.

Regulatory divergence

Closing the event, Monica Gogna, UK head of financial regulation at EY Law, highlighted differences between the EU and UK approaches to regulating crypto as a key consideration.

In recent years, the European approach has been shaped by the goal of protecting end investors. Going forward, the EU’s Markets in crypto-assets regulation (MiCA) and the Financial Conduct Authority’s (FCA) new consumer principle will be developments to watch.

While MiCA discussions are currently around how to efficiently use energy resources, Gogna said the FCA is being more granular, also looking at advertisements associated with crypto and the need to market crypto to retail appropriately

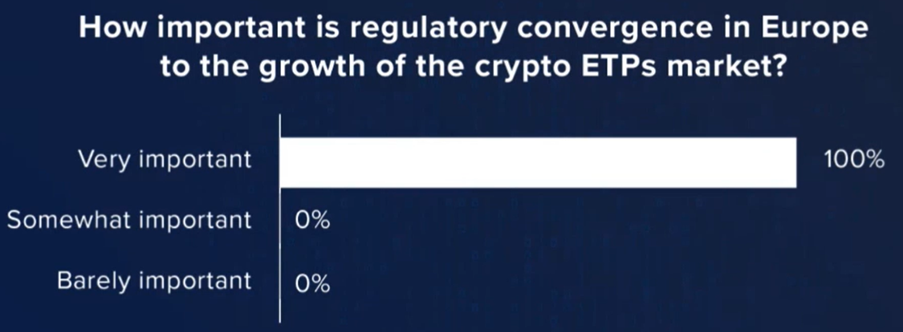

In a poll, attendees of the event resoundingly agreed regulatory alignment is important to crypto’s continued growth.

Source: ETF Stream

To watch on demand recordings of each session, click here.

Related articles