The German exchange, Deutsche Boerse, has introduced a liquidity indicator in its bid to improve transparency within ETF trading.

Germany being one of the leading ETF markets in Europe, the exchange currently has 1,383 ETF available with an average monthly trading volume of around 13 billion euros.

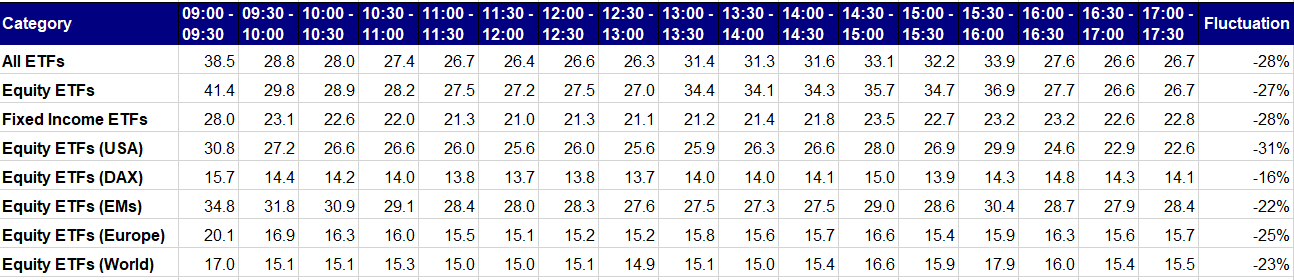

The intraday Xetra Liquidity Measure (iXLM) enables investors to regularly track the average daily trading costs of an ETF over a monthly period. Providing data over 30-minutes intervals, investors can check the spread price from 9:00 am until 5:30 pm.

The market is most volatile in the morning as investors are reacting to the Asian market which opens several hours before Germany's, according to Stephan Kraus, head of Deutsche Börse's ETF segment. As the day goes on and investors start to perform their investment decisions, volatility calms and the spread price falls.

The exchange hopes improving transparency will not only refine the trading experience for current ETF investors but will also be an opportunity for non-ETF investors to start including the investment products into their portfolios. Access to historical data offers investors and analysts the opportunity to spot specific trends within the market and can introduce this as a factor for future investment decisions.

Depending on the time, the implicit transaction costs can have a fluctuation of 30% from its highest cost in the morning to its lowest cost in the afternoon.

Source: Deutsche Boerse

The table above shows the average transactional costs for each 30-minute interval for each equity category for the month of January 2019. The costs for USA equity ETFs changed by 31% from its opening spread price with the smallest change coming from DAX equity ETFs with a 16% decrease.

Stephan Kraus said to ETF Stream: "The iXLM can change the way institutions and individuals invest in ETFs. Now being able to access historical transactional costs, investors could save in excess of 30% depending on the time of day they purchase the ETF. We hope this not only improves the experience for current investors but will attract more investors into the market."