The benefits ETFs offer are available to everyone - but only the rich seem interested.

The ETF industry prides itself on "democratising investing". On disrupting the travelling caravan of mutual fund managers, brokers and other "men in cufflinks" that make savers retire poorer.

Whereas mutual funds are on a purely commercial mission, the ETF industry has prided itself on also having a social mission. By ending high fees and exposing Wall St "croupiers", the ETF industry hoped everyone can retire richer and happier.

But how true is the self-perception? Not very, a new study suggests.

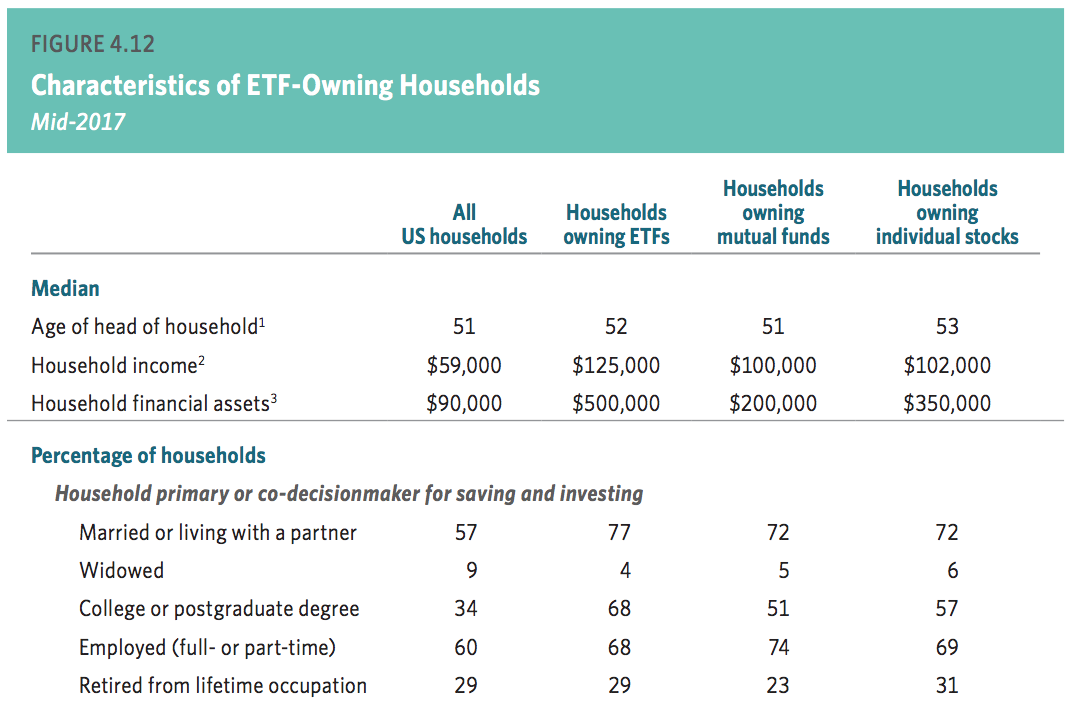

US ETF owners are twice as rich as mutual fund owners, a new survey by the Investment Company Institute, a Washington-based industry think tank, has found. The median household financial assets held by ETF-owning families was $500,000 - more than double that of mutual fund-owning families and more than quadruple the national average.

[caption id="attachment_3887" align="alignnone" width="546"] Source: ICI[/caption]

"ETF-owning households tended to include affluent investors who owned a range of equity and fixed income investments… [they] tended to have household incomes above the national median," the report concluded.

Given that financial assets like ETFs are a marker of wealth, one would expect rich families to own more ETFs than poor families. After all, rich families also own more property, shares, bonds - and every other asset.

But what the report found was a skew. That is, rich families stash a bigger fraction of their wealth in ETFs and more likely to pick ETFs over other types of fund on a dollar-for-dollar basis.

As ETFs are cheaper and more accessible than mutual funds, the skew is unlikely to have much to do with affordability. Instead, the ownership gap more likely stems from education and willingness to take risks, the report found.

"ETF-owning households also exhibit some characteristics that distinguish them from other households. For example, ETF-owning households tended to have higher education levels and greater household financial assets," it said.

"They also exhibit more willingness to take investment risk. 52% of ETF-owning households were willing to take substantial or above-average investment risk for substantial or above-average gain in 2017, compared with… 34% of mutual fund-owning households."

It added that the greater willingness of ETF owners to take on risk may also partly explain why equity ETFs have proliferated so much faster than bonds, cash and other lower-risk asset class ETFs.

Other insights

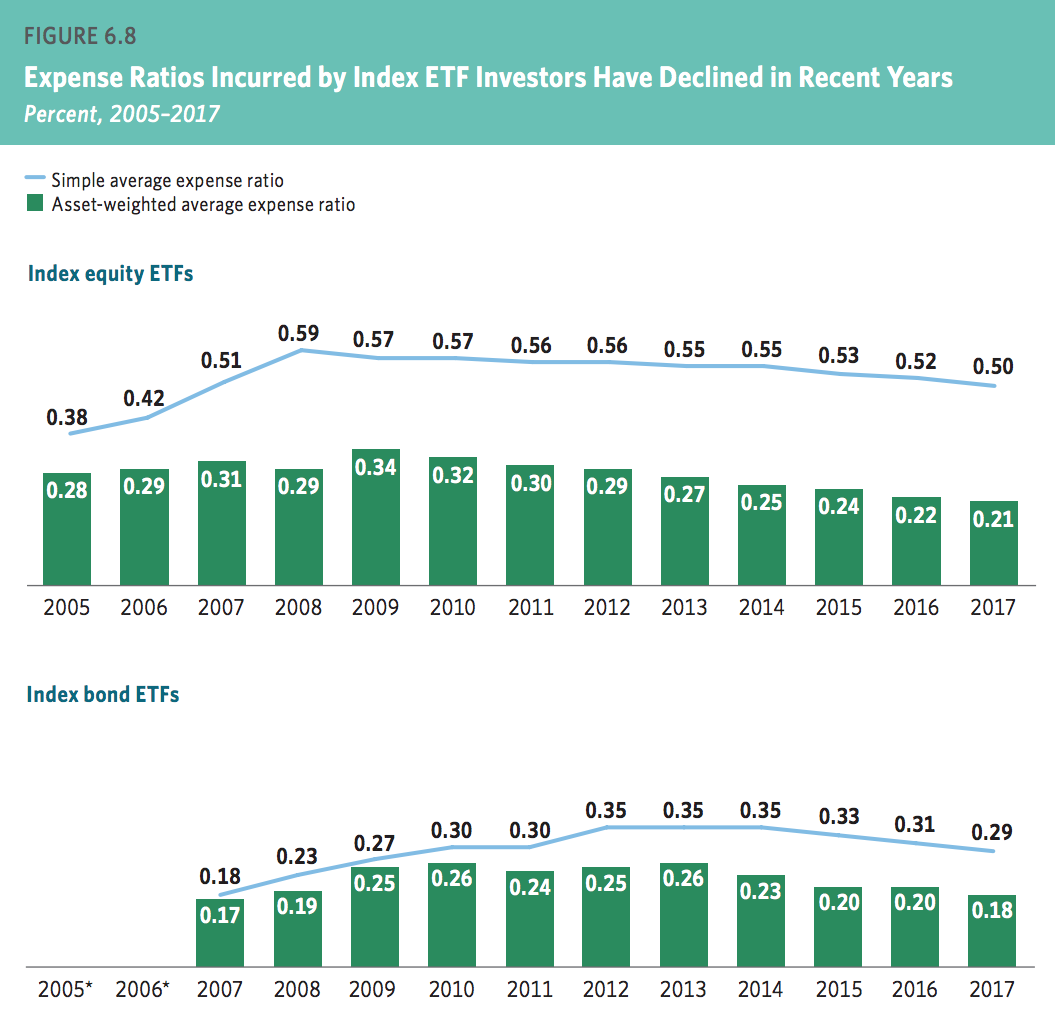

ETFs inflows were increasingly correlating with fees the report also found. The average fee for equity ETFs is 50bps - roughly in line with the historical average. Yet the average fee shareholders actually paid (the "asset-weighted average") was only 21 bps - an all-time low.

The difference shows a clear preference for cheapness among investors. And shows a greater willingness among ETF providers to roll out lower fee products in areas they know will attract assets.

[caption id="attachment_3889" align="alignnone" width="539"] Source: ICI[/caption]

In what may offer a forewarning for ETFs, the report found the average cost of an index mutual fund was now down to 9bps. The ultra-low cost was a result of increasing concentration of assets in fewer and fewer funds, it said. There was no reason given why something similar could not happen to index ETFs, which track the same indexes as mutual funds are often provided by the same companies.

For ETF providers that fail to take note and lower fees, there's always the ETF graveyard. The death rate for ETFs is steadily rising, with the number of US funds delisted hitting 114 in 2017, up from 46 five years earlier and almost none a decade prior.

"Few ETFs had been liquidated until 2008 when market pressures appeared to come into play and sponsors began liquidating ETFs that had failed to attract sufficient demand…. Since 2013, the number of ETF liquidations has risen steadily—a natural result of a maturing industry," it said.

It added that it suspected the number of closures would continue rising.

ICI's full report available here.