The ‘S’ pillar of environmental, social and governance (ESG) is becoming increasingly important for pension funds, however, a dearth of core-social related indices remain, according to a survey conducted by CREATE Research in partnership with DWS.

The survey, which interviewed 142 pension plans, found 66% expect to increase their allocations to ‘S’ pillar passive funds over the next three years despite just 14% currently using core social-related indices.

In the subsequent report, titled Passive Investing 2021: Rise of the social pillar of ESG, CREATE Research said the COVID-19 pandemic acted as something of a watershed moment for the often-underappreciated ‘S’ pillar of environmental, social and governance (ESG) considerations.

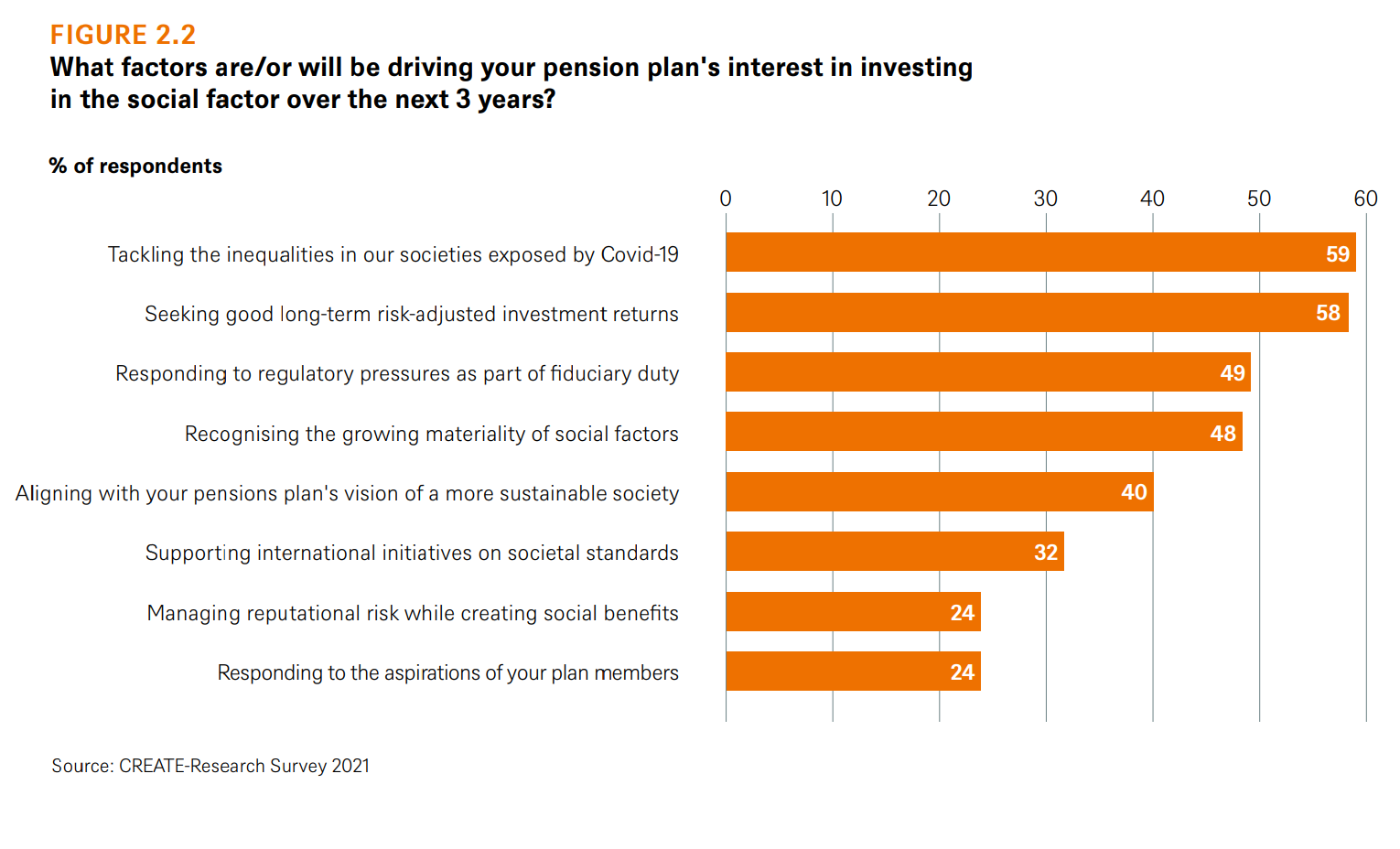

As a result, 59% of respondents said the need to tackle the inequalities exposed and exacerbated by the pandemic was a key reason for their allocations to socially conscious investments.

These societal divisions in the West have progressed over the last 40 years amid increased globalisation and digitalisation which have created winners and losers as governments have struggled to re-equip and reskill those who suffered loss of employment and income.

The rift between social groups was merely widened by the pandemic, the research said, with 48% of respondents now recognising the materiality of social issues in business performance and investment outcomes while 58% seek good long-term risk-adjusted returns by allocating to investments that factor in social considerations.

Speaking on topical social issues, a US pension plan commented: “Black Lives Matter considerations are increasingly material to us as shareholders.

“For example, in June 2020, Facebook dropped about $60bn in market value over a two-day period. This happened as prominent brands such as Coca-Cola and Starbucks pulled ads from the social media giant in protest against the spread of hateful content on the platform.

“Similarly, institutional shareholders forced the resignation of Rio Tinto’s CEO and his top colleagues for authorising the blasting of caves at an ancient heritage site that belonged to Aboriginal landowners. This was seen as a blatant case of destruction of cultural heritage and violation of human rights.”

Given the horizon of pensions can span 40 years – and perhaps longer in future – respondents see it as appropriate to factor in social indicators that are exposed to event risk and erosion risk during the process of asset allocation – and the idea of incorporating the ‘S’ pillar is an attempt to price the future into the present.

Another important factor is how regulators respond to social issues and the idea that the stewards of massive sums of capital can affect positive change.

Already, governments in different jurisdictions are trying to ensure the fiduciary role of pension plans adopts the sustainability agenda. On the social front, respondents expected policy intervention on social issues to have a material impact, with 49% stating this influenced their allocation to the ‘S’ pillar.

Social and passive in pensions

While pension plans may now be making the right noises in terms of factoring in social considerations, it appears supply has to-date fallen short of this seeming demand, with just two in 10 thematic sustainability indices covering the ‘S’ pillar.

Another area in need of cultivation is the use of passive funds in addressing social issues. While 65% of pension plans said they have a ‘mature’ portfolio of passive investments, only 11% stated they were mature regarding their passive allocations related to social factors with 89% either in awareness-raising, decision-making or implementation phases.

Furthermore, just a third of pension plans said their total portfolio had no allocation to social-related funds, versus 67% which had no allocation to social-related funds in their passive-only portfolio.

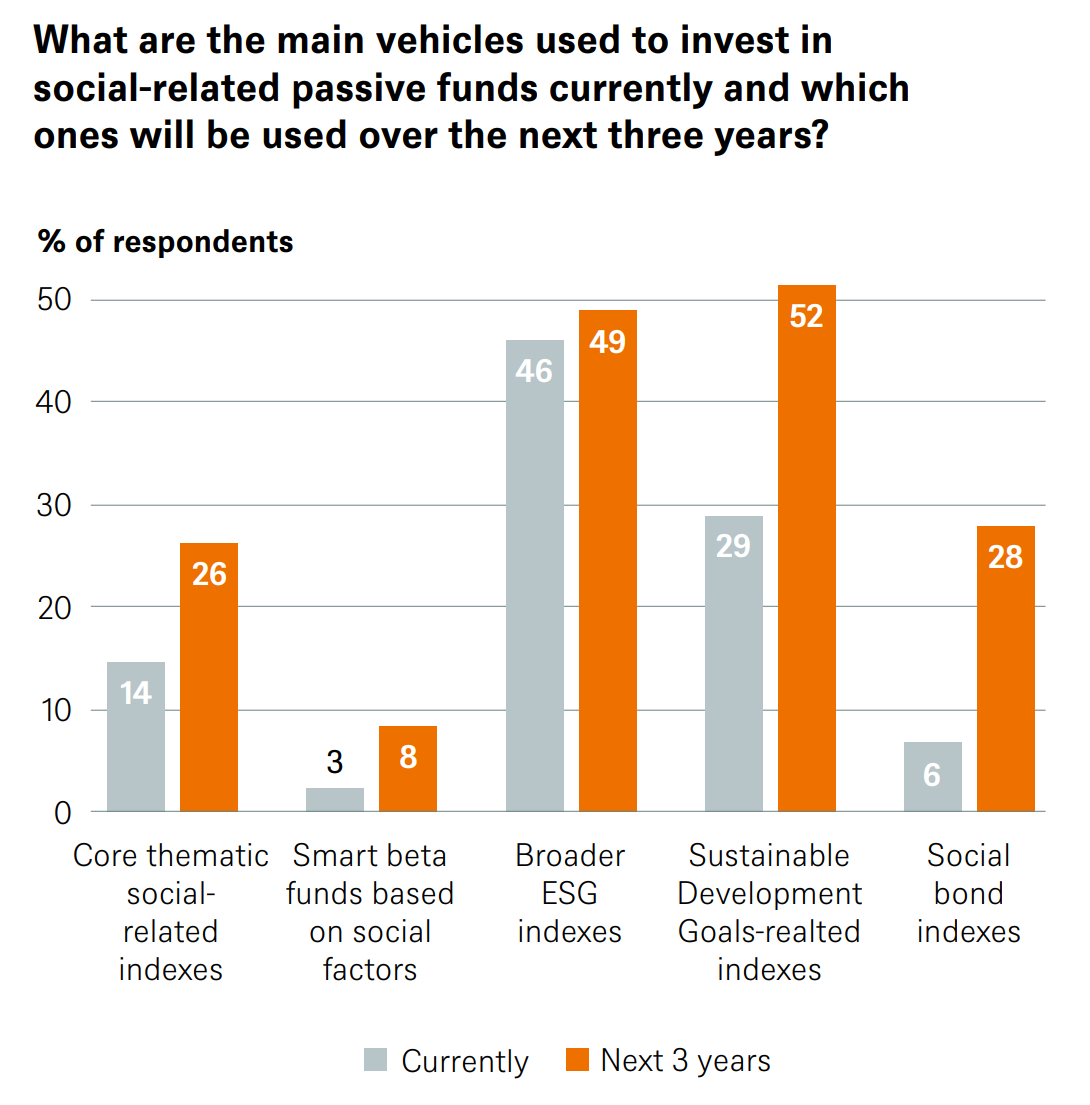

At present, 53% of respondents use equity-based passive funds and 28% use passive fixed income products to target the ‘S’ pillar with these numbers expected to rise to 62% and 50%, respectively, driven by growth in areas such as Sustainable Development Goals-related and social bond indices.

Interestingly, while 66% expect to increase the share of social-related passive funds in their portfolio, most were not willing to tolerate deviations from parent indices with 40% stating they would prefer a tracking error below 1% while 22% said they would accept deviation in excess of 2%.

Road bumps

Also, despite the optimism CREATE Research’s survey highlights, there are three constraints which social-related investments need to overcome to gain prominence in pension pots.

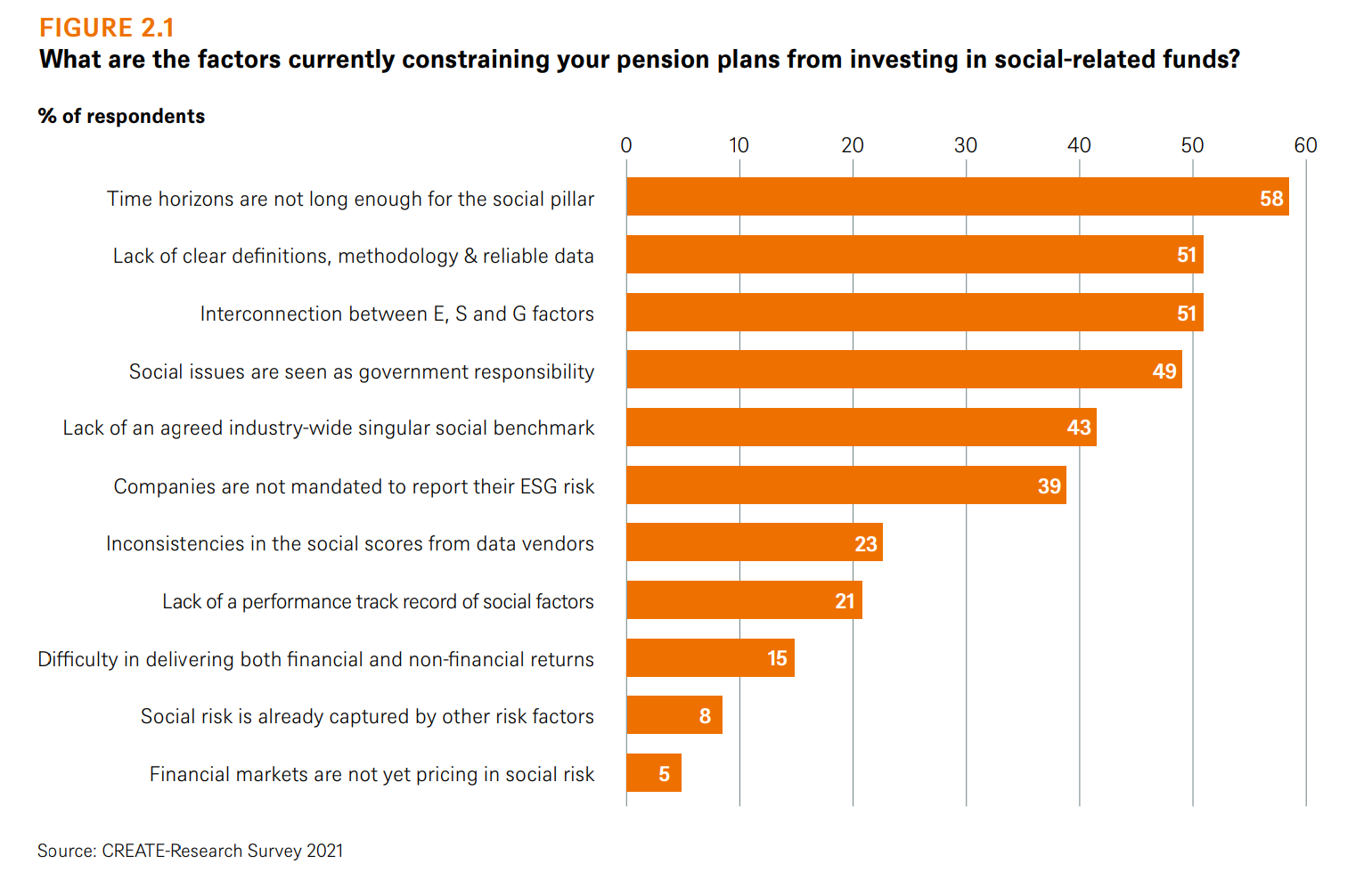

First, 58% of respondents said their time horizons were not long enough to realise the investment benefits of the ‘S’ pillar. At the moment, 66% of plans in Europe are already in negative cash flow, with 81% of the remaining cohort expecting to go negative in the next ten years as more members retire each year.

Demographic changes are forcing 90% of respondents to de-risk their portfolios, meaning they cannot afford to withstand potential losses requiring longer recovery periods. This means European providers focus more on idiosyncratic risk than structural forces – and the situation is roughly the same in the US and Japan, the report noted.

Second, social issues are still not a priority. More likely to be targeted in amalgamation within ESG products than individually, social issues can also act in contradiction to environmental concerns. Unfortunately, not only have pension plans traditionally been five times more likely to focus on environmental issues, but 49% believe that ‘public goods’ fall more under the remit of government agency, than capital markets.

Finally, and often mentioned in ESG circles, 51% are put off by a lack of standardised definitions, methodology and reliable data on the ‘S’ pillar due to its inherently qualitative and normative nature.

This, the report said, makes it difficult to create meaningful and measurable KPIs for social performance – and practically impossible to create universally agreeable ‘social’ benchmarks.

Not only do most companies lack the necessary data-reporting frameworks on social issues but even if indicators are able to measures company policies and procedures in an agreeable way, real-world or second and third-order outcomes are currently near-impossible to incorporate.

A Danish pension plan said: “The crux of the matter is that there is no universal agreement on what constitutes a socially ‘good’ company in practice. Hence, governments worldwide mostly do not mandate companies to provide data on their ESG practices within a consistent framework.

“As a result, data collecting and reporting by companies is largely self-directed and often self-serving. Companies may choose inappropriate outcome indicators, or they may choose the right indicators but use calculation techniques or ambitious assumptions that exaggerate.

“We are thus forced to use an array of definitions used by 150 different data compilers, whose proprietary scoring methods often yield a radically varied assessment of the same company. The result is greenwashing: short-cuts taken by some asset managers to repurpose their old funds with an ESG label, without rejigging the investment process.”

Further reading