Funds labelled either Article 8 or 9 under the Sustainable Finance Disclosure Regulation (SFDR) vary widely across Europe as countries diverge on their interpretation of directive, the European Fund and Asset Management Association (EFAMA) has found.

In a survey collecting data on SFDR Article 8 and 9 funds specifically, EFAMA found they were highly concentrated in a limited number of countries due to varying amounts of ESG investing across countries and divergent national regulator interpretations.

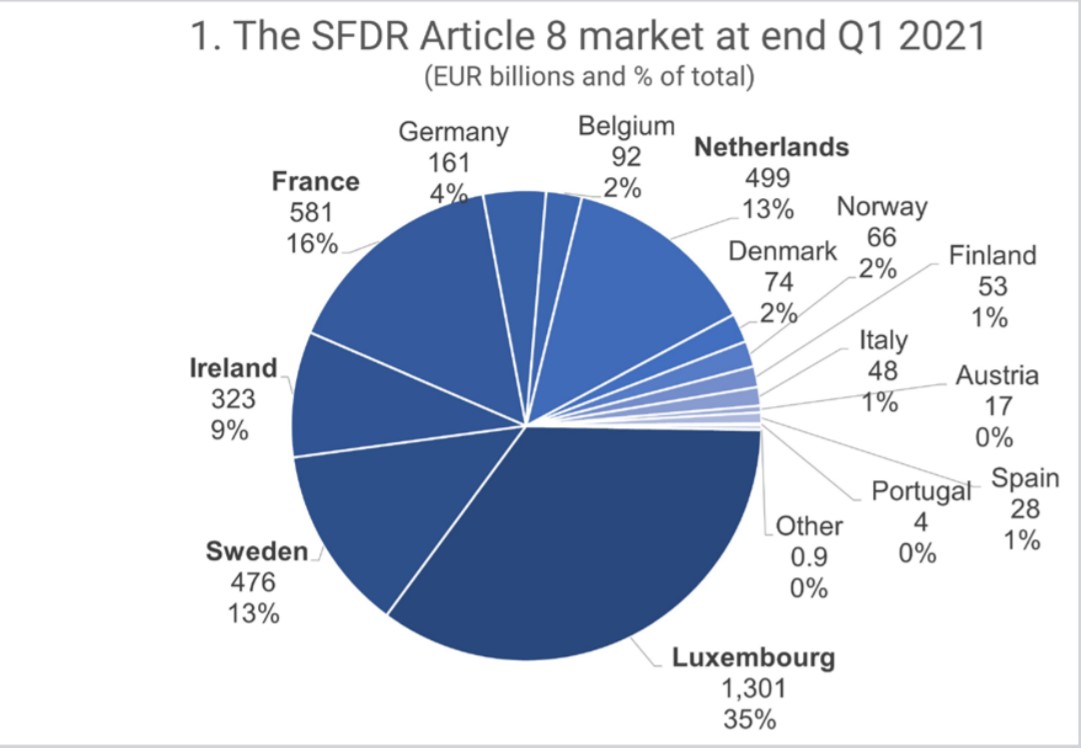

According to the survey, Article 8 funds have net assets under management of €3.7trn across Europe, while Article 9 funds have an AUM of €340bn.

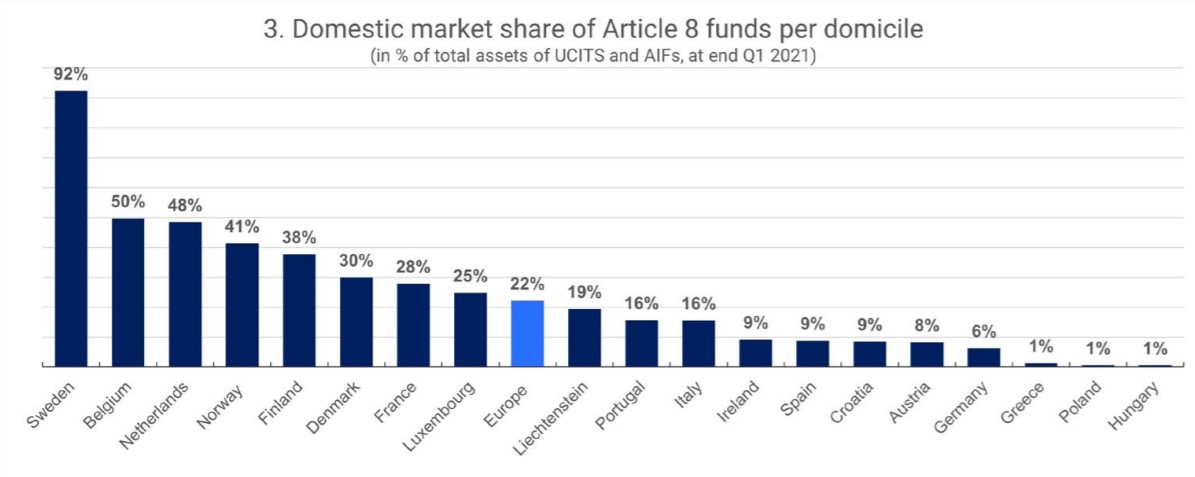

However, Article 8 funds have a 92% market share in Sweeden, compared to a 6% market share in Germany. Belgium (50%) and the Netherlands (48%) also have a high market relative to Europe’s average (22%) due to their “long tradition in ESG investing”.

Source: EFAMA and Morningstar

Germany’s low relative share, EFAMA said, was down to the importance of ‘Spezialfonds’ for institutional investors for which SFDR classification has less relevance.

It added the German regulator, BaFin, has had a much stricter interpretation of the SFDR level 1 text implemented in March this year.

Across Eastern Europe, ESG investing is very much still in its infancy, with Article 8 and 9 funds holding a market share of 1% in both Poland and Hungary.

Thomas Tilley, senior economist at EFAMA said: “The coverage of funds by SFDR Articles 8 and 9 is considerably uneven across Europe.

“Various factors play a role here, such as different SFDR Level 1 text interpretations by national regulators, the delayed implementation of the Level 2 measures and varying maturity levels of ESG fund markets between member states.”

Source: EFAMA and Morningstar

EFAMA said the absence of Level 2 SFDR measures – due to be implemented in June 2022 – has meant the industry has so far applied it on a best-effort basis.

It added SFDR risks creating confusion among investors, particularly around the taxonomy product disclosures, which come into force on 1 January without investee company disclosures and the taxonomy screening criteria.

Despite this, the industry body said it has “full confidence” in SFDR’s ability to prevent national divergences “once the regulation is entirely in place” but called on the European Union to deliver harmonised rules relating to fund transparency in a bid to alleviate discrepancies.

SFDR has been criticised in some quarters for potentially increasing greenwashing due to the “vague” definition of what constitutes an Article 8 fund.

Last month, the European Securities and Market Authority moved to alleviate concerns after it developed two new SFDR product categories should be created for funds that have an environmental objective.