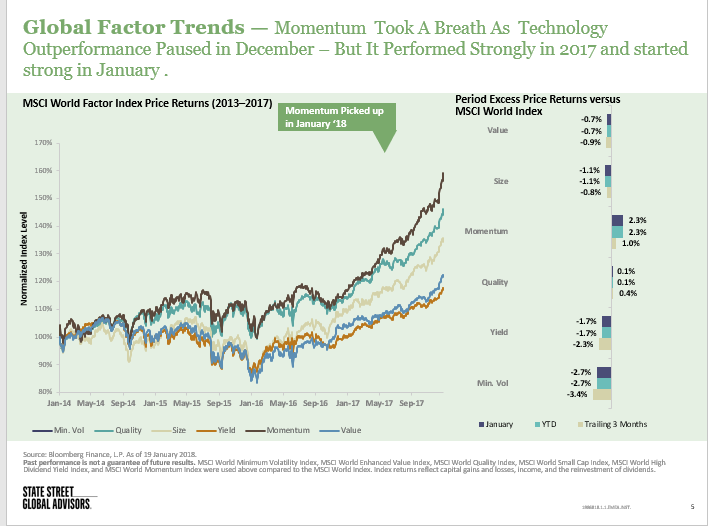

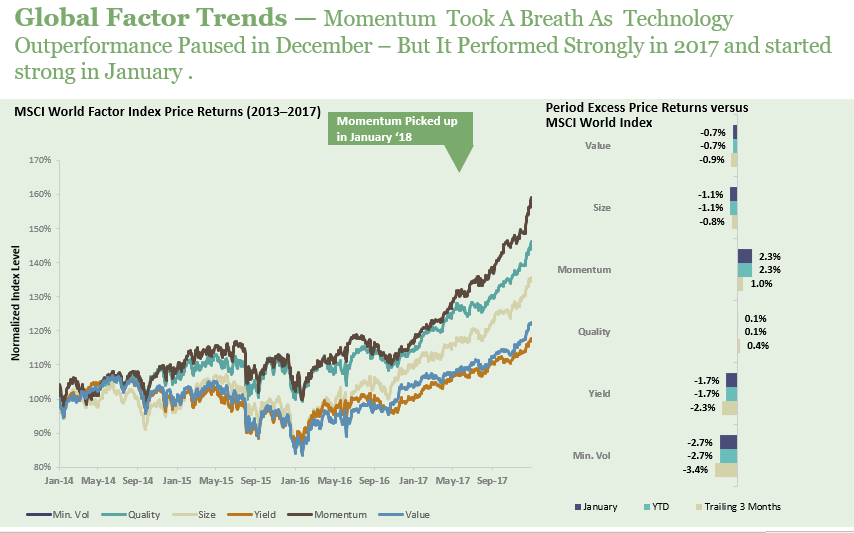

Momentum stocks have got off to a strong start in 2018, outperforming the MSCI World Index by 2.3% according to SPDR State Street Global Advisers. This follows strong outperformance in 2017 driven by the likes of Amazon, Facebook and Netflix.

Even with this strong recent outperformance, Antoine Lesne, Head of SPDR ETF Research & Strategy EMEA, still favours Momentum and thinks 'it's too early to throw in the towel' just yet. Monentum is a factor that should perform well when markets are rising so clearly Lesne is fairly optimistic about markets in 2018. That said, Momentum isn't the only factor Lesne likes. He's also positive on Quality and Yield as he thinks they provide 'a bit of protection'.

The chart below shows the strong performance of Momentum since January 2014 and in 2018 so far. It's also worth noting that Minimum Volatility has started badly this year. It's never going to do well when growth stocks are rising strongly, but of course, it should perform relatively well if the markets go into reverse.

Source: State Street Global Advisers

Lesne is less positive on Value. At a presentation this week he admitted that it looks cheap on a relative valuation basis but argued 'it would be strange for it to do well' given where we are in the economic cycle. That goes against Rob Arnott, the 'godfather of smart beta' who argues that investors should focus on relative valuation rather than on cyclical issues.

That said, Lesne did say that Value is 'a good hedge against rising inflation' - so if you think central bankers are going to tighten too slowly this year and let inflation take off, you might want to consider putting some of your money into Value factor ETFs.

In terms of sectors, Lesne is positive on financials, energy and materials. Financials should benefit as bond yields rise - it's easier for banks to make a profit when interest rates are higher. When it comes to regions he's most positive on emerging markets and Japan.