With AI fanning the embers of investor speculation and some of the Nasdaq 100’s biggest names now comparable in size to the GDPs of large economies, it bears considering what impact an upcoming rebalance of passive funds housing hundreds of billions of dollars will have on the index’s tech tyrants.

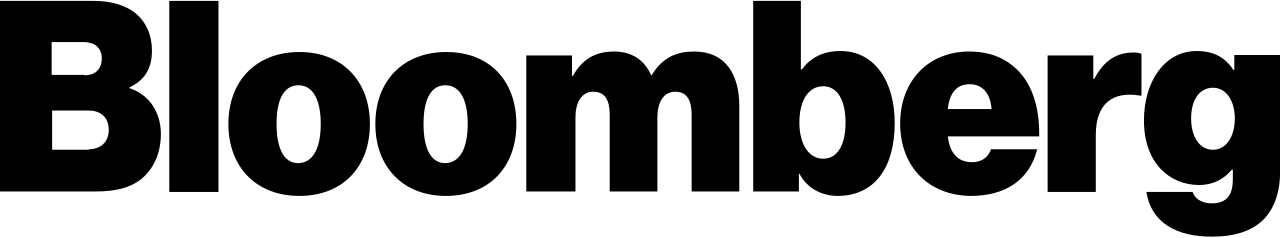

By 17 July, Nvidia, Tesla and Apple had racked up gains of 219.2%, 165.5% and 54.3%, respectively, since the turn of the year.

Source: Bloomberg

In fact, the recently coronated ‘magnificent seven’ or ‘FAATMAN’ collectively added a considerable $3.6trn in combined market cap during the period, according to Betterment investment researcher Ben Bakkum, a sum larger than the market caps of the FTSE 100, CAC 40, DAX 30, or the FTSE MiB, Swiss SMI and IBEX 35 combined.

These mammoth gains have pushed Nasdaq’s headline index to a 44.2% return so far this year, even as only three percent of the broader Nasdaq Composite’s constituents sit at one-year-highs, according to Bloomberg Intelligence data.

Liz Sonders, chief investment strategist at Charles Schwab, noted: “The Nasdaq has continued to power higher this year but the percentage of members making new 52-week highs continues to trend lower.”

Source: Bloomberg Intelligence

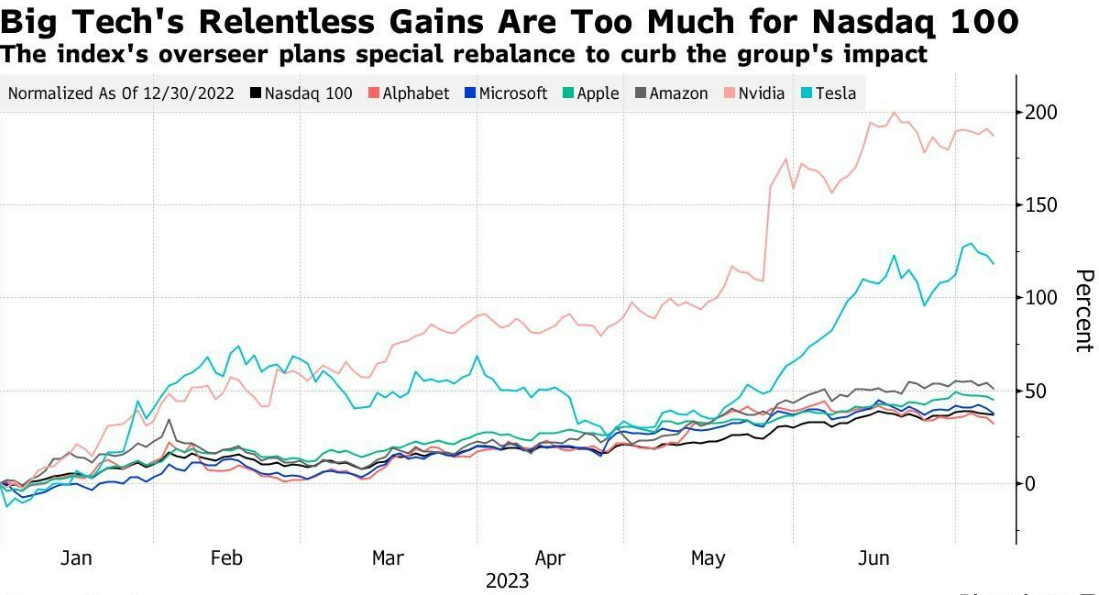

The key issue this raises is index over-concentration, with just six corporate issuers briefly comprising more than half of the Nasdaq 100’s total weight earlier in July.

This dominance violates the index’s ‘modified’ market cap methodology, which aligns with US Regulated Investment Company (RIC) diversification requirements by ensuring no single constituent has a weight exceeding 24% and issuers with weights over 4.5% do not claim a combined allocation greater than 48%.

The latter threshold was breached earlier this month with Tesla hitting a ten-month-high and becoming the sixth company to claim a weighting of at least 4.5% – prompting Nasdaq to schedule only its third ever ‘special rebalance’ between quarterly reviews on 24 June.

The reshuffle will see the combined weight of the ‘magnificent seven’ chopped from 56% to 44%, which may sound manageable, however, this includes some sizeable reductions including Microsoft losing its crown as the top constituent – dropping from a 12.8% to a 9.8% weight – while Nvidia will be cut from 6.9% to 4.3%.

Source: Nasdaq, Bloomberg, Goldman Sachs

Nasdaq materially impacted by a passive reshuffle?

With many investors becoming wise to the benefits of index-tracking vehicles, the growth of passive fund ownership is often lamented or at least underlined, with Bloomberg Intelligence last year finding the average S&P 500 company to be 21.2% owned by passive ETFs and mutual funds. But does this influence translate across indices – and what does this mean for next week’s rebalance?

According to Morningstar data, the Nasdaq 100 is tracked by at least 14 ETFs housing at least a billion dollars. EPFR, meanwhile, finds at least $251bn in passive ETF and mutual fund assets are benchmarked against the index.

While these numbers sound meaningful, it is worth noting the latter number comprises little over 1.4% of the index’s total $17.9trn market cap.

These numbers would mean Microsoft and Nvidia will see around $7.5bn and $6.3bn in passive fund assets divested as a direct result of the ‘special rebalance’ – manageable sums for companies both boasting valuations more than a trillion dollars.

Looking at the reverse angle, a more impactful dynamic may not be the effect of passive fund rebalances on underlying stocks but the performance impact of these rebalances on transparent, rules-based funds themselves.

A paper from the University of Illinois titled Should Passive Investors Actively Manage Their Trades? found US-listed passive equity ETFs face an average performance drag of 15 basis points (bps) a year due to routine imbalances – with these strategies seeing average portfolio turnover of 16% in 2020.

Next week’s Nasdaq 100 rebalance will see $30bn of passive fund assets shift from the overweighted group of six and into the remaining 94 constituents.

One might expect such a telegraphed shunt by “sunshine trading” strategies to be easy pickings for rebalance desks at hedge funds as money flows out of a select few stocks and into others, seeing ETFs sell stocks that have had more than a fortnight to deflate and rotate into those with newly buoyed prices.

However, this dynamic has not played out. In fact, the ‘magnificent seven’ gained an average of five percent last week as investors continued to pour money into Nasdaq trackers – Invesco’s flagship QQQ ETF and its Europe-listed equivalent alone have added $1.9bn new money since the rebalance announcement.

Peter Garnry, head of equity strategy at Saxo Bank, argued the notion the Nasdaq’s largest constituents would fall ahead of the reshuffle was “a bit silly”.

“Given the underlying value has not changed, any front-selling of shares in advance of the special rebalance should theoretically be met by bids as the underlying value has not changed,” he continued.

Countering a doom and gloom narrative, some might see the upcoming rebalance as a positive for the index and the products tracking it.

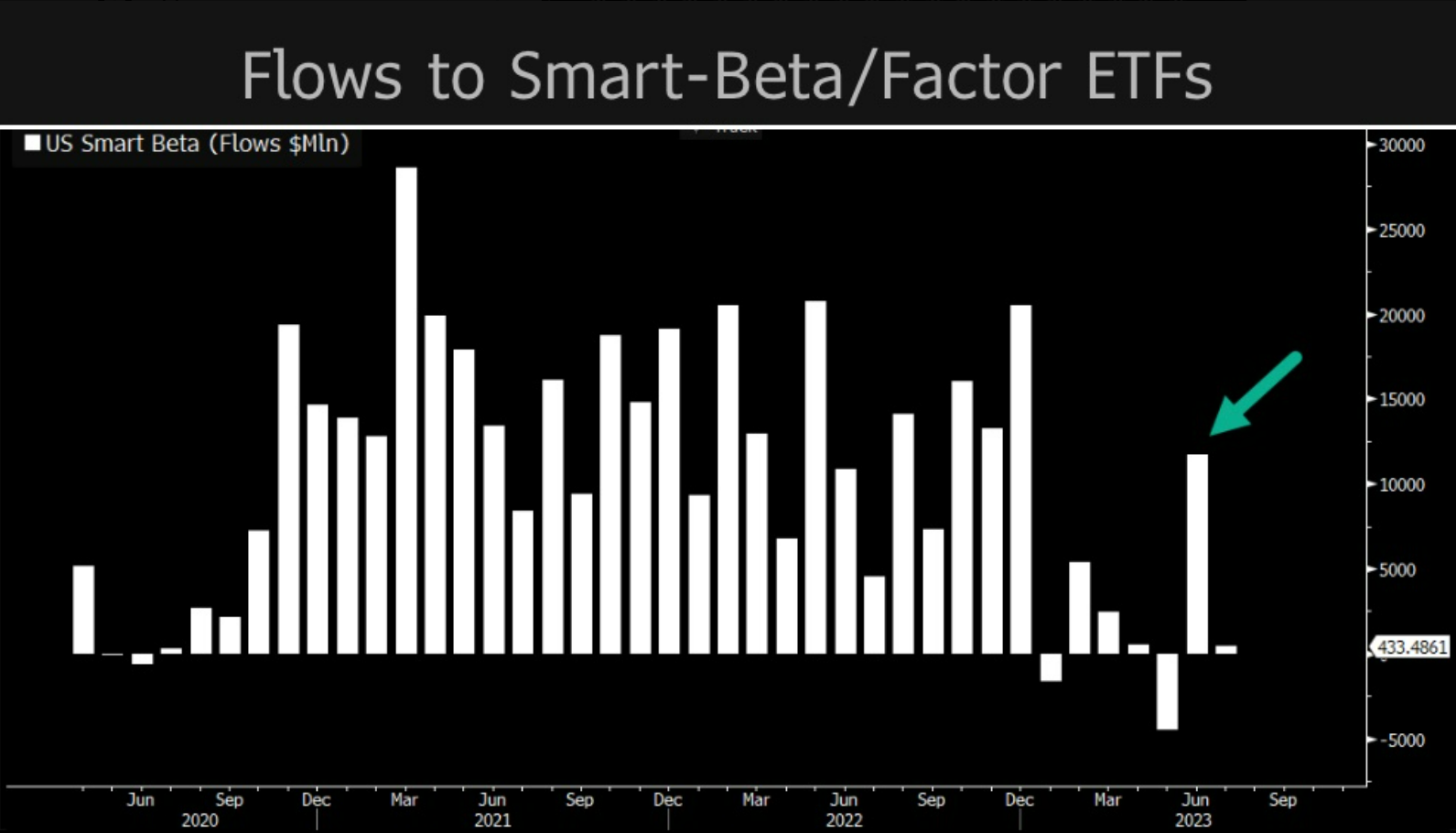

Last month, factor ETFs booked their strongest month of inflows so far in 2023 – even though less than a quarter are outperforming the S&P 500 – likely because some investors are anticipating an expiry date on the highly concentrated tech rally observed in recent months.

Source: Bloomberg Intelligence

At the very least, Nasdaq’s policing of its flagship benchmark shows index providers will not allow this kind of short-term froth to go entirely unchecked.