Documentation that indicates low extension risk, clean portfolios and good underlying collateral are essential elements in creating a high-value CLO ETF, according to Miguel Ramos Fuentenebro co-founder and partner of Fair Oaks Capital.

This statement follows a blog post from PGIM Fixed Income, which advises investors to be cautious about the differences between junior and senior AAA CLOs, though Fuentenebro noted the focus should instead be on the aforementioned features.

While often grouped under the same AAA label in ETFs, junior CLOs can exhibit behaviour more akin to AA tranches during periods of market stress.

Managers might opt to include both junior and senior AAA CLOs in the same basket for a slight pickup in yield and “a marginal improvement in the weighted average cost of debt for the overall CLO”, said Fuentenebro.

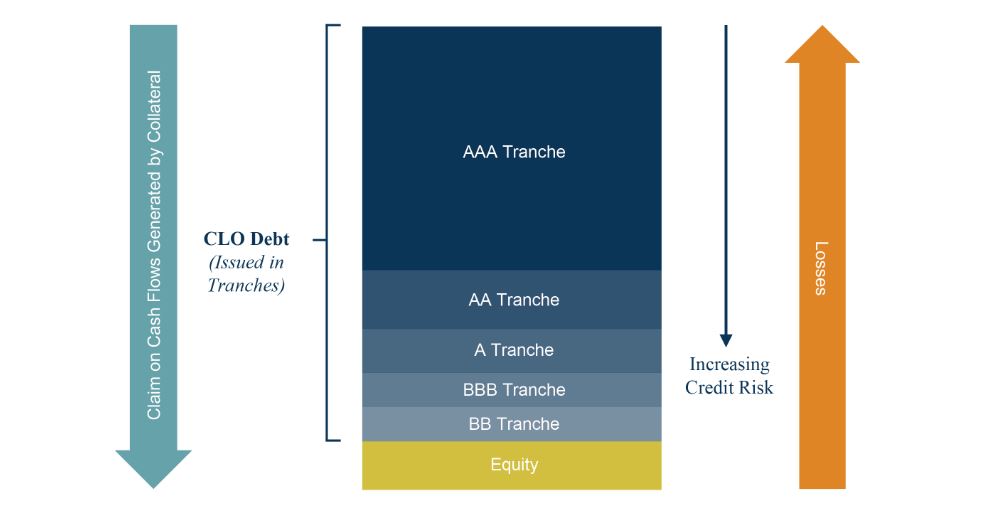

CLOs are structured in a series of tranches rated from highest to lowest depending on the priority of claims on the cash flows of the underlying loans as well as distances from credit losses.

In general, cash flows are distributed from the highest-rated tranche (AAA) downward to lower-rated tranches (BB), while losses are absorbed from the equity tranche upward toward the highest-rated tranches (AAA).

Chart 1: Structure of CLO tranches

Source, Oak Tree Capital

In simple terms, junior AAA tranches function similarly to AA tranches, so they do not get all the benefits laid out above for sitting at the top of the structure, making it misleading to group them under the same label, according to PGIM Fixed Income.

Fair Oaks Capital launched the first CLO ETF in Europe this year. The Fair Oaks AAA CLO UCITS ETF (FAAA) holds 100% AAA rated CLOs, with 3% of the ETF consisting of junior AAA CLOs and the remainder being senior AAA CLOs.

Fuentenebro still defended the inclusion of junior AAA CLOs in a AAA CLO ETF, stating “It is a bit simplistic to say senior AAA's are good and junior triple AAA's are bad”.

He said keeping a close eye on the CLO documentation is key, as they can indicate “extension risk”. This means managers can keep reinvesting for longer, delaying the repayment of the AAA note.

“It is not a single clause but a number of definitions or terms which could result in this,” he said.

In addition, Fuentenebro explained there is “creative legal tension” between AAA and equity investors.

“Equity wants the ability to extend or the flexibility to change the portfolio whereas the AAA wants a clear maturity and the transaction to remain as it was ‘advertised’. This is why, for example, we never invest in the debt of CLOs where we also own the equity.”

Fuentenebro also highlighted the importance of clean portfolios, noting that while the default probability for AAA CLOs is nearly zero, ‘clean’ portfolios tend to trade more favourably and at tighter spreads.

Finally, in response to data revealing junior AAA behaving like AAs during times of market stress, he said the insight “does not surprise him”.

“Junior AAA CLOs are a longer duration asset. So of course, it is going to behave like one.

“The weighted average life is much closer to AA than AAA, and the performance is not to do with the quality, just to do with the maturity.”