This is a marketing communication. Please refer to the prospectus and the KID or KIID before making any final investment decisions. For Professional/Qualified Investors only—Not for retail use or distribution.

The demand for ETFs has continued to grow. Well-known benefits such as full transparency, daily trading and instant price discovery have proven popular with investors of all types. In the UCITS space, ETFs made up 15% of all pooled funds’ assets at the end of 2023, up from just 8% five years ago.

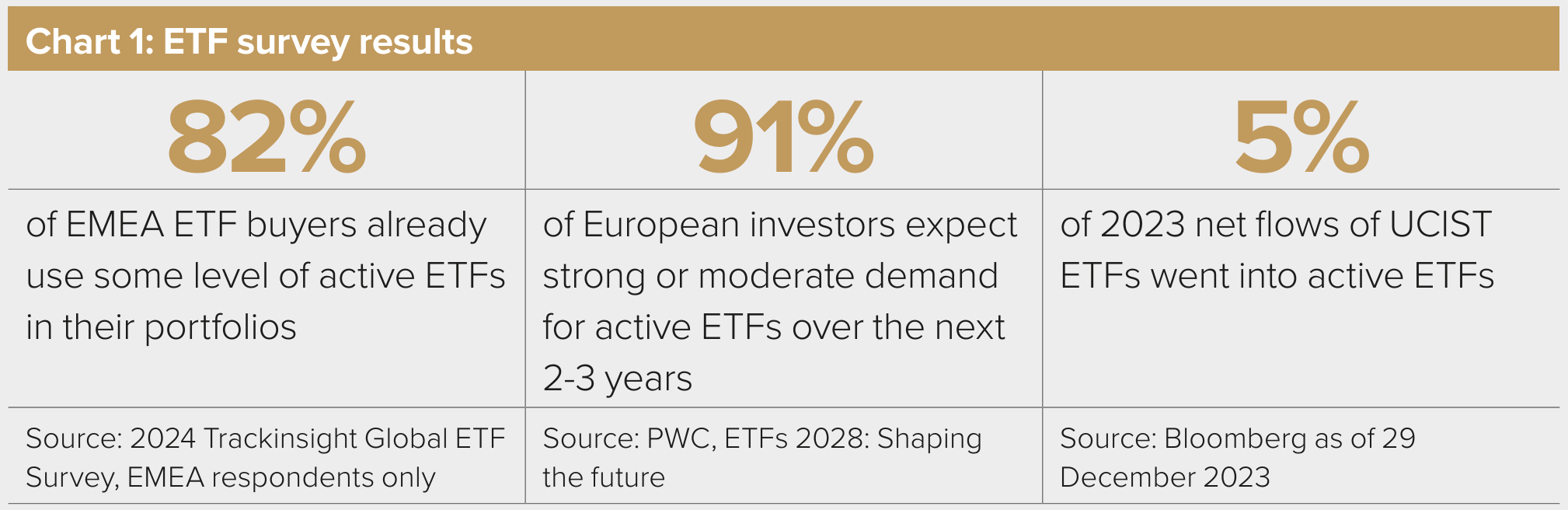

One exciting area of innovation in the space is active ETFs. The active ETF market has seen momentum steadily grow over the past years. While initially a US phenomenon, the latest ETF survey results from Trackinsight and PWC point to a broadening out of activity for this vehicle (see Chart 1).

The active revolution within the ETF industry

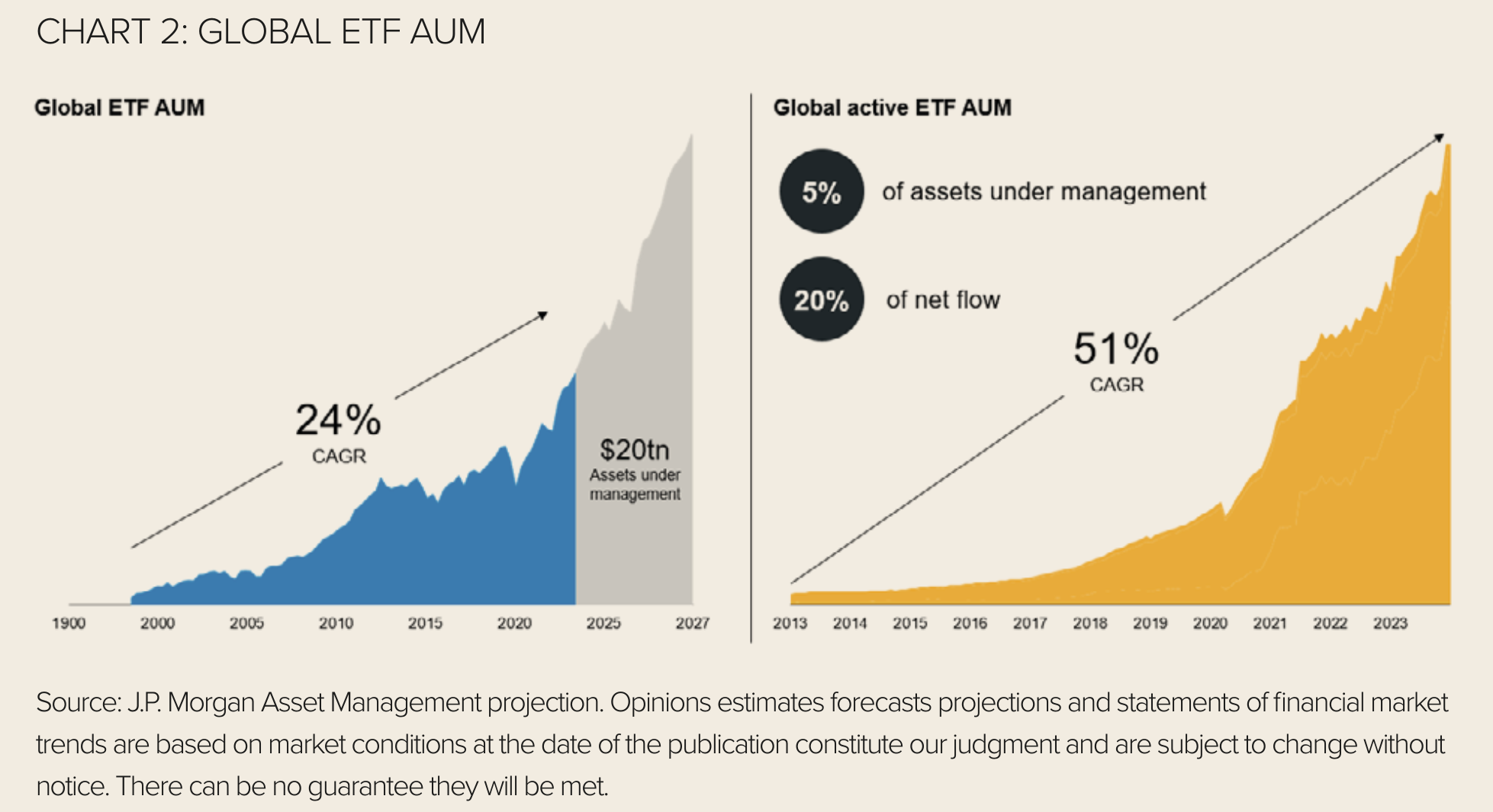

ETFs overall have been growing at a 24% compound annual growth rate (CAGR) over the past 10 years, but over the same period, the active ETF market has grown at a 51% CAGR.

While active ETFs globally still only hold 5% of assets under management, in 2023 they took in 20% of ETF net flows. At the end of the first quarter of 2024, global assets under management (AUM) in active ETFs were over $650bn and there were nearly 1,500 active ETFs available to investors.

Some 30% of these products were launched over the past year. Drilling into the active UCITS ETF space, AUM totalled more than $35bn, with 87 active UCITS ETFs trading. So there is still limited supply on active UCITS ETFs. Some 23 active ETFs were listed on European exchanges over the past 12 months, out of which seven were launched by J.P. Morgan Asset Management (see Chart 2).

There is more to active ETFs than alpha

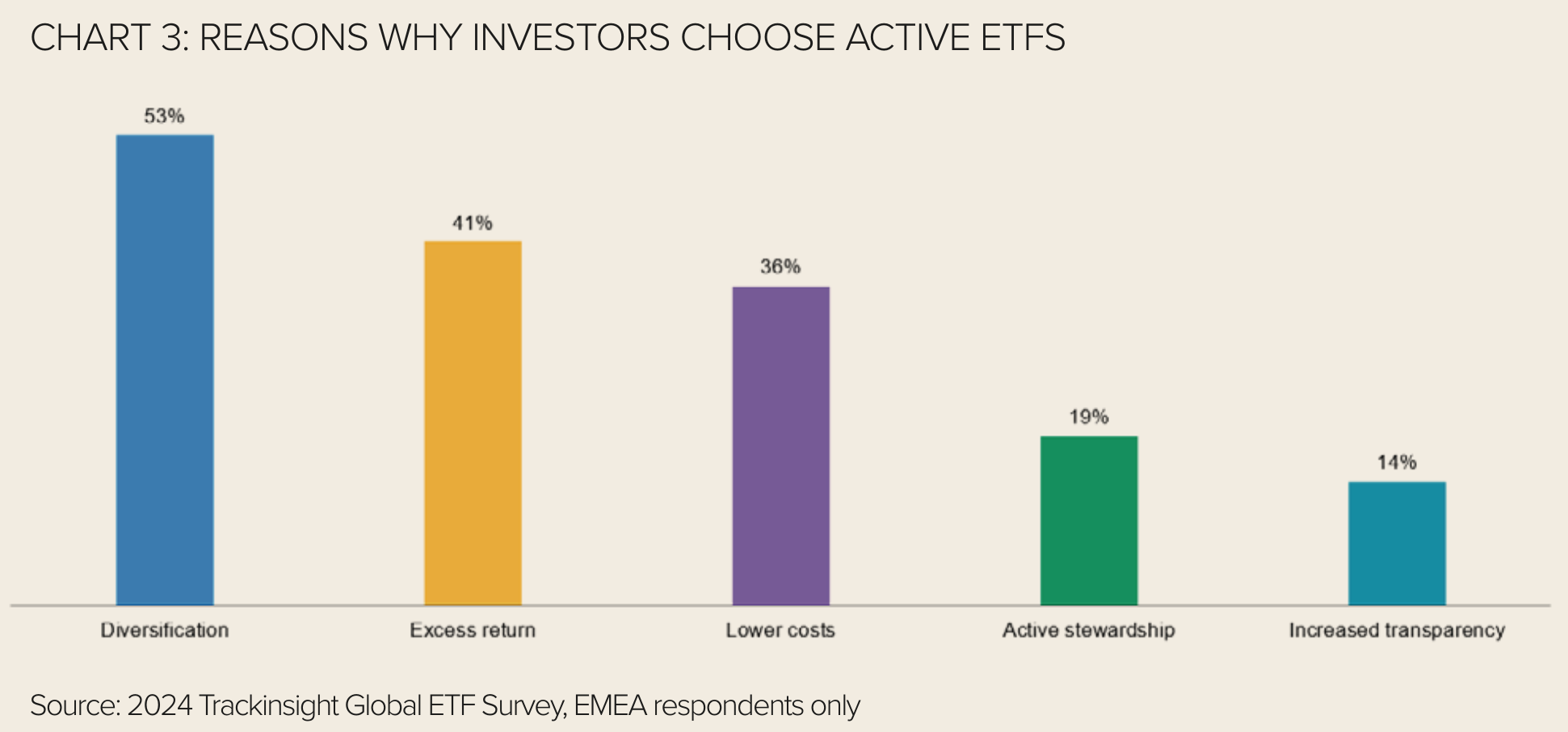

The potential to outperform a chosen benchmark is one of the key differentiators of active ETFs to their passive peers and one of the main reasons why ETF buyers select active ETFs.

However, there are several other key reasons for ETF buyers to choose active ETFs. According to the 2024 Trackinsight Global ETF Survey, diversification is the number one stated motivation for ETF buyers to choose an active ETF.

This can mean diversification out of a passive approach into an active one but also allocating to an additional ETF provider. Lower costs and increased transparency in comparison to the mutual fund wrapper are reasons for investors to allocate to active ETFs.

Investors who take ESG considerations into account also select active ETFs for the active stewardship element (see Chart 3).

Active equity ETFs see stronger demand

The main areas EMEA ETF buyers see value in utilising active ETFs are equities, ESG equities and thematic ETFs.

Interestingly, only 29% of EMEA ETF buyers think active approaches can add value when investing into fixed income. In our view, this is a misconception. In a global bond market of $130trn, only $2trn are in passive fixed income ETFs (source: Bloomberg, 28 December 2023).

Therefore, active strategies and direct investments form the majority of the global bond market. Given fixed income indices tend to overweight the largest debtor, we believe there are benefits to active allocation in the fixed income space in order to mitigate unwanted risk.

We think that the current stance on the allocation to active ETFs is partly influenced by the very limited supply of active fixed income UCITS ETFs.

J.P. Morgan’s active ETFs

J.P. Morgan Asset Management is one of the world’s largest asset managers. With roots traceable to 1873, our focus has always been on active investing across asset classes. We launched our first ETF in 2009 and our first active ETF in 2016. We are now one of the largest active ETF providers globally and the largest in the UCITS space.

As more active ETF providers enter the UCITS space, investors will be required to do detailed due diligence and work with a partner that has cultivated an active investing culture.

When selecting an active ETF provider, it is of course important to look closely at the strategy itself, but the capabilities and resources of the ETF provider are also crucial.

For example, deep research insights and resources are very relevant for active investment strategies; therefore, an active ETF provider should have a global network of analysts and portfolio managers.

Active ETFs as core building blocks

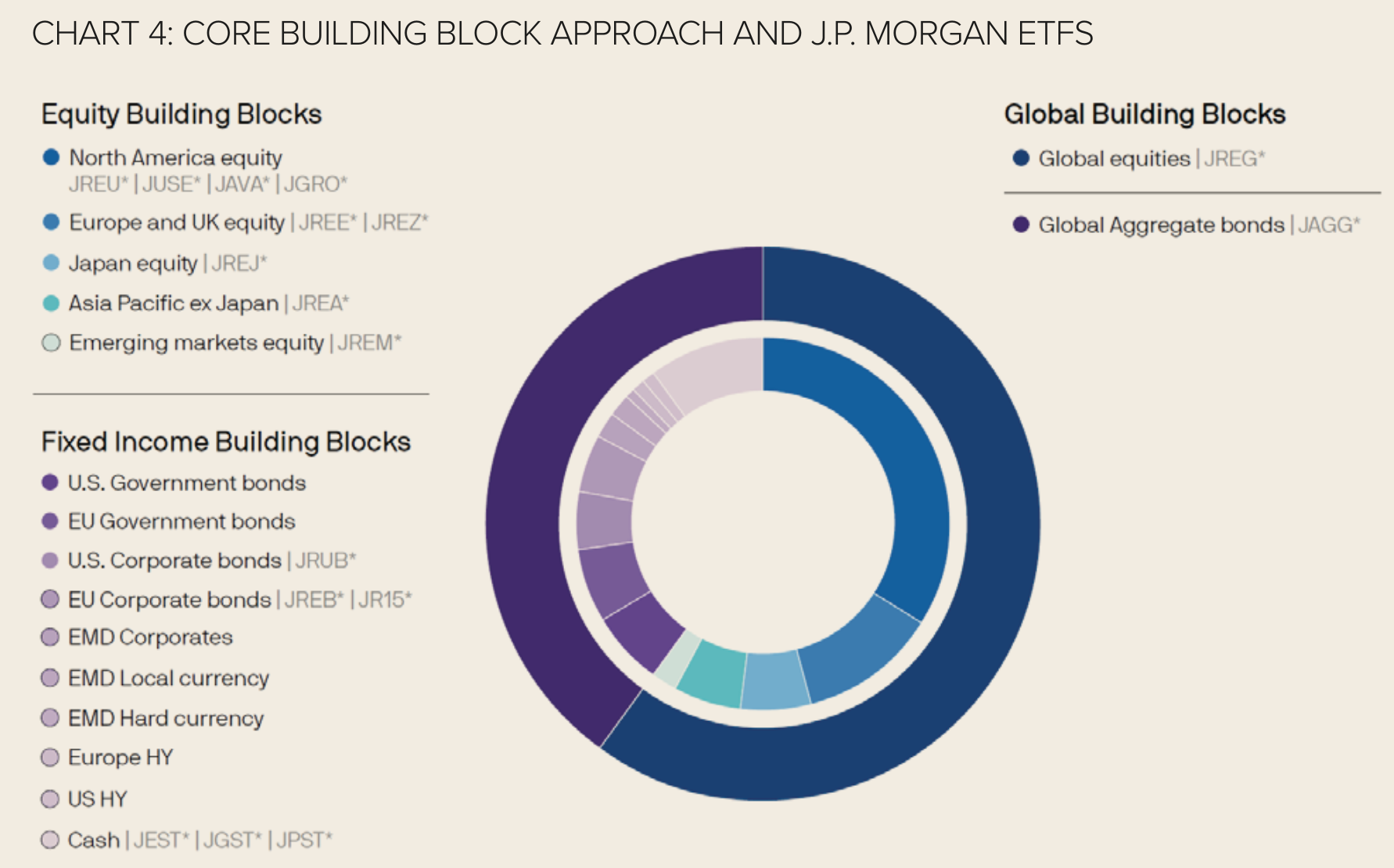

J.P. Morgan Asset Management offers UCITS investors 25 active ETFs across equities and fixed income. Investors can easily allocate building block across equity regions, fixed income segments or core allocations without ETFs to create a balanced portfolio.

And as the largest active UCITS ETF issuer, we are also committed to further building out the breadth and depth of our active ETF range with differentiated solutions (see Chart 4).

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full edition, click here.

Important information

(*) FOR BELGIUM ONLY: Please note the acc share class of the ETF marked with an asterisk in this page are not registered in Belgium and can only be accessible for professional clients. Please contact your J.P. Morgan Asset Management representative for further information. The offering of Shares has not been and will not be notified to the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten/Autorité des Services et Marchés Financiers) nor has this document been, nor will it be, approved by the Financial Services and Markets Authority. This document may be distributed in Belgium only to such investors for their personal use and exclusively for the purposes of this offering of Shares. Accordingly, this document may not be used for any other purpose nor passed on to any other investor in Belgium.

For Professional Clients / Qualified Investors only – not for Retail use or distribution. This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation. The value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Past performance is not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. Investment decisions shall solely be made based on the latest available Prospectus, the Key Information Document (KID), any applicable local offering document and sustainability-related disclosures, which are available in English from your J.P. Morgan Asset Management regional contact or at www.jpmorganassetmanagement. ie. A summary of investor rights is available in English at https://am.jpmorgan.com/lu/investor-rights. J.P. Morgan Asset Management may decide to terminate the arrangements made for the marketing of its collective investment undertakings. Purchases on the secondary markets bear certain risks, for further information please refer to the latest available Prospectus. Our EMEA Privacy Policy is available at www. jpmorgan.com/emea-privacy-policy. This communication is issued in Europe (excluding UK) by JPMorgan Asset Management (Europe) S.à r.l. and in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. In Switzerland, JPMorgan Asset Management Switzerland LLC (JPMAMS), Dreikönigstrasse 37, 8002 Zurich, acts as Swiss representative of the funds and J.P. Morgan (Suisse) SA, Rue du Rhône 35, 1204 Geneva, as paying agent. With respect to its distribution activities in and from Switzerland, JPMAMS receives remuneration which is paid out of the management fee as defined in the respective fund documentation. Further information regarding this remuneration, including its calculation method, may be obtained upon written request from JPMAMS.

09jc241505090849