Active managers have long had a bone to pick with the default approach of all funds being compared as equals against an index, instead contending the average investor dollar is likely to reside in a handful of active behemoths with market-beating track records.

This is an interesting and glaring nuance in the age-old active-passive debate. With most of the headlines inspired by annual reports from index providers spotlighting the percentage of active funds which outperform – or not – versus an index provider’s own equivalent benchmark, managers contend a sleight of hand takes place by equal-weighting fund performance.

Simon Evan-Cook, fund manager at Downing, argued a more practical view of the investor experience is offered by asset-weighting fund performance within each sector or ‘universe’.

“As with companies listed on a stock market, funds are not spread evenly. In any given sector, there tend to be a few big fish swimming with a shoal of tiddlers.

“If 99 very small funds underperform, while the one in which most money is invested does well, then active management is, on balance, providing value for investors’ money,” he said.

While this logic makes sense – and Evan-Cook was previously able to prove large funds outperformed across several categories more than a decade ago – the question of whether managers outperform on an asset-weighted basis deserves revisiting and especially over a longer horizon.

A mixed decade for managers

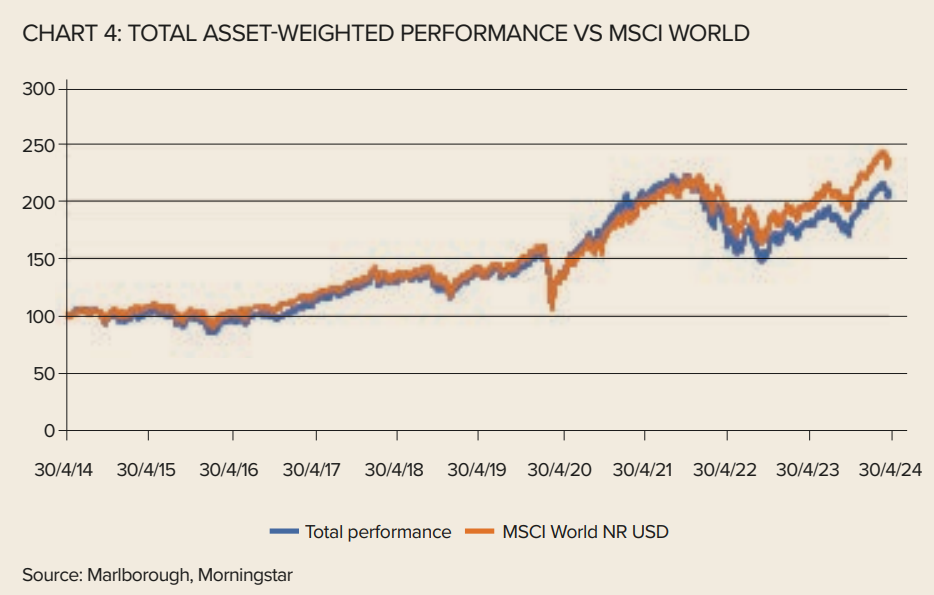

Research conducted for ETF Stream by Marlborough, based on Morningstar data, revealed active managers have clearly underperformed global index exposures on an asset-weighted basis.

Over the past decade, the IA Global sector trailed the MSCI World index with an asset-weighted return of 108.5% versus 133.9% for the benchmark, as at 30 April.

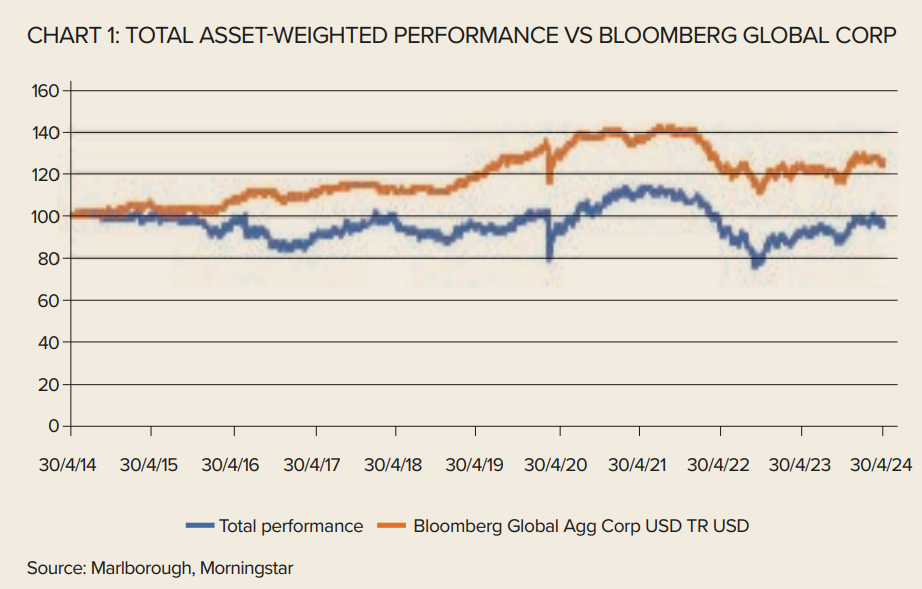

Similarly in the IA Global Corporate Bond sector, managers booked a stark asset-weighted return of -3.3% versus 25.5% for the Bloomberg Global Aggregate index.

At no point during the period did funds in that fixed income category look to mount a challenge against the index, however, global equity managers were actually beating the MSCI World until the 2022 correction wiped out their advantage.

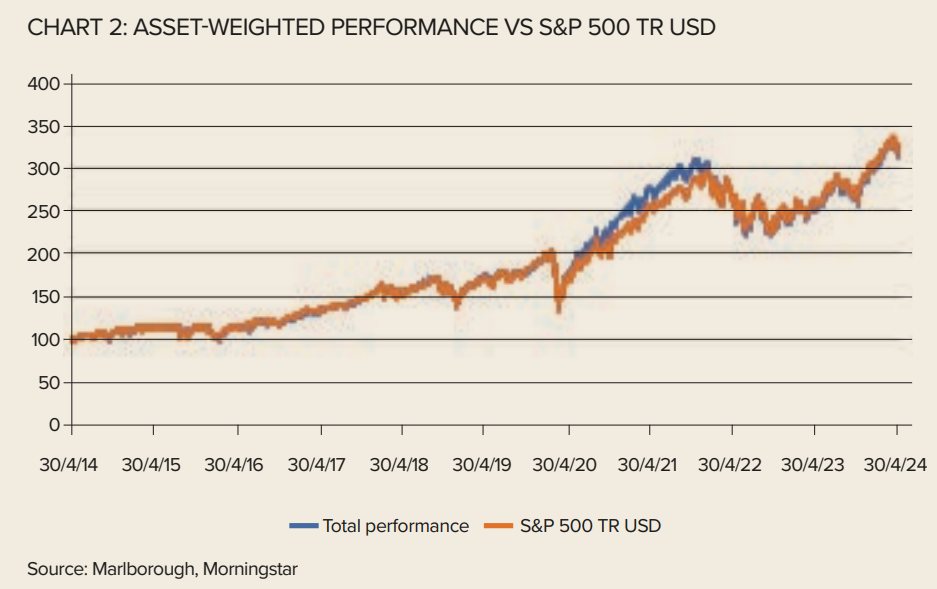

The same dynamic has played out across other popular equity categories. After leading the S&P 500 until the end of 2021, the IA North America sector finished the decade with gains of 219.3% compared to 222.1% for the popular US benchmark.

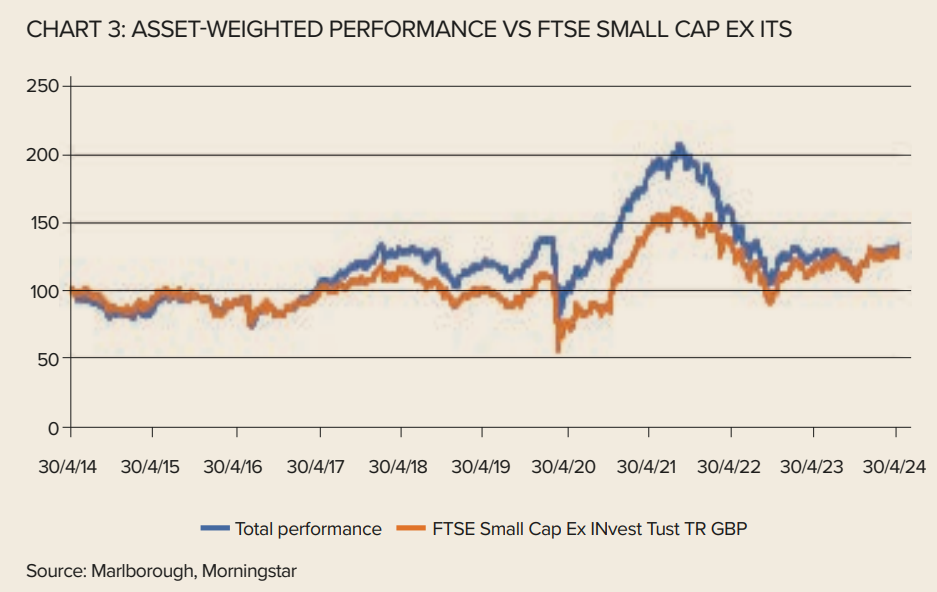

Likewise, the IA UK Smaller Companies sector finished the period in pole position, up 33.7% versus 31.7% for the FTSE SmallCap ex Investment Trusts index, but this narrow advantage obscures the fact managers ceded most of the commanding 42.9% lead they had amassed by October 2021.

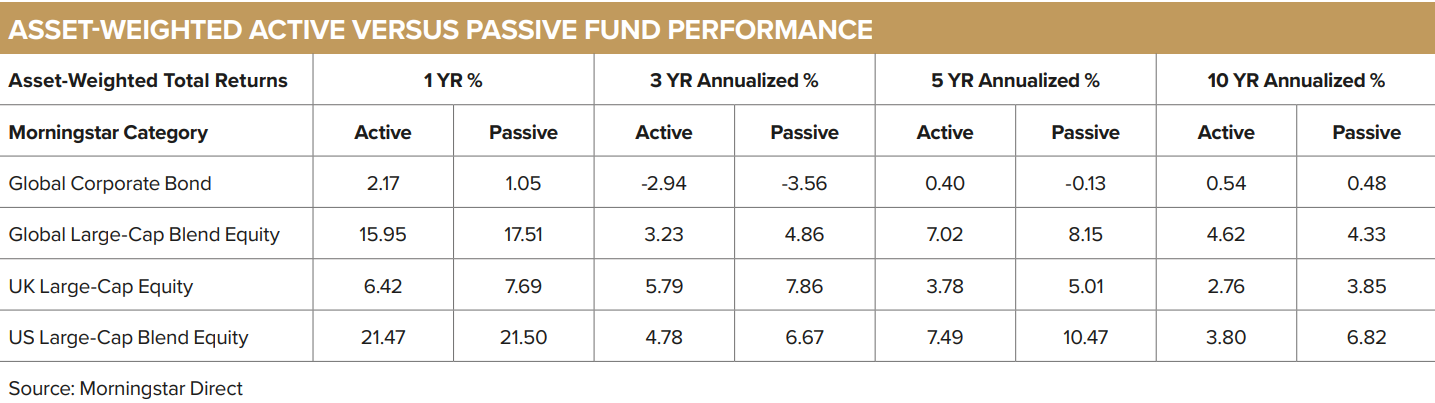

Interestingly, data produced for ETF Stream by Morningstar Direct tell a different story, with global corporate bond funds booking asset-weighted annualised returns of 0.54% over the past decade, seven basis points (bps) ahead of the asset-weighted annualised returns for equivalent passive funds, while global large-cap blend equity managers boast annualised gains of 4.62%, 29bps ahead of index funds.

However, US large cap managers booked annualised returns of 3.8% over the ten-year period, more than 3% a year behind US equity trackers.

While admittedly two datasets drawing different conclusions does not make for a satisfying bottom line, it should be noted the two do not have the same parameters.

For instance, Marlborough’s findings rebalance manager asset weightings monthly through the sample period to eliminate survivorship bias.

However, Morningstar’s data has the strength of comparing asset-weighted average returns of active and passive funds, net of fees, representing the investor experience rather than the returns of popular indices.

So is big beautiful?

Contradictory findings aside, a key reason even the largest funds have often struggled to maintain dominant positions across categories is because returns become asset gathering and there is no guarantee past success can be recreated.

In fact, S&P Dow Jones Indices’ latest Persistence Scorecard revealed in five of six equity and in all four fixed income fund categories, not a single top manager whose performance placed in the top quartile for the year to December 2019 managed to remain in the top quartile for the next four years.

“Of the 1118 actively managed funds whose performance over the 12-month period ending December 2019 placed them in the top quartile in their respective categories, just two funds remained in the top quartile in each of the four subsequent one-year periods ending December 2023,” SPDJI said.

Evan-Cook added the ‘big is best’ assumption can be dangerous as larger funds can become difficult to manage.

“A massive fund can severely constrict a manager’s process. It takes them longer to get into and out of a stock because they own so much of it. So, if a company goes wrong, they are stuck with it.

“It can also force them to buy larger stocks than before, or more of them – both of which can crimp on their ability to outperform.”

He added there is also the potential for experienced managers to either leave their funds or lose their ‘hunger’ having attained success.

“In short, there is a sizable risk that giant stars one day become red giants or supernovae – and judging if or when that will be, or even if it has already happened, is tough,” he concluded.

In fact, in his report authored in 2012 Evan-Cook referred to one manager’s three funds which accounted for 3.3% of the headcount of funds in the 92-strong UK Income sector at the time, but a colossal 40% of the sector on an asset-weighted basis, or larger than the 84 smallest funds combined.

The manager in question was Neil Woodford, who later established his own firm and whose funds became a blackhole for investor assets.

The right active-passive blend

Despite the rise and fall of star managers, it is commonly accepted that active funds have an easier time achieving outperformance in certain exposures over others and this is reflected in the way fund selectors blend active and passive within portfolios.

Scott Truter, assistant portfolio manager at Marlborough, said the firm’s multi-asset team currently relies more heavily on passive funds within US equities given the challenges managers face in consistently outperforming, whereas active stock selection may yield greater success in UK smaller companies and emerging markets.

“One of the reasons is there may be fewer analysts covering companies,” Truter said. “We believe this creates opportunities for an active manager with resources and expertise to identify companies with potential that may have been overlooked by other investors.”

He added managers can reposition to seize opportunities that passive funds cannot, such as currently attractive valuations in Japanese mid-cap equities.

This nimbleness serves a purpose within fixed income such as in high yield bonds where Marlborough relies exclusively on active managers.

“An active manager can deliver value by researching the companies and understanding them and thus seeking to avoid those that may be at risk of default,” he continued.

“We also believe active managers offer an advantage in being able to really target bonds with, for example, a specific duration, where they see a particular opportunity.”

Truter concluded by stating passives can be a useful stopgap for capturing an immediate opportunity while researching appropriate active managers to capture the exposure, however, the current backdrop of higher interest rates and volatility has seen his team edge up its active exposure.

Asset-weighting returns may tip the scales more in favour of active funds but they are yet to consistently outstrip passive rivals, net of fees. For the foreseeable, the outlook remains one of fund selectors picking moments in each management style, with the momentum in new asset gathering in favour of low-cost trackers.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full edition, click here.