Is it possible to combine quantitative finance and ESG data? Thomas Kuh, head of index at Truvalue Labs, examines the potential link between systematically generated ESG signals and alpha generation.

ESG investing grew to more than $31trn in assets in 2018 – up 34% in two years – according to a study by the Global Sustainable Investment Alliance. At the same time, the number of ESG ETFs available to investors is also growing. As of September 2019, there were 253 ESG ETFs/ETPs available globally with more than $47bn in assets. Blackrock estimates this could rise to $400bn by 2028. According to a June 2019 FT article, 60 per cent of global ESG ETF assets are domiciled in Europe.

With the burgeoning interest in ESG, more attention is being paid to the data and ratings that drive ESG benchmark construction and investment decisions. One of the familiar criticisms of the ESG scores, analysis and commentary now available is a lack of consistency and standards. A number of studies document the low correlation between ESG ratings and scores from different providers, and there is considerable uncertainty in the investment community about the quality of data underlying the results produced. In short, there is a lack of verifiable, quantitative analysis generated from statistically significant volumes of systematically assessed, uncollated original data.

This critical issue is now being addressed by academics and researchers producing formal studies backed by the application of artificial intelligence to big data. We use proprietary natural language processing (NLP), machine learning (ML) and sentiment analysis to derive ESG signals from more than 100,000 sources of unstructured data in multiple languages from all parts of the globe. The data is analysed using the materiality framework from the Sustainable Accounting Standards Board (SASB).

A 2018 study, Public Sentiment and the Price of Corporate Sustainability by Professors George Serafeim of Harvard Business School and Aaron Yoon of Kellogg School at Management at Northwestern University, concludes that “combining corporate sustainability performance scores based on ESG data with big data measuring public sentiment about a company’s sustainability performance, I find the valuation premium paid for companies with strong sustainability performance has increased overtime and that the premium is increasing as a function of positive public sentiment momentum”.

Three fund buyers reveal their favourite ESG ETFs

An August 2019 Journal of Applied Corporate Finance article, ESG, Material Credit Events, and Credit Risk, by Professor Witold Henisz and James McGlinch of the Wharton Business School of the University of Pennsylvania, demonstrates the connection between ESG performance and credit risk.

Many contemporary ESG studies focus on individual companies or specific portfolios, but recent work conducted by Dr Stephen Malinak, Greg Bala, Shirley Birman and James Cardamone of Truvalue Labs offers a systematic investigation of how strategies based on new world ESG signals impact performance relative to a broad range of benchmarks.

The study, Performance Tests of Volume, Insight and ESG Activity Signals, tests the effectiveness of timely ESG signals as screening tools and quantitative “alpha” factors for a variety of global and regional equity benchmarks. It includes large cap, mid cap and small cap stocks across developed and emerging markets over the past twelve years. The data follows news and commentary on over 16,000 companies based on NLP algorithms that parse text written in 12 languages.

DATA AND METHODOLOGY

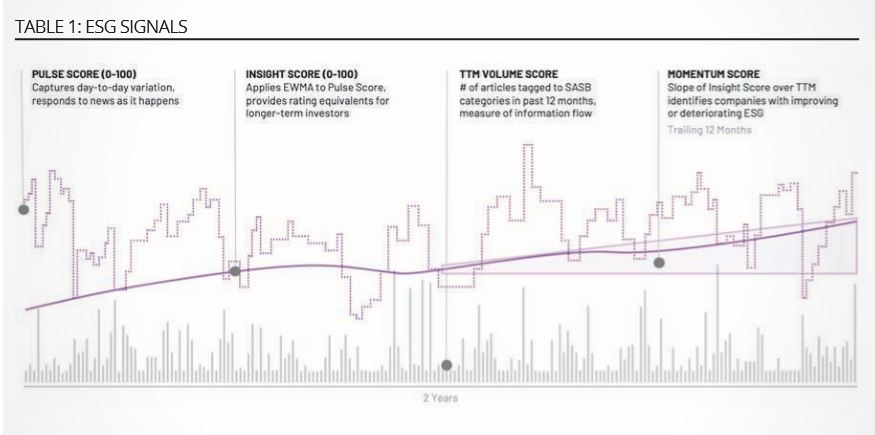

Truvalue Labs produces quantitative ESG signals derived from unstructured text using NLP, ML and sentiment analysis (see Table 1). The Pulse Score is a measure of near-term ESG performance changes that responds to news as it happens. It highlights both opportunities and controversies, enabling real-time monitoring of companies.

Source: Truvalue Labs

The Insight Score is a measure of a company’s longer-term ESG track record, equivalent to an ESG rating. Scores are less sensitive to daily events and reflect the enduring performance record of a company over time. The Momentum Score measures the trend of a company’s Insight score and is used to identify companies with improving or deteriorating ESG performance. The Volume Score measures the information flow or number of articles about a company over the past 12 months. Different groups of companies can have markedly different behaviour for quant factors, due to variations in size, macroeconomic conditions, local market behaviour, historical path dependence or other issues.

Therefore, the study looked at the performance of Truvalue Labs data signals for a range of benchmarks. The analysis tested multiple regional portfolios and benchmarks represented by widely invested ETFs, which are legally required to disclose their holdings on a regular basis. All these funds are available in FactSet’s Alpha Tester 4 platform as point-in-time portfolios so they can be tested on an as-was basis, including all dead companies and avoiding survival bias and look-ahead bias.

PERFORMANCE RESULTS

This paper offers three key findings:

• Top quintile companies consistently outperformed bottom quintile companies globally over the past 12 years

• These performance results held up at country and region levels

• The ESG Activity Signal is additive when analysing contributions to performance from traditional risk premia (or, smart beta) factors

GLOBAL COMPARATIVE QUINTILE PERFORMANCE

Combining multiple signals enabled better performance than looking at individual signals on their own. ESG Data Volume is a strong signal, particularly in comparison to expectations for a company based on its typical trading volume, a measure of investor and trader attention to a company. Companies with stronger trailing twelve months (TTM) ESG Data Volume tended to have larger price movements driven by ESG issues. Furthermore, companies with low TTM ESG Data Volume relative to expectations tended to lag their benchmarks, while companies with heavy TTM ESG Data Volume relative to expectations tended to outperform strongly.

Overlaying this investor attention signal with the long-term Truvalue Insight score adds ESG polarity (driven by the degree to which sentiment on ESG issues at a company is positive or negative), and companies with large amounts of positive ESG news perform best. The ESG Activity Signal combines information on long-term ESG polarity (Insight) with a measure of investor attention, represented by TTM Data Volume.

Companies with positive ESG-related news on high data volume relative to expectations tend to outperform. The best longer-term shorting opportunities—and the riskiest companies to exclude from a long-only strategy—are companies with negative ESG data that is not yet broadly disseminated. Combining our Volume and Insight signals this way into an ‘ESG Activity Signal’ provides a robust longer-term screening, trading and indexing strategy that works across a very broad range of stocks (see Table 2).

Source: Truvalue Labs

REGIONAL COMPARATIVE QUINTILE PERFORMANCE

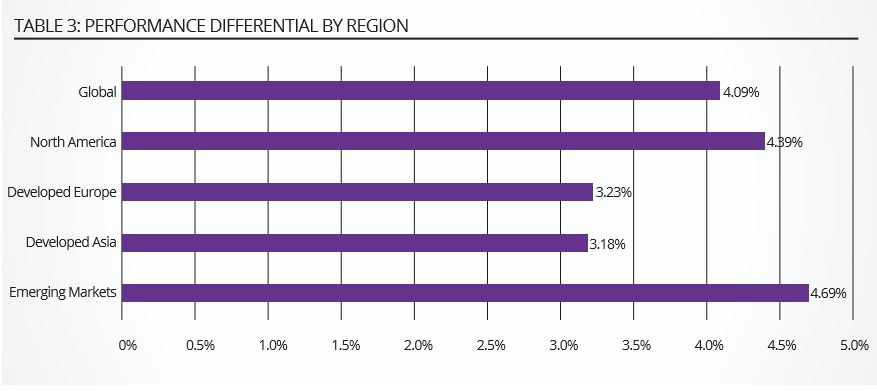

The study showed consistently strong quintile spreads for each global geographic region which are represented by different ETFs covering well-known indices in each region, including large, mid, and small-cap companies. The coverage universe was based on point-in-time ETF constituents for the past 12 years, with portfolio rebalances on a monthly basis.

As Table 3 shows, there are some interesting variations between different geographies with the greatest performance improvements occurring in emerging markets and North America, and the least – although still significant – in Europe and developed Asia. The study does not attempt to account for these 100+ basis point differences, although they may be attributable to the impact that ESG-aligned investors are already making in certain regions.

Source: Truvalue Labs

ESG ACTIVITY SIGNAL AND RISK PREMIA

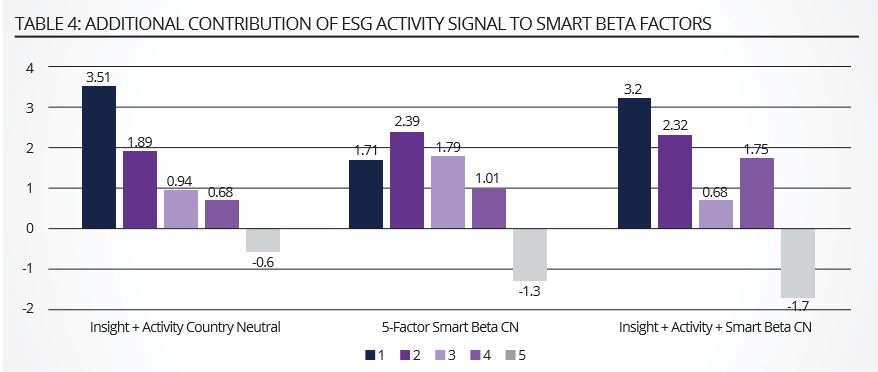

The ESG Activity Signal brings together information on long-term ESG polarity as well as investor attention, enabling a quantitative rating that can be easily combined with other quantitative factors such as well-known risk premia or smart beta factors. Overall performance of the ESG Activity Signal is on par with performance of a blend of five commonly-used smart beta factors (size, minimum volatility, price momentum, value, and quality).

ETF Insight: Can ESG investors do good and avoid underperforming?

Table 4 indicates that adding the ESG Activity Signal to this typical blend of smart beta approaches increases a 3% annualised smart beta quintile spread to 5%, significantly improving performance while strongly integrating ESG considerations in portfolio construction. These results suggest the hypothesis that ESG could itself be considered an investment factor. Further study is required to investigate whether this is the case or not.

Source: Truvalue Labs

CONCLUSION

The study analysed ESG data from over 5,500 companies back-tested over a 12-year period through to mid-2019. The geographical spread was broad covering over 3,100 companies beyond North America of which over 1,200 were in emerging markets. This breadth of input led to clear, statistically significant results.

The key takeaway of the study is that the application of systematically generated ESG signals shows strong potential for alpha generation across global markets. This approach is in contrast to studies where ESG analysis is primarily employed to exclude certain corporations or portfolio constituents, rather than demonstrate opportunities for performance enhancement with both the long and short investment strategies.

As more ESG ETFs come to market, investors expect a high level of quantitative rigour with regard to ESG data inputs and benchmark methodologies. This recent research provides useful guidance to inform the construction of new, more sophisticated ESG indices and portfolios. At the same time, it provides a roadmap for future research to deepen our understanding of the investment implications of ESG factors.

Thomas Kuh is head of index at Truvalue Labs

This article first appeared in the Q4 2019 edition of our new publication, Beyond Beta. To receive a full copy, click here.