After struggling to attract assets earlier in the year, equal-weight ETFs have been pulling in hefty flows in recent months as investors worry about excessive stock market concentration.

According to Morningstar’s European ETF Asset Flows Update, three funds tracking the S&P 500 Equal Weight index appeared in the top 10 of the US Large-Cap Blended Equity category for Q3 – the Xtrackers S&P500 Equal Weight ETF (XDEW), the iShares S&P 500 Equal Weight ETF (ESWP) and the XTrackers S&P 500 Equal Weight ESG ETF (XSZP).

They booked net inflows of €2.1bn, €1.4bn and €1.1bn over the quarter respectively.

Inflows have been particularly strong since the market volatility over the summer, with XDEW and ESWP topping the category’s inflow charts for September.

Jose Garcia-Zarate, associate director of passive strategies at Morningstar, said the renewed interest in equal-weight strategies: “suggests that some investors are becoming wary of the high concentration in tech stocks found in traditional market-cap-weighted benchmarks.”

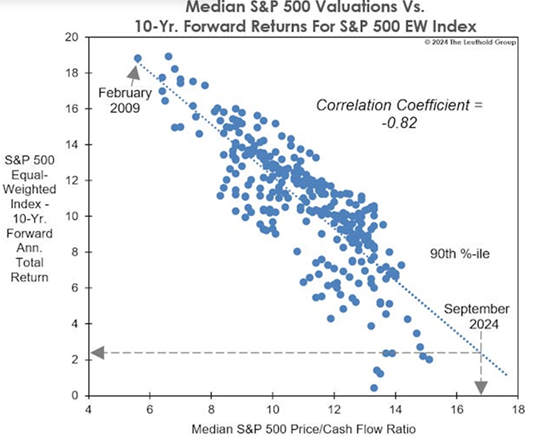

But are equal-weight ETFs a good way to protect against excessive stock market concentration? An interesting chart by research firm The Leuthold Group calls that into question.

The theory

Although there are various ways to measure it, stock market concentration is generally seen as the extent to which a small number of stocks dominate the performance of an index.

The greater the concentration, the greater the reliance on a small number of very large companies.

Concentration typically spikes in one of two environments: bear market bottoms – defensive stocks – and in bull market peaks – highly valued growth stocks.

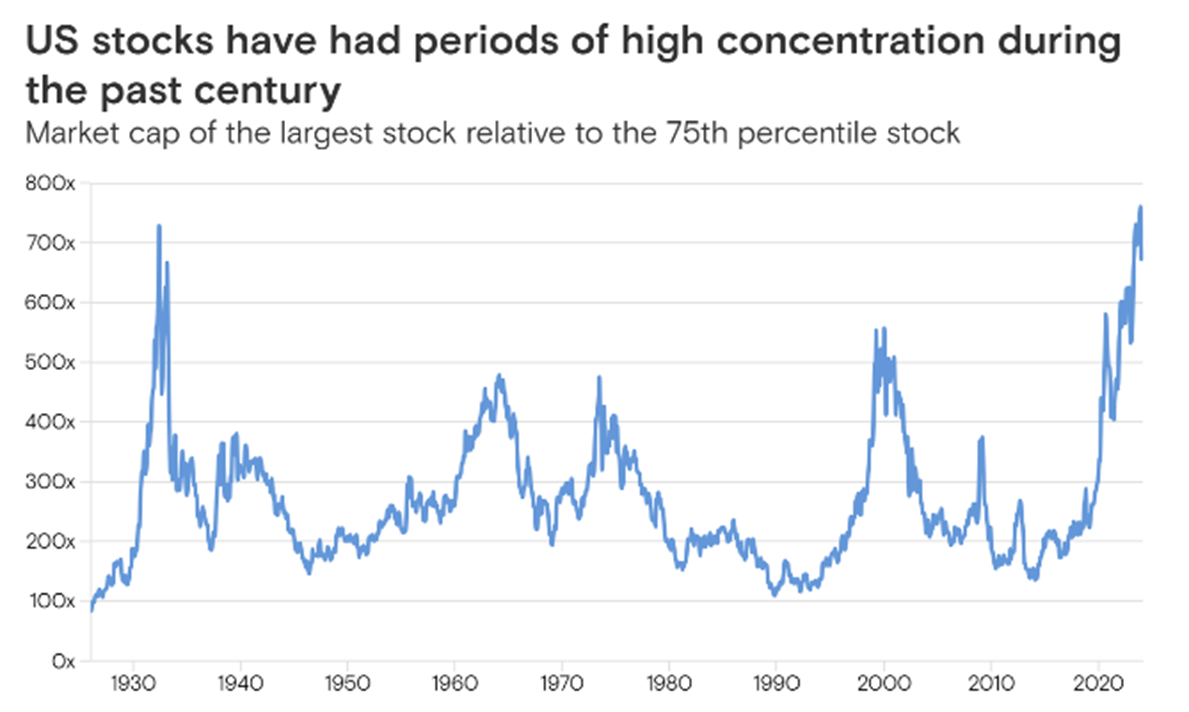

As the below chart from Goldman Sachs shows, concentration spiked in 1932, 1973 and 2008 – the depth of a bear market, as well as in 1964 and 2000 – the peak of a bull market.

The recent spike has been of the bull market variety, with cap-weighted S&P 500 investors heavily exposed to the richly valued Magnificent 7 stocks. At index level, the Shiller P/E ratio for the S&P 500 is now around 37x – one of the steepest valuation levels on record.

If investors fear a downturn in market sentiment, exposure to equal-weight ETFs ought to make sense – avoid excessive exposure to the stocks with furthest to fall. This fear has driven the recent inflows.

The reality?

But are equal-weight ETFs good protection for excessive concentration and toppy valuations at index level?

Perhaps, but equal-weight investors might want to put the champagne on ice.

The below chart from The Leuthold Group suggests equal-weight investors can expect paltry annual returns of around 2.5% for the next ten years based on historical correlations between the index’s median price-to-cash flow ratio and forward-looking returns.

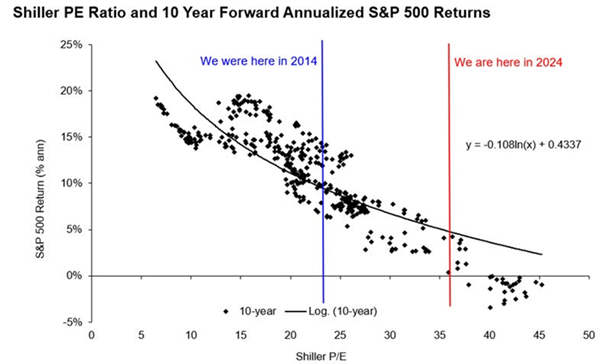

Cap-weighted investors, on the other hand, could be set for annual returns of around 5% for the next decade based on a similar analysis by New Edge Wealth using the Shiller P/E as the valuation method.

According to the trendline, forward-looking returns for cap-weighted ETFs may not be as bad as feared, even from this lofty starting point.

The data, of course, can be cut in countless different ways and the valuation metrics, time periods and observation points used in the analysis are highly subjective.

The above examples may be extreme, but for investors worried about extreme stock market concentration and elevated valuations, they may want to investigate whether equal-weight will really give them the protection they are looking for.