Japan has long been overlooked by international investors after decades of deflation and economic stagnation left many unexcited by the world’s third-largest economy.

However, the end of eight years of negative interest rates is seen as a win against deflation and corporate reform has propelled the country’s equity market back into investors’ crosshairs.

On average, Japanese equities make up 3.6% of EMEA investors’ equity allocation in moderate-risk multi-asset portfolios, according to BlackRock, well below its 5.4% weighting in the MSCI ACWI index.

It means many fund selectors missed out on much of Japanese equity's recent gains. The flagship Nikkei 225 index has returned 47% since the start of 2023, outperforming the US, Europe and China.

There are signs investors are catching up. Last month Japanese equity ETFs recorded $6.9bn inflows globally, its largest monthly inflows since June 2023, with European investors allocating $1.3bn, according to BlackRock data.

However, the world’s largest asset manager believes the market still has further to go.

Corporate reform, foreign investor flows and macro sea change could all prove a tailwind for Japanese equities.

Regulatory pressures to bolster capital improvement plans have led to an increase in share buybacks creating a wealth effect that supports consumption, BlackRock said.

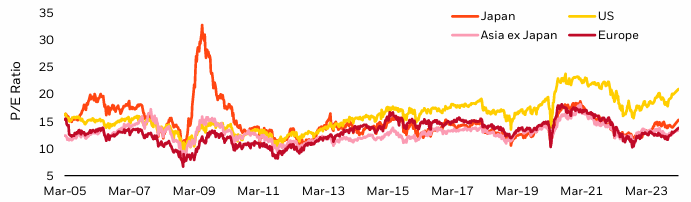

Meanwhile, valuations remain inexpensive versus the country's historical average and versus more expensive US equities while much of the stock market's outperformance looks set to be driven by strong earnings.

Analysts have revised company earnings higher, anticipating a 12-month earnings growth estimate of 7.9%.

Chart 1: 12-month forward P/E ratio

Source: BlackRock

The Bank of Japan’s (BoJ) recent move to hike interest rates for the first time in 2007 – as well as ending the purchase of its ETF programme – could be seen as it winning the battle against its deflationary cycle.

Despite this, concerns have grown recently that inflation is being induced by a weak yen instead of being driven by a wage growth spiral driving it towards the policy goal of 2%.

However, BlackRock believes wage growth is heading in the right direction.

“Members of Japan’s largest union group have so far secured average annual increases of 5.28% outpacing last year’s 3.8%, which itself was the biggest increase in 30 years,” it said.

“Investors should start to look at unhedged exposures to Japanese assets, where possible, and opportunities away from large-cap exporter stocks.”

Despite the opportunities it could create for investors, the end of the BoJ’s negative interest rate policy could cause some interim volatility.

This has already been felt in the market, with the Nikki 225 index down 6.5% since 19 March.

Japanese bonds will likely feel the impact of rising rates, however, the BoJ has said it will keep an accommodative monetary policy while continuing to buy long-term bonds.

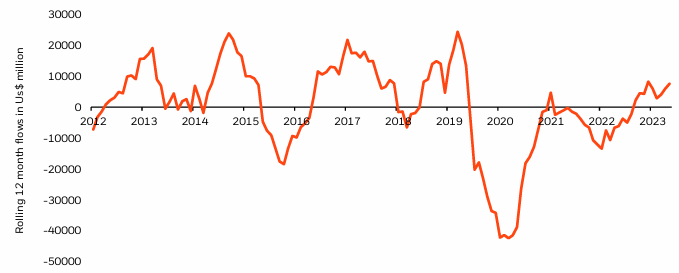

Foreign investor inflows and domestic investors' appetite to invest could also bolster the country’s equity market.

“Even with the return of foreign investors in 2023, years of persistent selling means that we are only just seeing benchmark allocations returning to neutral in both iShares flow and foreign institutional investor flow,” BlackRock said.

“As Japan’s weighting in indices rebalances in line with its higher market cap, passive investors will need to continue to buy Japanese equities if they are to maintain their allocations.”

Chart 2: Investors are still not overweight

Source: BlackRock

ETFs to consider

For investors looking to increase their exposure to Japanese equities there are almost 80 unhedged ETFs to consider.

The largest ETF in the market is the $5.5bn iShares Core MCSI Japan IMI UCITS ETF (SJPA) which has a total expense ratio (TER) of 0.12%. Meanwhile, the Amundi Prime Japan UCITS ETF (PRIJ) is the cheapest in the market with a 0.05% fee.