Inflation and labour markets have remained stubborn for some time, causing many major central banks to delay the start of their monetary easing cycles. However, there are signs that these key measures are beginning to ease, which paves the way for fixed income markets to deliver attractive risk-adjusted returns.

Is it too late to invest in fixed income?

It is a natural concern for investors to think they have missed the fixed income train given how far credit spreads have compressed already. Spreads are at multi-year tights, and it does not seem like they could com[1]press any further.

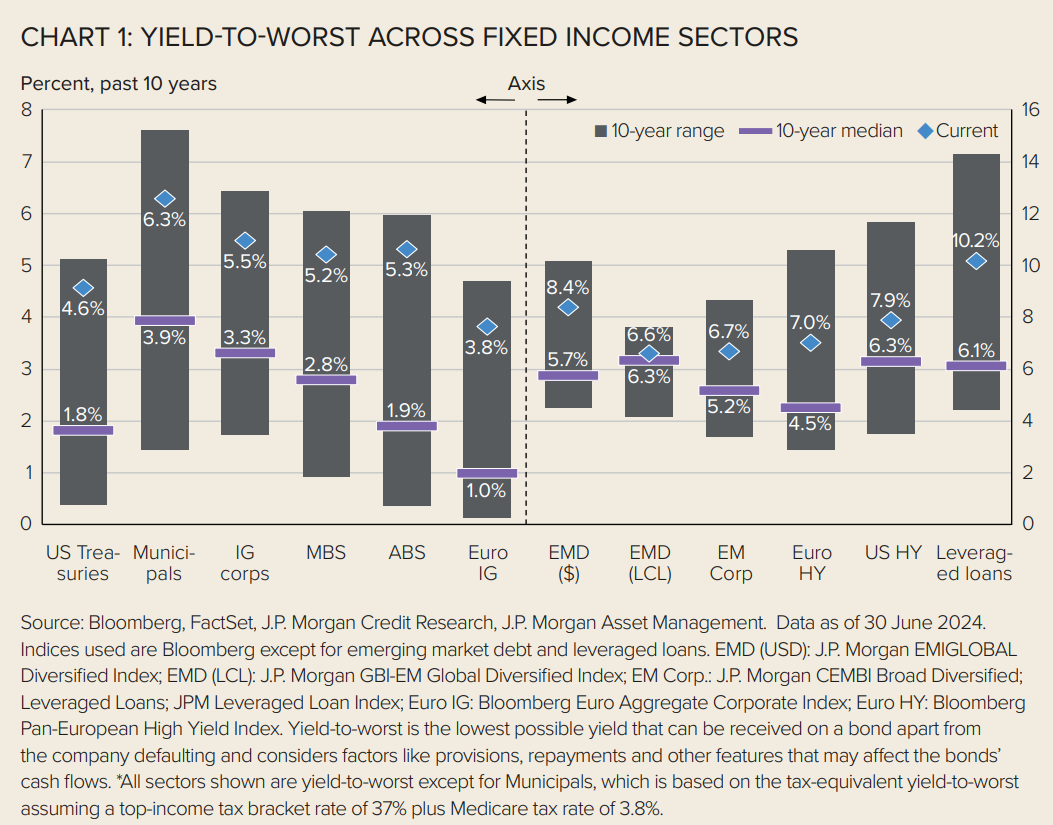

However, while spreads may offer less upside potential, all-in yields across nearly all major fixed income sectors remain well above longer-term averages. Investors still have time to lock in these yields before central banks embark on their cutting cycles.

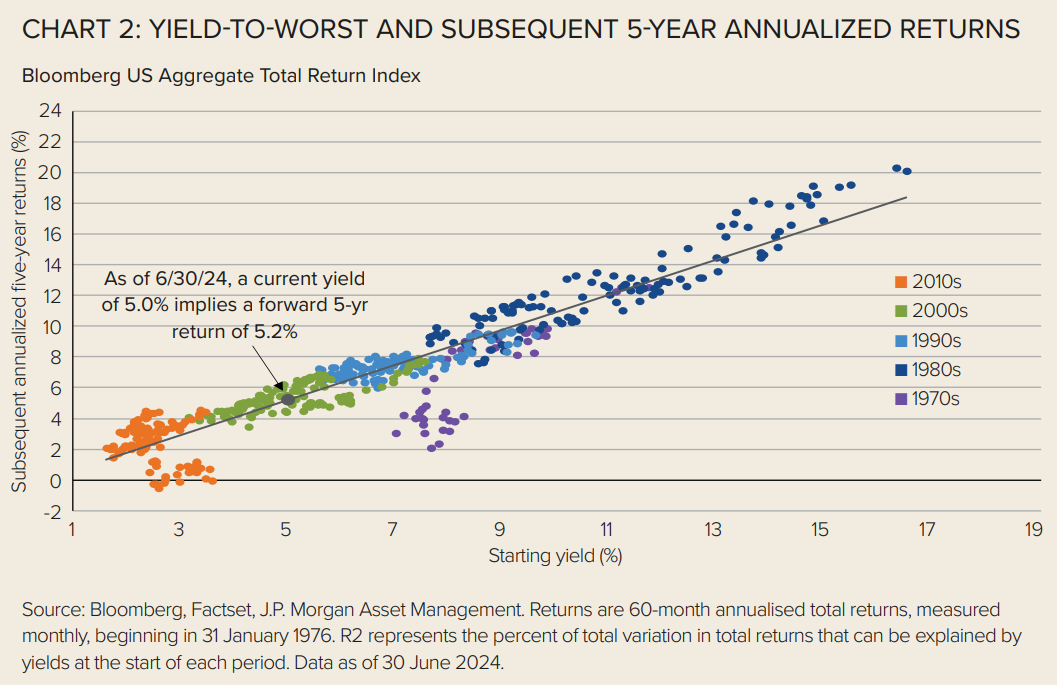

This is especially important given starting yields are historically a strong predictor for future annualised returns over the following five years. A yield-to-worst on the Bloomberg US Aggregate Total Return index of 5% at the end of June implies over a 5% annualised return going forward.

Income-seeking investors now have an alternative source of yield in core fixed income as money market yields decline.

So what about spreads?

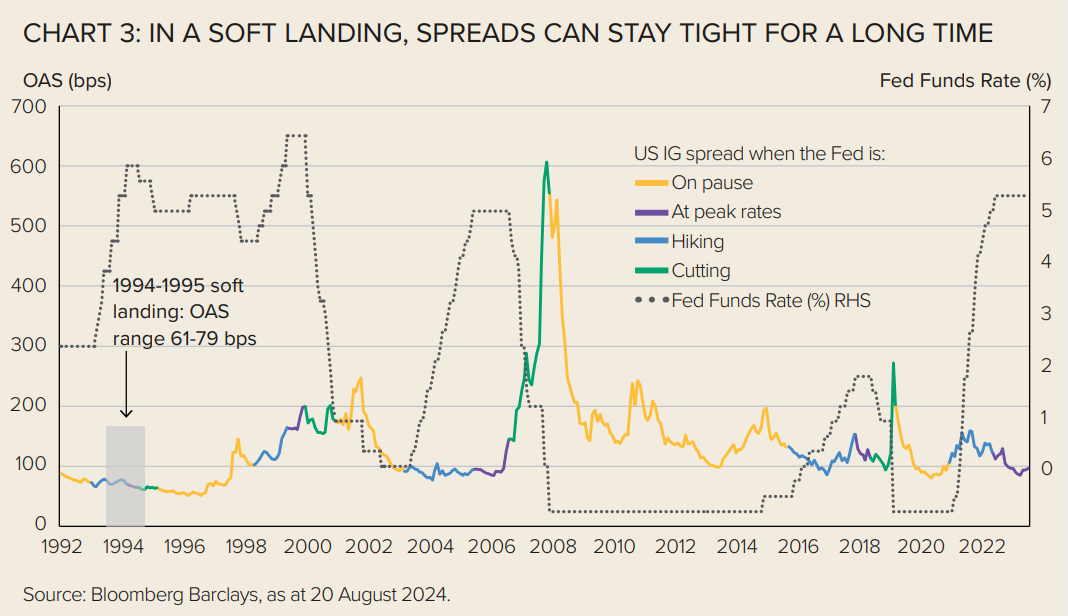

There is no escaping the fact that spreads are not cheap. A resilient consumer and strong corporate balance sheets have meant that investment grade and high-yield spreads continued to grind tighter to levels not seen since 2021.

However, given our base case scenario for the US economy is a soft landing, historical analysis suggests that credit spreads can tighten further from here. From both the top-down and bottom-up, we are seeing reassuring signs that credit markets remain healthy, which supports being overweight versus our benchmark.

Positioning for a soft landing scenario

We continue to see attractive opportunities across the global fixed income landscape. We believe a strategy with an active approach to investing across the global fixed income spectrum is best placed to exploit risks and opportunities as we enter what could be an exciting period for fixed income investors.

Our JPM Global Aggregate Bond Active UCITS ETF – an active core bond allocation launched in October 2023 – is positioned to capture two key macroeconomic themes that we think will play out in the coming months: an interest rate cutting cycle by most major central banks and a soft landing for economic growth.

This means the portfolio has a diversified basket of duration as well as sectors that offer greater carry, such as investment grade credit, MBS and European peripheral debt.

Given the current path of inflation, particularly in the US, we think now is the right time to increase the amount of duration we have within our portfolio. We think the best way of illustrating this conviction is via steepeners.

The US Treasury yield curve has been inverted since 2022 but as more cuts are priced into the front-end, we expect to see this unwind. The steepener trade also acts as a recessionary hedge to the riskier parts of the portfolio should a recession occur. In this scenario, the Federal Reserve’s cutting cycle will need to be more aggressive than currently priced and the curve can steepen by an even greater extent.

Within credit markets, we continue to favour overweight positions in investment grade assets. Although investment grade spreads are relatively compressed all-in yields remain above longer-term averages.

From a technical perspective, supply and demand in primary issuance markets has been strong, providing further support to the asset class. Meanwhile, from the bottom-up, corporate earnings also continue to look robust. A strong fundamental and technical backdrop means that we continue to think spreads can grind tighter going forward, while current yields provide an attractive entry point for investors looking to increase their investment grade exposures.

However, the portfolio remains well poised for a multitude of scenarios. Our barbell approach to holding credit risk as well as duration means that if a soft landing is not realised, our risks are diversified and we can hedge against the possibility of a recession.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full edition, click here.

Important information

For Professional Clients / Qualified Investors only – not for Retail use or distribution. This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation. The value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Past performance is not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. Investment decisions shall solely be made based on the latest available Prospectus, the Key Information Document (KID), any applicable local offering document and sustainability-related disclosures, which are available in English from your J.P. Morgan Asset Management regional contact or at www. jpmorganassetmanagement.ie. A summary of investor rights is available in English at https:// am.jpmorgan.com/lu/investor-rights. J.P. Morgan Asset Management may decide to terminate the arrangements made for the marketing of its collective investment undertakings. Purchases on the secondary markets bear certain risks, for further information please refer to the latest available Prospectus. Our EMEA Privacy Policy is available at www.jpmorgan.com/emea-privacy-policy. This communication is issued in Europe (excluding UK) by JPMorgan Asset Management (Europe) S.à r.l., 6 route de Trèves, L-2633 Senningerberg, Grand Duchy of Luxembourg, R.C.S. Luxembourg B27900, corporate capital EUR 10.000.000. This communication is issued in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. Registered in England No. 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP. In Switzerland, JPMorgan Asset Management Switzerland LLC (JPMAMS), Dreikönigstrasse 37, 8002 Zurich, acts as Swiss representative of the funds and J.P. Morgan (Suisse) SA, Rue du Rhône 35, 1204 Geneva, as paying agent. With respect to its distribution activities in and from Switzerland, JPMAMS receives remuneration which is paid out of the management fee as defined in the respective fund documentation. Further information regarding this remuneration, including its calculation method, may be obtained upon written request from JPMAMS.