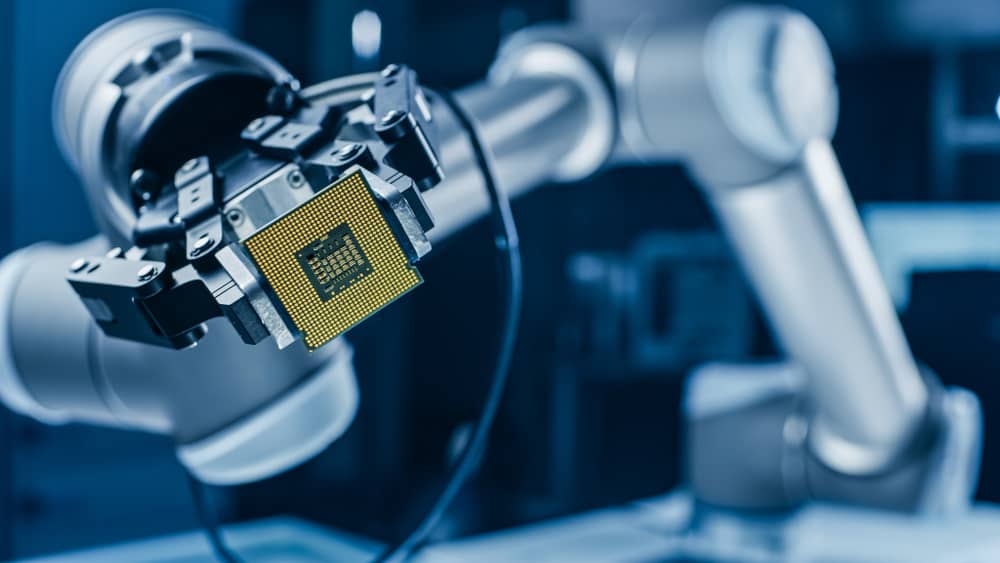

Semiconductor ETFs continued to top the performance charts in the second quarter of 2024 as clean energy continued its poor performance for the year.

Nvidia continued to beat earnings expectations in the first quarter of the year as artificial intelligence (AI) demand drove record revenue growth of $26bn.

The chipmaker’s share price is up 27.8% since May 23, as at 9 July, and a huge 175% since the turn of the year.

Nvidia drives tech ETFs

As a result, the $432m Amundi MSCI Semiconductors ESG Screened UCITS ETF (SEMG) – which holds a 32.9% weighting to Nvidia – rose 18% over the quarter.

Tech ETFs including the Invesco US Technology Sector UCITS ETF (XLKQ) and the iShares S&P 500 Information Technology Sector UCITS ETF (IITU) – each with a 20.5% weighting to Nvidia rose by 14.1% and 13.7%, respectively.

Beyond Nvidia, other semiconductor companies also boosted ETFs.

For example, the HSBC MSCI Taiwan Capped UCITS ETF (HTWN), the Xtrackers MSCI Taiwan UCITS ETF (XMTW) and the iShares MSCI Taiwan UCITS ETF (ITWN), rose 13.8%, 13.5% and 13.4%, respectively.

This was driven by a strong quarter from the Taiwan Semiconductor Manufacturing Company (TSMC) which rose 35%.

‘Tech mania’ also drove the rally in Turkish ETFs over the quarter, with the Amundi MSCI Turkey UCITS ETF (TUR) and the iShares MSCI Turkey UCITS ETF (ITKY) topping the performance charts with returning 21.6%, respectively.

The Turkish tech sector has led the rally, while rampant inflation has driven retail investors to tap into the stock market.

Clean energy falters

While the worst-performing ETF of the month was the VanEck Rare Earth and Strategic Metals ETF (REMX) – falling 17.3% over the quarter – it was ETFs linked to the clean energy theme that stood out.

Poor performance was felt across the sector, with the Global X Solar UCITS ETF (RAYZ) falling 16.2%, while the Global X Lithium & Battery Tech UCITS ETF (LITU) and the VanEck Hydrogen Economy UCITS ETF (HDRO) fell 13.9%, respectively.

Stubborn inflation and higher-for-longer interest rates have hammered energy transition companies typically carrying large amounts of debt.

The prospect of another Trump presidency also creates a challenge for the sector, with the former President threatening Biden’s Inflation Reduction Act (IRA) which has seen $470bn of tax credits allocated to the roll-out of renewable energy utilities and energy storage in the US.

Latin American ETFs suffer

In a stark turnaround from last year, Mexican ETFs underperformed in Q2 as volatility hit the market following a June presidential election.

The iShares MSCI Mexico Capped UCITS ETF (CMXC) and the Xtrackers MSCI Mexico UCITS ETF (XMES) fell 17.1% and 16.7%, respectively.

Brazilian equity and more broadly Latin American equity ETFs also recorded a quarter of underperformance.

The iShares MSCI EM Latin America UCITS ETF (LTAM) returned -12.7%, while the Amundi MSCI Brazil UCITS ETF (BRZ) led the away among Brazil-focused ETFs, falling 12.4%.