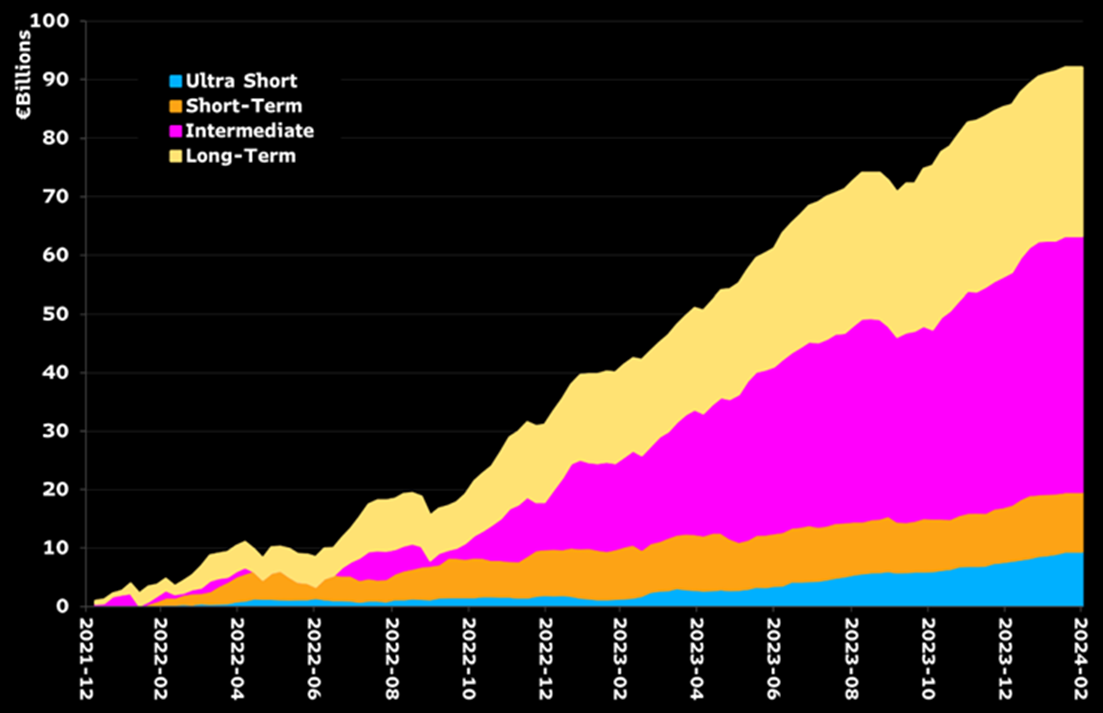

Fixed income UCITS ETFs booked their leanest month of asset gathering “in years” last month as investors repriced their expectations of steep interest rate cuts in 2024.

Fixed income ETFs across all durations saw 16 months of strong inflows taper in February with broad bond ETFs suffering the largest outflows, according to data from Bloomberg Intelligence.

Overall, fixed income ETFs saw just $2.8bn inflows last month versus $8bn in January, according to Invesco, as higher-than-expected US inflation led investors to fear the Federal Reserve will not cut rates as aggressively as previously forecasted.

Chart 1: Fixed income ETFs by duration cumulative weekly flows

Source: Bloomberg Intelligence

“Fixed income experienced challenges in February due to stronger economic data pushing back rate cut expectations and putting upward pressure on bond yields,” Paul Syms, head of EMEA ETF fixed income and commodity product management at Invesco, said.

“Additionally, the risk-on tone and strong returns from equities meant that fixed income ETFs flows were relatively subdued over the month.”

A key casualty among core fixed income ETF issuers was BlackRock, which booked little over €1bn inflows into its European-listed exchange-traded products (ETPs) in February, its lowest monthly asset gathering “in almost two years”, according to Bloomberg Intelligence.

While cyclical fluctuations in flows are commonplace, BlackRock’s net new assets in February were considerably below the €5.4bn monthly average inflows into its European ETF range in 2023 and represented just 7% of ETF inflows in Europe last month, set against a monthly average of 44% for the past two years.

Driving the uncharacteristically low take for the world’s largest manager was an exodus from its popular iShares Core € Corp Bond UCITS ETF (IEAC) which saw €2bn outflows in February following €4.6bn inflows in 2023.

“IEAC has outflows every February as investors redeploy cash parked in the ETF over the new year, but last month's may have been especially large in the face of weakening expectations for interest-rate cuts,” Henry Jim, ETF analyst at Bloomberg Intelligence, suggested.

Silver linings remain

A sobering month of asset gathering for fixed income ETFs comes after the market priced in as many as six interest rate cuts by the Fed in 2024, with most asset managers touting this as the year when prices across the asset class would stage a concerted comeback.

“The backdrop for fixed income remains broadly supportive with interest rates likely to start coming down in the middle of the year,” Syms said.

“It, therefore, seems likely that investors will take advantage of opportunities to put cash to work in bond markets, increasing duration to lock in yields before central banks start easing policy.”

Some bright spots appeared away from headline flows among the largest ETF issuers.

For instance, Goldman Sachs Asset Management saw the highest relative monthly asset growth, owing to a €32m inflow into the Goldman Sachs Access UK Gilts 1-10 Years UCITS ETF (GBPG) and the €50m seeding of the Goldman Sachs Global Green Bond UCITS ETF (GSXG).

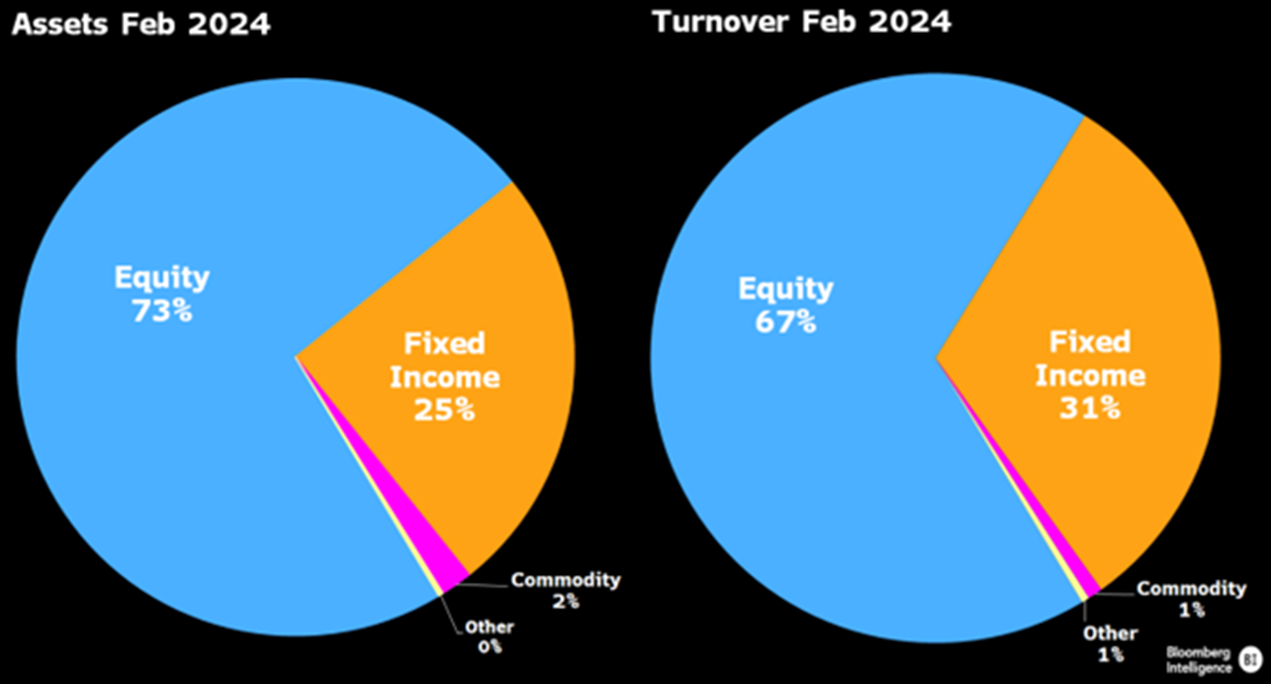

Jim also noted fixed income ETFs accounted for 31% of European ETF trading volume, punching above their 25% market share, as investors continue to favour ETFs as their fixed income trading vehicle of choice.

Chart 2: ETF assets vs turnover by asset class

Source: Bloomberg Intelligence