ARK Investment Management founder, CEO and CIO Cathie Wood has lashed back at news that hedge fund manager Michael Burry has taken out a $31m position against her company’s flagship ETF.

According to a 13F regulatory filing on Monday, the ‘Big Short’ investor’s Scion Asset Management owned put contracts against 235,000 shares of the Ark Innovation ETF (ARKK) at the end of Q2, Bloomberg revealed.

With Burry warning retail investors about unsustainable valuations and the potential for “the mother of all crashes” in cryptocurrency and meme stocks, ARKK returning 314% between its low in March 2020 and its high in February of this year would have made it a prime target for sceptics looking for a shorting opportunity.

While the exact detail of the contracts taken out by Scion are unknown, put positions would have allowed the firm to sell ETF shares before a pre-agreed price and date with the contracts’ value increasing as and when a securities’ value falls below the agreed price threshold.

Taking to Twitter to respond to Burry’s bearish play, Wood said: “To his credit, Michael Burry made a great call based on fundamentals and recognized the calamity brewing in the housing/mortgage market.

“I do not believe that he understands the fundamentals that are creating explosive growth and investment opportunities in the innovation space.”

Offering a positive word on the prospects of the firm’s ETFs, Wood added: “In our view, the seeds for the innovation that ARK Invest is dedicated to researching were planted during the 20 years ending with the tech and telecom bust.

“Having gestated for more than 20 years, these technologies should transform the world during the next 10 years.”

Unfortunately for ARK, Burry and others seem to have had strong convictions against innovative tech companies in the short term. In addition to direct ARKK shorts, Scion also increased wagers against Tesla – a top ARK holding – from 800,100 to 1.1 million between Q1 and Q2.

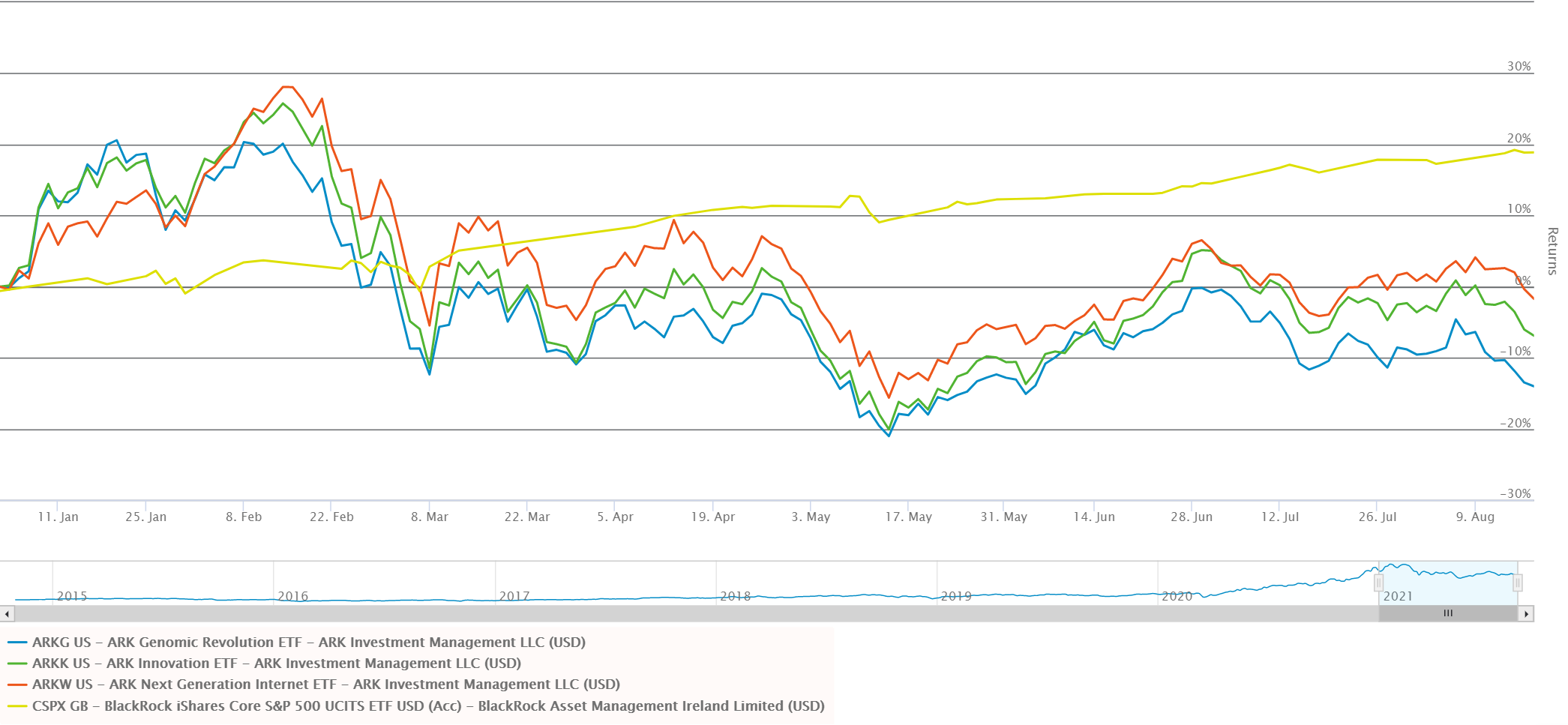

Since seeing its price peak little over seven months ago, ARKK has since fallen by 26% with some of its top ten allocations, including Spotify and Teladoc, falling more than 30% so far in 2021. Also, having comfortably outperformed most conventional benchmarks in 2020, the three top ARK ETFs have underperformed the S&P 500 by at least 20% year-to-date.

Source: ETFLogic

This period of underperformance is in line with conventional wisdom on bond coupons with US 10-year Treasury yields almost doubling between the end of the year and the end of Q1.

Such trajectories tend to be bad news for growth equity-based ETFs such as ARK’s given their underlying often have premium valuations based on hopes of future growth. When rates rise – meaning more expensive borrowing – this has an impact on companies’ future cash flows, and in turn, a negative effect on valuations.

Despite this, Wood stressed the worst of the corrections were confined to the beginning of the year.

“Most bears seem to believe that inflation will continue to accelerate, shortening investment time horizons and destroying valuations.

“Despite what we believe has been a supply-chain related/short term burst in inflation, both equities and bonds have appreciated since March,” she continued.

More contentiously, while many are seeing the spread of the COVID-19 delta variant as a warning light for currently bullish equity markets – and a cause of the recent commodity slump – Wood suggested current market strength will provide another “leg up” for innovation strategies.

“The deflation in commodity prices is cyclical but is adding to the secular forces caused by technologically enabled disruptive innovation [good deflation] and creative destruction [bad deflation].

“If we are correct, GDP and revenue growth will diminish until the opportunities in nascent technologies begin to move macro needles. In this environment, innovation based strategies should distinguish themselves.”

ARKK backers seem to agree. The ETF has gathered $6.5bn assets since the turn of the year despite returns being in negative territory.

These investors, like Wood herself, are taking the long-sighted view that volatile, concentrated portfolios might have pronounced periods of underperformance but also the potential for the most exciting runs of strong returns.

Abandoning the common line that all returns equal the market before fees, ARK supporters believe the drawdowns are a temporary pain worth enduring for innovation-based alpha. Over the last five years this has been proven right with the company’s core trio outperforming Europe’s most popular S&P 500 ETF by a factor of three.

Source: ETFLogic