The recent cultivation of clean energy investment, defining the clean energy industry, the headwinds facing this sector and how to gain exposure using ETFs were some of the key areas covered during ETF Stream’s recent webinar on clean energy ETFs in partnership with First Trust.

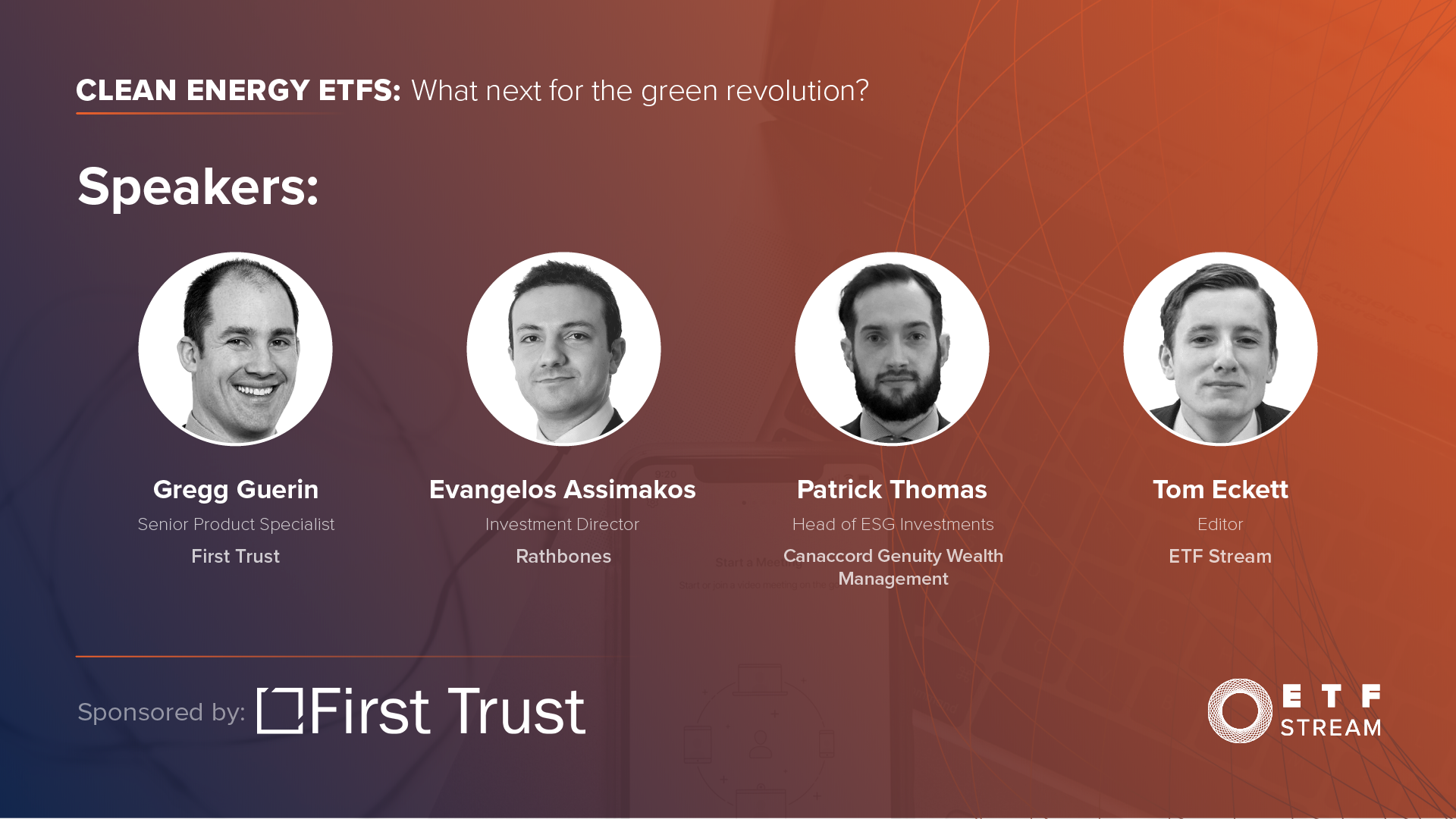

The webinar, entitled Clean Energy ETFs: What next for the green revolution?, started by discussing the rapid investor adoption of clean energy and countries’ energy mixes in recent years.

One of the driving forces behind the sector’s momentum has been the steep decline in the price of energy produced by renewable sources, according to Gregg Guerin, senior product specialist at First Trust.

“What has happened in this last 20 months are a few categorical shifts,” Guerin said. “For one, we’re producing energy from the sun and the wind cheaper than fossil fuels.”

Certainly, the effect that pandemic volatility had on fossil fuels also inspired energy providers and investors to diversify their energy mix.

However, Guerin also identified a fundamental difference between clean energy’s past and forward-looking investment cases.

“Traditionally, clean energy returns have been driven by subsidies and substitutes,” Guerin noted.

Whereas now, rather than their fates being rigidly tied to government policy and oil prices, Guerin said clean energy equities are now able to be profit-making.

Evangelos Assimakos, investment director at Rathbones, offered another reason for the theme’s recent ascendance, stating the range of ETFs targeting it now means investors have a range of entry points to choose from.

“Now you have a far greater range of choices, so the offering has increased,” Assimakos said. “This is now an investable theme with momentum behind it.”

A break down of clean energy ETFs as competition hots up

Patrick Thomas, head of ESG investments at Canaccord Genuity Wealth Management, added investors increasingly believe clean energy is a theme with staying power, and this means people are entering for the right reasons, as opposed to short-term profit-taking.

Thomas also spoke on the returns slump suffered by clean energy ETFs this year, and aside from being a backtrack from exceptional performance in 2020, dips are something investors should become accustomed to.

“People should see this space as being inherently cyclical because energy is,” Thomas continued. “Clean energy and climate issues are a structural shift but it will have ebbs and flows, so people should expect that in the longer term.”

However, the outlook remains bright according to Guerin, who stated the theme is being driven by technological innovation – and further innovation should assist in reducing the cost of clean energy production in future.

Defining the value chain

As clean energy products adapt to remain suitable for the vast sums of assets flowing into them, another discussion being had is what can and cannot be considered clean energy – and what the prospects are for each subsector.

While there is likely some debate about whether cleantech – such as energy efficiency products – should be amalgamated within individual clean energy ETFs with other areas such as renewables utilities, there is broad consensus that the clean energy value chain goes beyond wind and solar power.

Among other examples, Guerin noted grid-scale storage, battery technology, hydrogen, electric vehicles (EV) and the underlying components for each, should also be included.

Over the next decade, it is expected that the meteoric rise of EV demand will continue playing out. However, the future of hydrogen appears less certain.

Are hydrogen ETFs more than just hot air?

“Countries around the world are looking to invest in hydrogen, what we need to do is reduce the cost.” Guerin added. “In particular, green hydrogen relies on the continued cost cutting of solar power.”

Thomas said transport and heating are two of the areas he will be watching closely for hydrogen deployment in the coming years. Meanwhile, Assimakos said like other clean energy subsectors, hydrogen equities have seen their frothy valuations cut in recent months, and further normalisation can be expected as innovative energy products enter the mainstream.

“New technologies will also come through, and in years to come, hydrogen may become what wind and solar is now,” Assimakos added.

Which way is the wind blowing?

Speakers said despite investor support for the clean energy theme having existed for some years, a broader uptake has only occurred in the last 18 months or so.

Looking beyond the pandemic and reduced clean energy costs, it is clear to many the election of US President Joe Biden was a boon for clean energy ETF support, with monthly inflows into the product class tripling between October and November 2020.

However, there was consensus that investors should not exaggerate the contribution of Biden’s arrival to secular clean energy adoption.

“I view Joe Biden as blowing into a sail that already had a hurricane blowing into it – he certainly will not hurt,” Guerin said.

Guerin added he expects policy under Democrat leadership to remain accommodative but warned excessive oversight would represent a barrier to growth.

Assimakos noted regulation of the sector will likely remain supportive but added the removal of the timing of subsidy removal is an area companies and investors need to watch closely.

Outside of politics, another challenge facing clean energy is the tarnishing of its green image by those taking heed of the mining emissions created while extracting rare earths for the components essential for batteries, solar photovoltaic units, converters and more.

Offering some fundamental wisdom, Assimakos said: “Economics is the study of trade-offs. Until we get where we want to go, there will be trade-offs.”

He added the decarbonisation process will be gradual, not immediate and wholesale, and will involve processes such as mining and piecemeal transitions such as from coal to natural gas.

Metal ETPs have a love-hate relationship with clean energy investors

Thomas continued: “You cannot do clean energy without pulling this out of the ground, though this process is getting a lot more technologically advanced, and miners are thinking a lot more about their mining processes.

“Governments such as the US are also thinking about relying less on China, so this will ultimately be a geopolitical arena.”

In Thomas’s view, the main risk facing clean energy investors in coming months is for long markets lean into the cyclical equities rotation.

“Headwinds will be stylistic and something like the market favouring deep value over growth,” Thomas said.

ETF selection

Another factor playing on investors’ minds is how to use ETFs to gain exposure to the secular shift to clean energy. With new products entering the space at a high pace, speakers listed areas requiring investors to carry out due diligence.

Assimakos said it is crucial to look at a product’s allocations and make sure the liquidity profiles and concentrations in particular stocks are favourable.

“You need to be wary of liquidity and you don’t want an ETF provider to own a huge portion of a single company,” Assimakos noted.

Thomas added when using rules-based products, investors need to identify the criteria for inclusion in an ETF’s underlying index, to understand the purity of exposure they are getting to a theme.

SPDJI’s next consultation could prompt BlackRock clean energy ETF zenith

In terms of how to use ETFs most effectively, the speakers agreed they offer a way of providing broad exposure to a future theme instead of picking individual winners in an uncertain future.

“It is hard to predict and tell what’s going to happen. In 2006, you would have invested in BlackBerry and Nokia over Apple for smartphone exposure,” Guerin stressed.

Thomas said ETFs are ideal for targeting subsectors such as EVs and the future of food, but warned they work less well in providing exposure to more nuanced areas such as the circular economy.

“We tend to marry ETFs with some direct stock picks where we feel a company is represented well in major indices and save our clients some costs,” Assimakos added. “Then we can invest in less prominent companies via ETFs in a more concentrated way.”

Overall, clean energy has risen to prominence over the past year or so. For better and for worse, ETFs have felt the effects of and contributed to this sector’s volatility. Investors seeking exposure to this long-term theme should prepare for more uncertainty as clean energy ekes out its share of the future energy mix – and must choose a product that tracks this space substantively.

To watch the webinar,click here.