Cryptocurrency investors were reminded this week that with the potential for great returns comes great risk. Both bitcoin and ethereum tumbled to multi-month lows last Tuesday before clawing back some of those losses on Wednesday and Thursday.

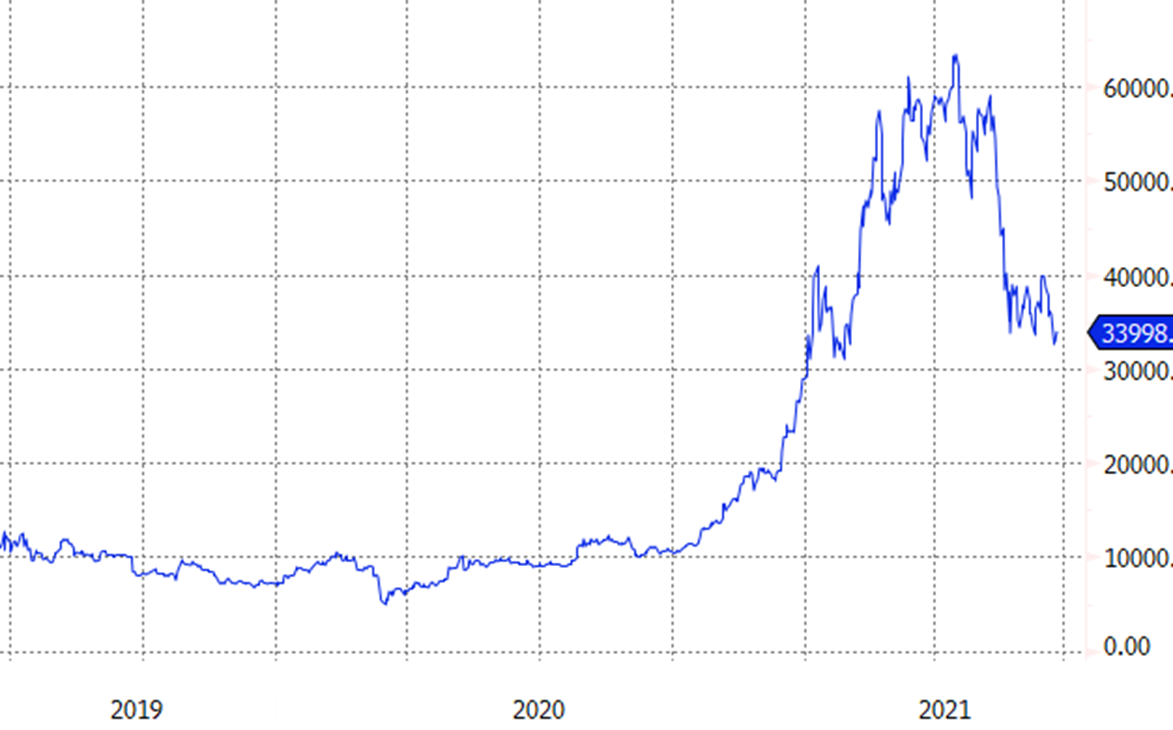

Bitcoin briefly wiped out all of its gains for the year after it fell below $29,000. The largest cryptocurrency by market value reached a peak of more than $63,000 in April – close to double current prices.

At one point, bitcoin’s market capitalisation was nearly $1.2trn, making it more valuable than either Facebook or Tencent. Today all of the bitcoin in the world is worth about $620bn.

Chart 1: Bitcoin prices

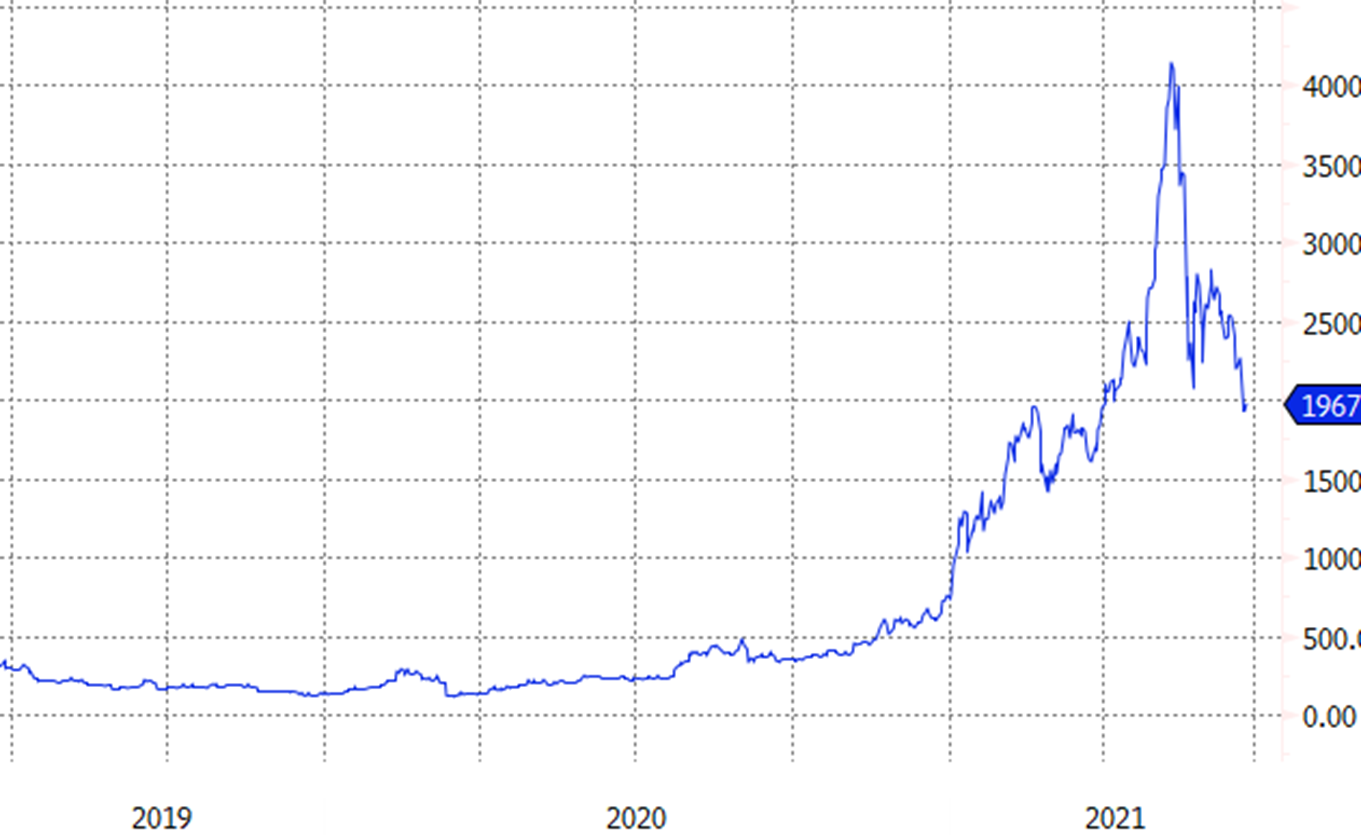

Meanwhile, ethereum prices tumbled to a low of $1,700 on Tuesday, down nearly 60% from its record high set just a month ago, but still more than double the $740 level where it started the year.

Chart 2: Ethereum prices

This year’s varying performance between bitcoin and ether illustrates that while most crypto tokens tend to move in the same direction on a day-to-day basis, returns can deviate sharply over longer periods of time.

Volatility the norm

This year’s big surge and subsequent plunge in token prices is par for the course in the volatile crypto markets. A growing acceptance of cryptocurrencies by institutional investors pushed bitcoin and other tokens higher for about six months between last October and this May.

Prices for what some consider to be digital gold jumped more than sixfold in that half-year period, as some of those institutions reasoned that bitcoin could make for a good inflation hedge, a sought-after characteristic amid an economic boom and signs of quickly rising consumer prices.

At the same time, ethereum – the native cryptocurrency of the Ethereum blockchain – also climbed about 6x between October and May—from around $400 to $2,500. Ethereum is at the forefront of two red hot areas of innovation in the blockchain space: decentralised finance (DeFi) and nonfungible tokens (NFTs).

As demand for these applications and digital goods spiked, so too did prices for ether, which is used to power the ethereum blockchain. The frenzy for DeFi and NFTs was so intense that ether prices shot up more than 60% between April 15 and May 11 – a period in which bitcoin actually declined.

Other crypto tokens like dogecoin and shiba inu saw even greater spikes for seemingly no reason other than speculation. At the peak of the frenzy, even some of the most ardent crypto bulls were conceding that pockets of the crypto market had become bubbly.

Catalysts

Of course, when you get prices shooting up the way they did, it does not take much to wring out the excess. A series of tweets by Tesla CEO Elon Musk criticising the energy consumption of the bitcoin network started the sell-off in the space.

Tesla, ESG and bitcoin: An unholy trinity

The Chinese government piled on by imposing restrictions on cryptocurrency activity in the country, including all but wiping out the massive Chinese bitcoin mining industry. Miners validate and group transactions together on the bitcoin blockchain and the sudden dismantling of the Chinese mining industry spooked the market, though it did not necessarily change any fundamental characteristics of the bitcoin network itself.

Crypto winter?

The steep sell-off in token prices has raised the question of whether we are now entering another crypto winter. The last swoon in prices took bitcoin from nearly $20,000 to as low as $3,000 over the course of a year, an 84% decline. Ethereum plummeted from around $1,400 to $80 in the same time frame – a drop of 94%.

For context, bitcoin and ether have fallen 55-60% peak-to-trough so far in this correction. There is no telling whether they will fall further from here. Bulls argue that the interest in crypto is much higher today than it was a few years ago, putting a higher floor on prices.

Bears argue that little has changed, and that these are largely speculative assets that are prone to massive, repeated bull/bust cycles. Only time will tell who is right.

This story was originally published on ETF.com