Though reopening trades soared after COVID-19 vaccinations received emergency use authorisation approval in December, the delta variant threatens to put a damper on the return to normal.

Withdaily cases back on the rise, particularly among the unvaccinated, a consumer pullback has started to show up in the high-frequency data and could potentially weigh on related ETF returns. As economic data is reported on a lag, this high-frequency data could be a more accurate glimpse of the current state of the U.S. economy.

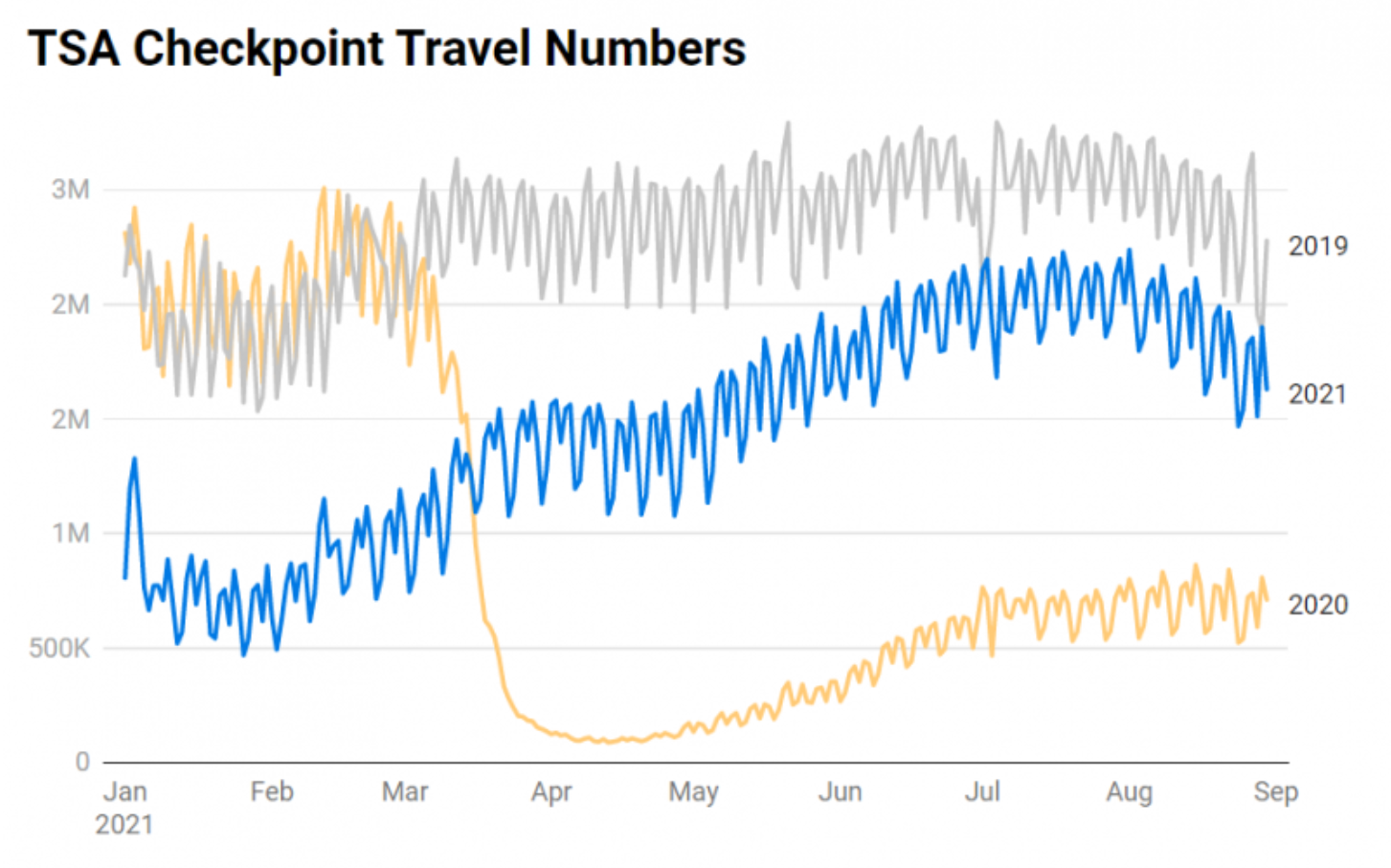

Travel trending down

Though travel recovered from 2020 levels, rising throughout much of the summer, the number of travellers passing through TSA checkpoints has yet to reach levels seen back in 2019.

Not only have travel numbers not fully recovered from pre-pandemic levels, travel has started to decline, having peaked on 1 August at 2.2m travelers. Looking at data from 2019 suggests travel does tend to taper off after the summer months.

However, it could also be a sign that travelers are becoming wary in light of the delta variant.

Enthusiasm for the names held in the U.S. Global Jets ETF (JETS)seems to have already waned. This ETF invests in domestic and foreign airlines. Top holdings include names such as Delta, Southwest and American Airlines.

The ETF has gained 3.2% this year versus 21.7% for the SPDR S&P 500 ETF Trust (SPY).

Delayed return to the office

After making plans for workers to return to the office in the fall, many companies across the country have had to delay these plans due to the spread of the delta variant. Companies such as Apple, Amazon and Microsoft have all delayed plans for their employees to return.

A recent survey from PwC shows that only 19% of companies plan to be fully in-person this fall.

This shift in plans could be beneficial for ETFs such as the Direxion Work From Home ETF (WFH). The fund, which launched in June 2020, tracks an equally weighted index of global firms that provide technology that supports a more flexible work environment.

Though WFH has underperformed SPY year-to-date, it has continued to grind higher, gaining 16.9% so far.

As Zoom’s recent earnings report underscores, these companies have faced slowing growth and have been tempering expectations for the future. With some companies even scrapping physical locations altogether and planning for a fully remote workforce going forward, this could be a longer-term secular trend to watch.

Several ETFs hold larger allocations to Zoom, including the Ark Innovation ETF (ARKK)and the Global X Cloud Computing ETF (CLOU). ETFs such as these that are focused on disruptive innovation and cloud computing could also be winners from the extension of work from home policies.

In-person school critical variable

One big question mark for many parents–and potentially for the trajectory of the economy–is whether school will be in-person this year or if students will have to shift back to remote learning. While many parents and caretakers juggled work and virtual learning in the spring of 2020, the stress of this task also led many to leave the workforce.

The vast majority of children have or are heading back to in-person learning this fall. However, with debates over whether or not children should be wearing masks in the classroom, the potential for disruptions due to the need for students to quarantine remains high.

This could be a drag on the economy for the next few quarters as some adults might delay looking for employment. The negative economic impacts of disruptions to in-person learning as well as the knock-on effects, such as reduced income levels, could be bad news for small cap ETFs such as the iShares Russell 2000 ETF (IWM).

Small cap playbook

Small caps tend to outperform large caps when the economy is in a recovery phase. In the beginning of the year, IWM was outperforming SPY. However, the ETF has been trending sideways for much of the year and is now underperforming SPY.

It is possible the market is in a “wait and see” mode, waiting to see the trajectory of cases as students return to school and the cooler months cause people to spend more time inside.

There are many developments, such as a more contagious variant or vaccine approval for children, that could shift the trajectory of new cases for better or for worse.

While the future is yet unknown, COVID-19 remains one of the biggest factors affecting the markets. New cases and hospitalisations remain a data point to watch for a clue on which areas of the market might over or underperform.

This story was originally published on ETF.com