This article first appeared in ETF Insider. To read the full edition, click here.

US recession fears spiked over the summer, with worries about the state of the labour market leading to volatility in equity markets. At face value, a slowing economy would seem to contradict the view of equity analysts, who are currently forecasting a broadening in US profit growth after several quarters of dominance by the ‘magnificent seven’. However, the detail within these forecasts is important. Picking through the earnings outlook, it is plausible that earnings do broaden out as the US economy slows.

An outright recession would be more of a challenge, though this is not our base case. Investors should nonetheless be aware of downside risks to the economy, and that risk assets are likely to remain especially sensitive to economic and earnings data. Resilience in equity portfolios will therefore require balance. This includes diversification by sector and style, as well as across cyclicals and defensives, and a focus on quality companies.

The economy is not the stock market

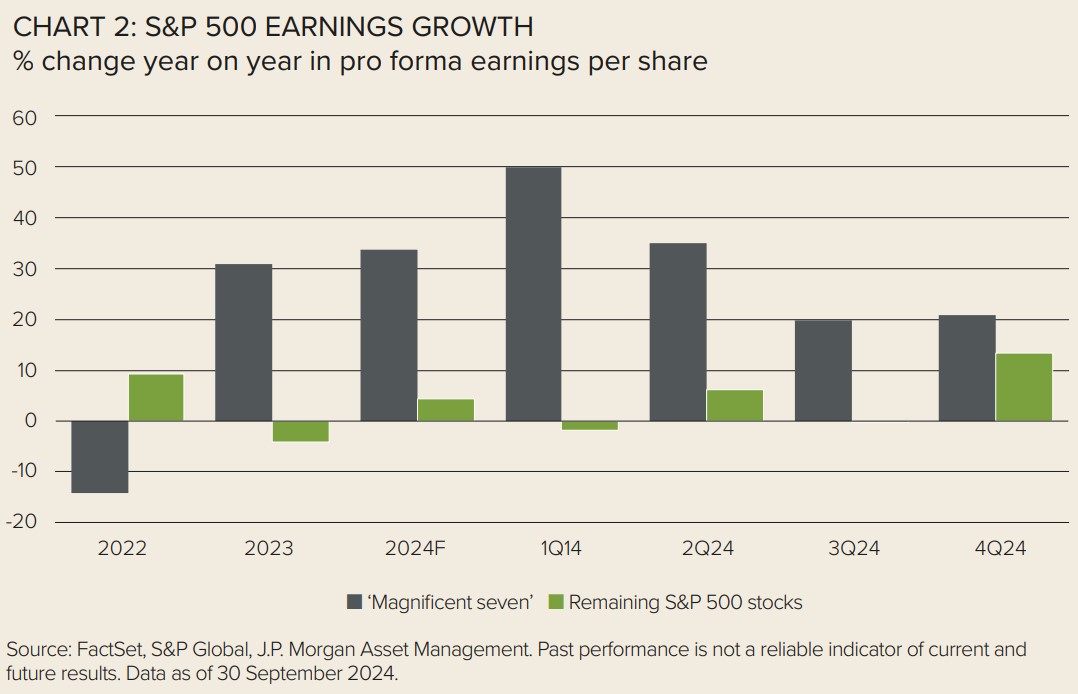

Over 2023 and the first half of 2024, only a handful of stocks in the S&P 500 index saw their earnings expand. The magnificent seven companies grew their profits 31% year on year in 2023 as global technology demand surged, whereas earnings in the rest of the S&P 500 actually contracted.

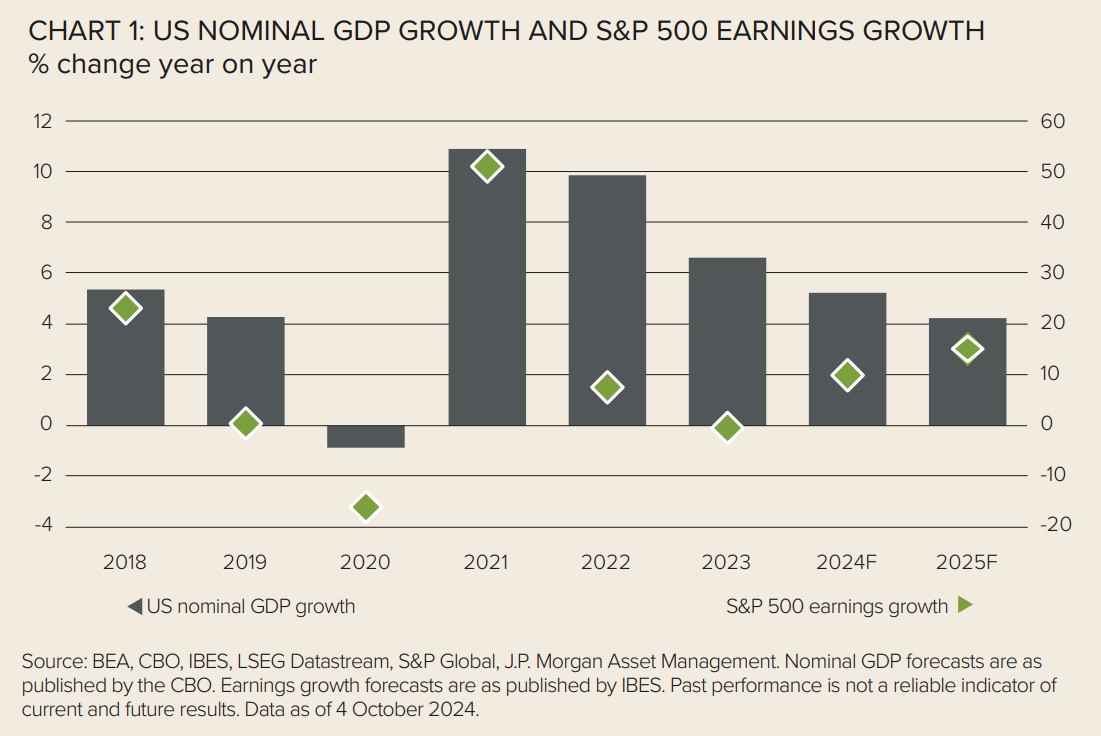

Yet this was the year in which the broad economy grew by over 6% in nominal terms. This disparity between the performance of the US economy and corporate earnings is important and is central to why we think it is possible for activity to slow while profits broaden.

Digging into the detail of today’s earnings forecasts reveals why. Profit growth in the magnificent seven and the rest of the S&P 500 is forecast to converge meaningfully by the final quarter of 2024, which would represent a major pick up in earnings for the non-mega cap firms.

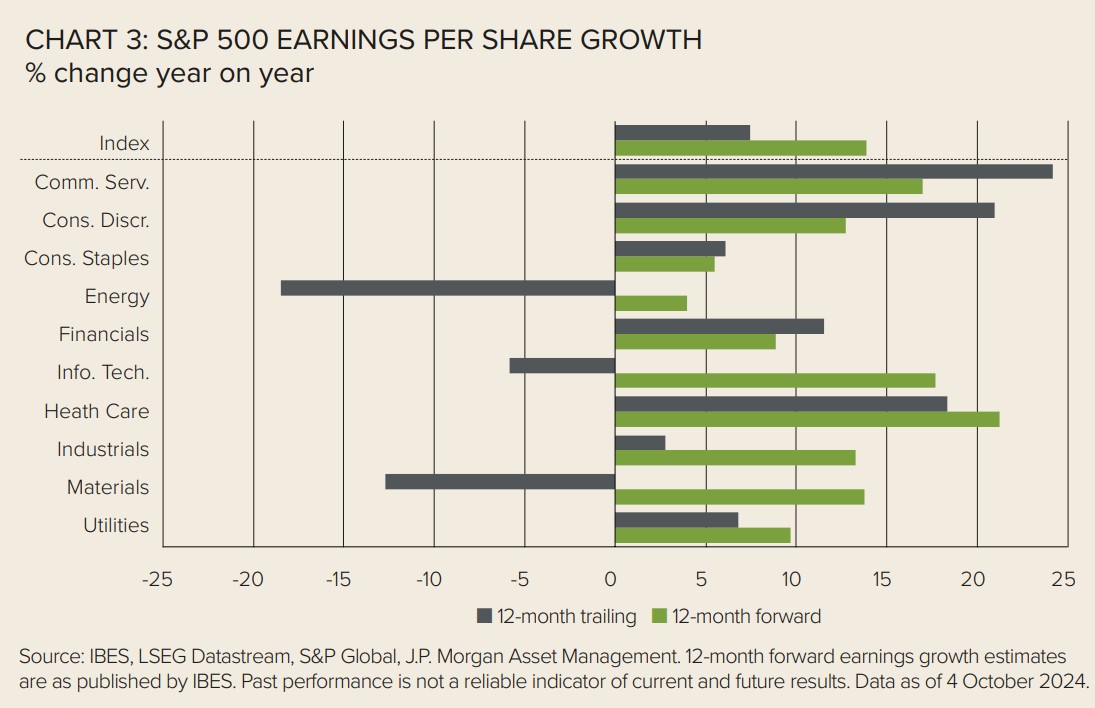

Much of the positivity baked into these earnings forecasts reflects idiosyncratic, sector-specific tailwinds. For example, some industries – such as energy and materials – delivered exceptional earnings growth in 2022, with profits boosted by a spike in global commodity prices. Healthcare also saw strong earnings growth thanks to COVID-related demand. However, this strength was paid back in 2023, as the level of earnings per share in these sectors normalised.

As this payback period fades, profits in these industries are forecast to improve meaningfully – one factor behind consensus forecasts for broader earnings participation.

Elsewhere in the US equity market, slowing wage growth is expected to be particularly positive for labour-intensive industries. These sectors have recently faced a margin squeeze, as US labour costs were slower to fall than inflation – a challenge for sectors less able to pass on cost increases, such as industrials and consumer staples. But as wage growth continues to normalise, margin pressures should recede.

Finally, an improvement in the global manufacturing cycle is expected to support broader earnings growth. After a period of pandemic-related strength, global goods demand eased meaningfully in 2023. But gains in manufacturing sentiment indices suggest the demand picture may be improving, which would be a boost for the industrials sector in particular.

Looking further ahead, while we do anticipate policy rate cuts from the Federal Reserve over the next 18 months, we also expect interest rates to settle at higher levels than seen over the 2010s. Alongside a slowing, but not collapsing, US economy, this could also support financials’ earnings as net interest margins remain stronger.

Slowing fine, recession more of a challenge

While we think a slowing in US activity doesn’t necessarily contradict current earnings expectations, a recession would clearly challenge today’s forecasts for broader earnings growth across the S&P 500 index. Sectors such as industrials and financials would struggle to reach current consensus profit numbers in a period of intense consumer weakness.

However, a significant economic downturn is not our base case. Corporate fundamentals remain strong, and layoffs are still muted. Part of the recent increase in the US unemployment rate is down to strong immigration and participation, rather than solely being driven by workers being laid off.

Even if the US does experience a slowdown, the excesses that typically lead to a nasty downturn do not appear to be present today. Household debt levels are contained, and investment levels look moderate rather than overextended.

Conclusion

We do not currently see reasons to be concerned about the fundamentals of the US equity market. Consensus US earnings forecasts don’t look overly optimistic given our base case of a slower – rather than collapsing – US economy. Investors should remember that the S&P 500 is not the US economy. Nonetheless, markets will remain reactive to incoming data given perceptions of increased recession risk. Balance is key. Diversification across sectors and styles, as well as a focus on quality companies, looks prudent given still-high uncertainty about the path ahead.

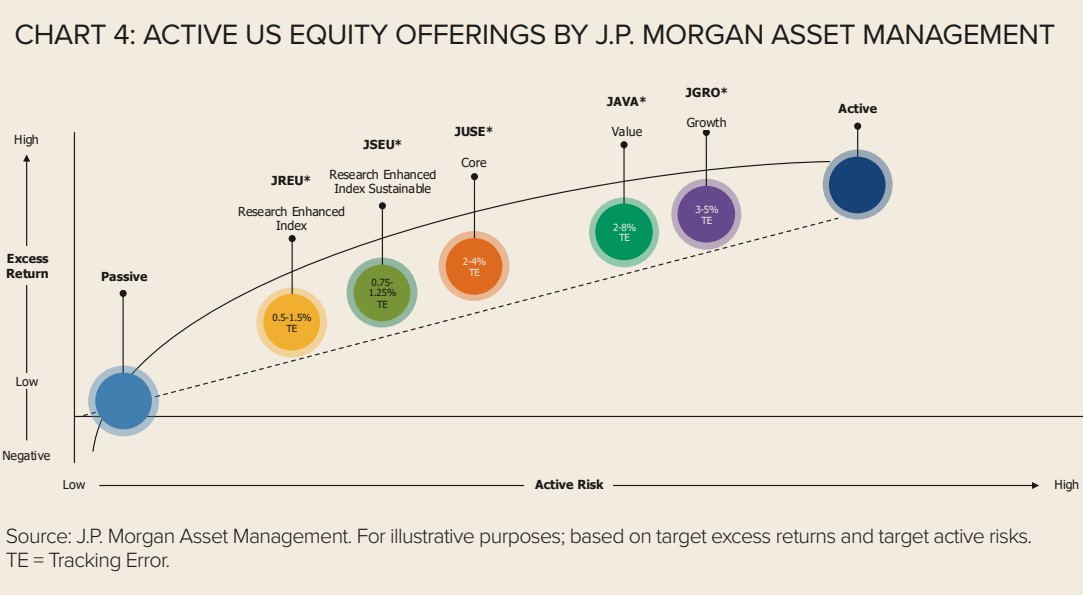

Allocating to US equities with active ETFs

We continue to believe that active alpha can play a critical role in equity portfolios when the future direction of the stock market is uncertain and more differentiated asset performance is expected. As the largest active UCITS ETF provider (source: Bloomberg as of 30 September 2024). , we offer investors a variety of active US equity ETFs to express their asset allocation views and sustainability preferences, from index-like Research Enhanced strategies to active core allocations and value or growth tilts.

Important information

(*) FOR BELGIUM ONLY: Please note the acc share classes of the ETF marked with an asterisk in this page are not registered in Belgium and can only be accessible for professional clients. Please contact your J.P. Morgan Asset Management representative for further information. The offering of Shares has not been and will not be notified to the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten/Autorité des Services et Marchés Financiers) nor has this document been, nor will it be, approved by the Financial Services and Markets Authority. This document may be distributed in Belgium only to such investors for their personal use and exclusively for the purposes of this offering of Shares. Accordingly, this document may not be used for any other purpose nor passed on to any other investor in Belgium.

For Professional Clients / Qualified Investors only – not for Retail use or distribution.

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation. The value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Past performance is not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. Investment decisions shall solely be made based on the latest available Prospectus, the Key Information Document (KID), any applicable local offering document and sustainability-related disclosures, which are available in English from your J.P. Morgan Asset Management regional contact or at www.jpmorganassetmanagement.ie. A summary of investor rights is available in English at https://am.jpmorgan.com/lu/investor-rights. J.P. Morgan Asset Management may decide to terminate the arrangements made for the marketing of its collective investment undertakings. Purchases on the secondary markets bear certain risks, for further information please refer to the latest available Prospectus. Our EMEA Privacy Policy is available at www.jpmorgan.com/emea-privacy-policy. This communication is issued in Europe (excluding UK) by JPMorgan Asset Management (Europe) S.à r.l. and in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. In Switzerland, JPMorgan Asset Management Switzerland LLC (JPMAMS), Dreikönigstrasse 37, 8002 Zurich, acts as Swiss representative of the funds and J.P. Morgan (Suisse) SA, Rue du Rhône 35, 1204 Geneva, as paying agent. With respect to its distribution activities in and from Switzerland, JPMAMS receives remuneration which is paid out of the management fee as defined in the respective fund documentation. Further information regarding this remuneration, including its calculation method, may be obtained upon written request from This communication is issued in Europe (excluding UK) by JPMorgan Asset Management (Europe) S.à r.l., 6 route de Trèves, L-2633 Senningerberg, Grand Duchy of Luxembourg, R.C.S. Luxembourg B27900, corporate capital EUR 10.000.000. This communication is issued in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. Registered in England No. 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.