When it comes to ESG funds, it is hard to be shocked by the brazen product sleight of hand of some fund management companies, which are dressing up funds in an ESG cloak, covering up that there is really very little difference to their traditional, non ESG funds.

In December 2020, Legal & General Investment Management (LGIM) unveiled a first of its kind on the European ETF market, the L&G ESG China CNY Bond UCITS ETF (DRGN), which has gathered $435m assets under management (AUM) since launch.

Here are the reasons why we believe LGIM are brazenly greenwashing and misleading investors.

DRGN “aims to provide exposure to the government and policy bank bond market in China” – how can this ever be a candidate for inclusion in an ESG ETF in the first place?

When funds invest in companies, using a ESG methodology, they often use the UN Global Compact (UNGC) which asks companies to embrace, support and enact, within their sphere of influence, a set of core values in the areas of human rights, labour standards, the environment, and anti-corruption.

I would argue that the same principles should be applied to bonds as shares. These core values make up the Ten Principles of the UNGC, many of which appear to be highly questionable as regards the Chinese Government, and with China reported to be the world’s biggest polluter.

Human rights principles

Principle 1: businesses should support and respect the protection of internationally proclaimed human rights

Principle 2: make sure that they are not complicit in human rights abuses.

Labour standards

Principle 3: businesses should uphold the freedom of association and the effective recognition of the right to collective bargaining

Principle 4: the elimination of all forms of forced and compulsory labour

Principle 5: the effective abolition of child labour

Principle 6: the elimination of discrimination in respect of employment and occupation.

Environment

Principle 7: businesses should support a precautionary approach to environmental challenges

Principle 8: undertake initiatives to promote greater environmental responsibility

Principle 9: encourage the development and diffusion of environmentally friendly technologies

Anti-corruption

Principle 10: businesses should work against all forms of corruption, including extortion and bribery

LGIM claims “the fund promotes a range of environmental and social characteristics which are met by tracking the index” but it transpires this index has no exclusions whatsoever but somehow “adjust the market value of index constituents from the baseline J.P. Morgan China Aggregate index”.

Source: LGIM

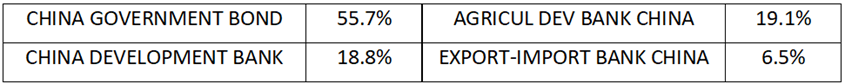

This tilting seems in practise highly dubious as DRGN holds the exact same four China government/quasi-government issuers as a typical non-ESG China government bond ETF – being bonds issued by the Government of China, China Development Bank, Agricultural Development Bank of China, and the Export-Import Bank of China.

What fundamental ESG difference does it make anyway if you simply tilt between four different issuers of bonds, all of which are 100% Chinese government-owned?

The current weightings of the index to these four issuers are as follows:

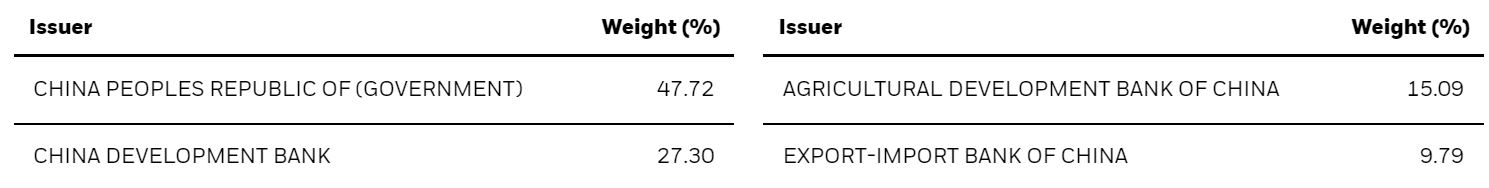

This is very similar to the weightings in the exact same four issuers as a non-ESG China government bond ETF such as the iShares China CNY Bond UCITS ETF (CNYB).

Source: BlackRock

It is no wonder then, that when we look at the index used by DRGN and compare this with a non-ESG Chinese Government Bond index over five years, they have virtually identical performance – the difference is just 0.1% per annum.

Source: Bloomberg

How to clean up this greenwashing

LGIM should immediately remove the ESG label/name from this fund name and literature as it is clearly misleading to purport to investors/clients that this fund has any credible ESG credentials.

The Financial Conduct Authority (FCA) should urgently review the evidence within this blog and if appropriate, fine LGIM for mis-selling, and publicise as a deterrent to others pursuing blatant greenwashing. This anti-consumer, misleading practice in the fast-growing ESG investing sector is scandalous and in our view occurring on an industrial scale in the UK.

The FCA has publicly defined greenwashing as “marketing that portrays an organisation’s products, activities or policies as producing positive environmental outcomes when this is not the case”. It appears that LGIM has been unable to defend this fund, saying that “LGIM would not comment on the record as to why it uses an ESG label on this fund”.

The LGIM board must review its procedures and processes that allowed this fund to ever be launched in the first place. There is nothing wrong in offering investors exposure to Chinese government bonds (we believe these are very attractively priced at present), but please do not pretend such bonds should be included in an ESG fund.

The LGIM board should not award any ESG related bonuses as “from 2021, an ESG measure will become part of the annual bonus performance conditions for executive directors. This was included in the new remuneration policy which shareholders approved in 2019”. It is pure hypocrisy for LGIM to claim greenwashing “will be one of the biggest challenges to asset managers in 2020″.

Alan Miller is CIO at SCM Direct

Further reading