With equal weight S&P 500 ETFs returning to fund selectors’ vocabulary last year, the big asset allocation question of 2024 is whether outsized midcap bets can triumph over ‘magnificent seven’ headiness.

Last year’s surprisingly ‘risk-on’ backdrop tested the resolve of any cutting the weight of large cap US tech, consumer and communications names.

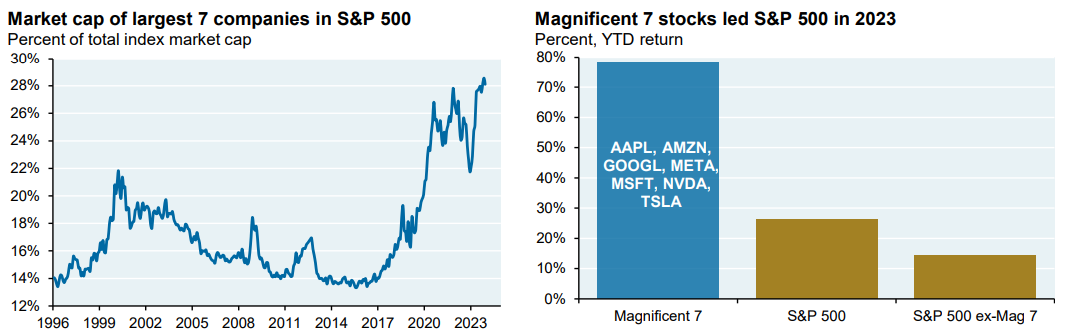

Within the first five months of 2023, the ‘magnificent seven’ comprised all gains made by the S&P 500, with Apple’s $2.7trn market cap by June exceeding the combined scale of the bottom 200 of the index’s constituents as well as all Russell 2000 members.

These numbers and an emergency rebalance of the Nasdaq 100 sent over-concentration alarm bells ringing for many investors, prompting the US-listed Invesco S&P 500 Equal Weight ETF (RSP) to book its biggest week of inflows since its inception, adding $1.7bn assets.

US equities then gained a second lease of life last November, with Federal Reserve Chair Jerome Powell signalling a policy pivot could be on the cards sooner than previously advertised, driving the market cap-weighted S&P 500 up 16.2% in six weeks.

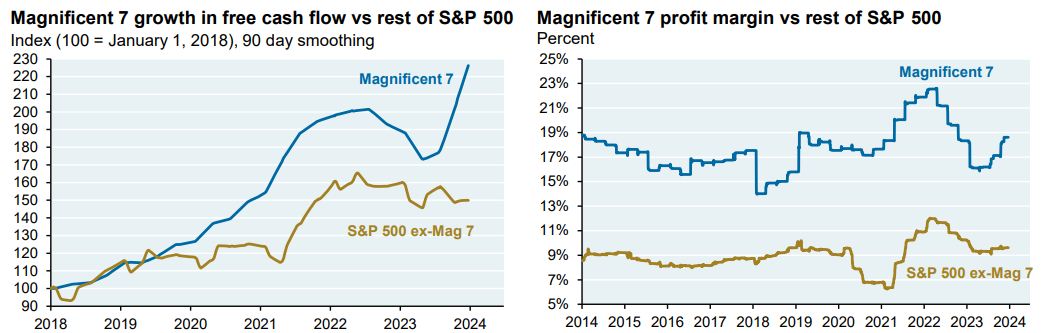

Summarising the narrow leadership that defined last year, Michael Cembalest, chairman of market and investment strategy at JP Morgan Asset Management, noted cashflows, operating earnings per share and revenues were either flat or down for the S&P 500, excluding the ‘magnificent seven’.

The mega-cap cartel, meanwhile, saw free cash flows increase by an average of more than 20% while their earnings exploded 33% during 2023.

Chart 1a and 1b: Comparing magnificent seven cash flow and profit margins to S&P 493

Source: JPMAM, Bloomberg

Cembalest argued without headwinds such as meaningful antitrust action against tech giants, the picture for 2024 appears to be single-digit earnings growth and returns for the median S&P 500 constituent and continued resilience from the megacaps.

“Without judicial brakes on them, the strong are getting stronger and I see little reason, other than valuations that become too high relative to the market, that this should change,” he said.

“While mega cap stocks look increasingly expensive relative to the market, after adjusting for their higher earnings growth expectations they do not look nearly as overpriced.”

Avoiding the crowd

However, Cembalest noted “everyone seems to agree; this is a very crowded trade”. In fact, he underlined the concentration issue by pointing to the combined weight of the S&P 500’s top seven today – twice what it was in 2017 – and the fact 72% of constituents underperformed the index, the second-highest figure since 1980.

Chart 2a and 2b: Magnificent seven concentration and returns versus S&P 500

Source: JPMAM, Bloomberg

This poses the difficult question for investors – siphon off some big tech allocation and risk underperforming as many have over the past decade or maintain and potentially be exposed to painful mean reversion.

Richard Champion, deputy CIO at Canaccord Genuity Wealth Management, said at ETF Stream’s ETF Buyer London event last November: “The US remains the best market in the world. They have companies that are more profitable, they have a better legal and capitalistic framework in which to operate so they deserve a premium.

“In the US, we have been looking at the equal-weighted ETF as a way of getting a bit more breadth without taking too much specific risk.”

He was not alone either, with the Xtrackers S&P 500 Equal Weight UCITS ETF (XDEW) finishing the year among the top inflowing ETFs in Europe, with $2bn net new assets, despite $657m outflows in the first five months of the year.

Last time XDEW saw a similar influx of attention, at the beginning of 2021, the ETF spent the rest of the year competing versus market cap-weighted ETFs, only to outperform by more than 6% the following year.

Agreeing with Champion, Dan Caps, investment manager at Evelyn Partners, told ETF Stream his team has allocated to equal-weight S&P 500 ETFs to implement their conviction in the US soft landing – with inflation coming down, consumer and labour market data remaining resilient – without increasing their existing ‘magnificent seven’ allocation.

“We did not decrease our allocation to market cap, we just brought in equal weight as we were increasing our overall regional allocation.

“It allowed us to add to the US while not being as exposed to those lofty multiples. From a tactical perspective, equal weight fit the bill for what we were trying to do at the time – to achieve broader exposure to the US economy – I have no doubt that drove a lot of flows into the strategy last year.”

He added by upsizing the weight of S&P 500 midcap constituents, equal weighting introduces active bets on size and the US domestic economy, much as a FTSE 250 allocation would for the UK.

Does equal weight beat market cap?

Looking at the year ahead, Caps suggested equal weight could reclaim ground on market cap. While not yet entering the small cap space, he argued the size premium would be expected to outperform in early recovery phase.

“Today, I would expect the equal weight to outperform market cap, but we will always have market cap in there because it is what clients expect from our index-based proposition,” he continued.

On a longer-term horizon, the tussle between the size bias of equal weighting the S&P 500 and the parent index’s current growth bias continues to rage on.

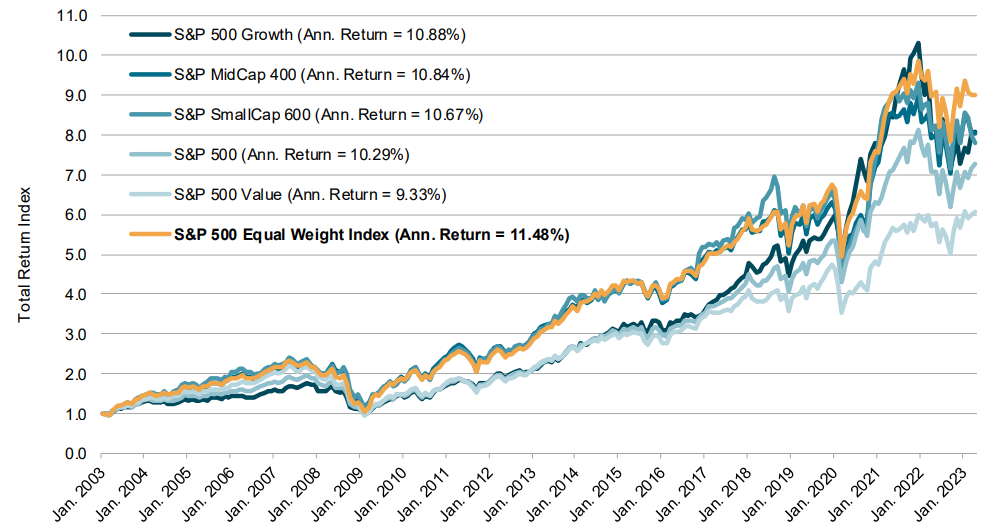

Last June, S&P Dow Jones Indices revealed little over 20 years after launching its equal weight benchmark, it had managed to beat all other iterations of the S&P 500 since inception.

Notably, much of the index’s head start, as with the S&P MidCap 400, came in the first decade of the century, only to face fierce competition from the tech-heavy S&P 500 Growth index over the past 10 or so years.

Chart 3: Comparison of S&P 500 indices’ performance

Source: SPDJI

“It is almost very supportive of an efficient markets narrative,” Caps concluded,. “It is hard to predict where the markets are going to go so if you were just going to take a step back and let them do their thing, equal weight takes this to the extreme of passive investing.”

Interestingly, SPDJI noted equal weighting the S&P 500 tends to beat the parent index during the same pockets of relative strength as active US equity managers.

On a long-term basis, combining the two approaches may be the key to smoothing out regime changes and the periods of volatility that intersect them.