A new report from GMO claims ESG screens offer particular promise in emerging markets.

The trend to ESG has become so pronounced that investors are now demanding ESG filters on their emerging markets investments, a new white paper from asset manager GMO has indicated.

Thanks to millennials getting richer and wider awareness of the possible benefits among institutional investors, ESG screens have entered the mainstream in recent years. And with these trends scheduled only to continue, ESG screens will only get stronger and more popular, the report said.

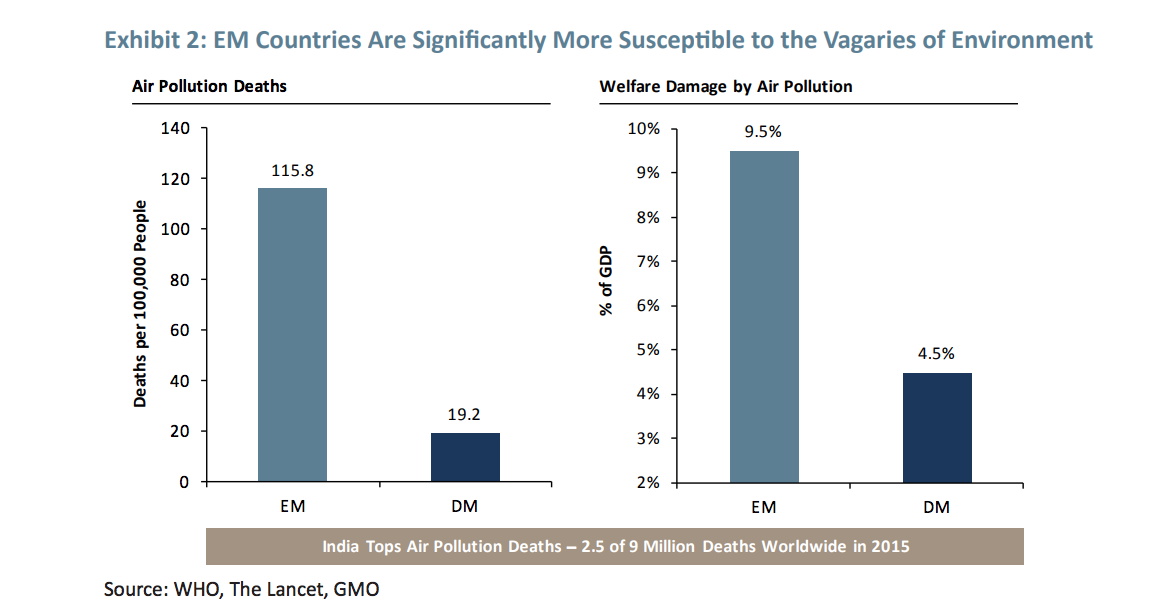

But while the ESG movement has to date been focussed in developed countries, it is perhaps even more important for emerging economies, given that they stand most to lose from bad ESG practices.

"EM economies are generally both more exposed and less prepared to manage the impact of ESG risks than DM," the report said.

"Therefore, it is of utmost importance that investment analysts factor in both country-level as well as issuer-level ESG risks when making EM investment decisions."

The high share of GDP taken by agriculture in EM countries is cited as evidence for the importance of factoring in the environment. As agriculture is more susceptible to global warming than other sectors, EM countries are the likely frontline losers when a changing climate hits crop yields.

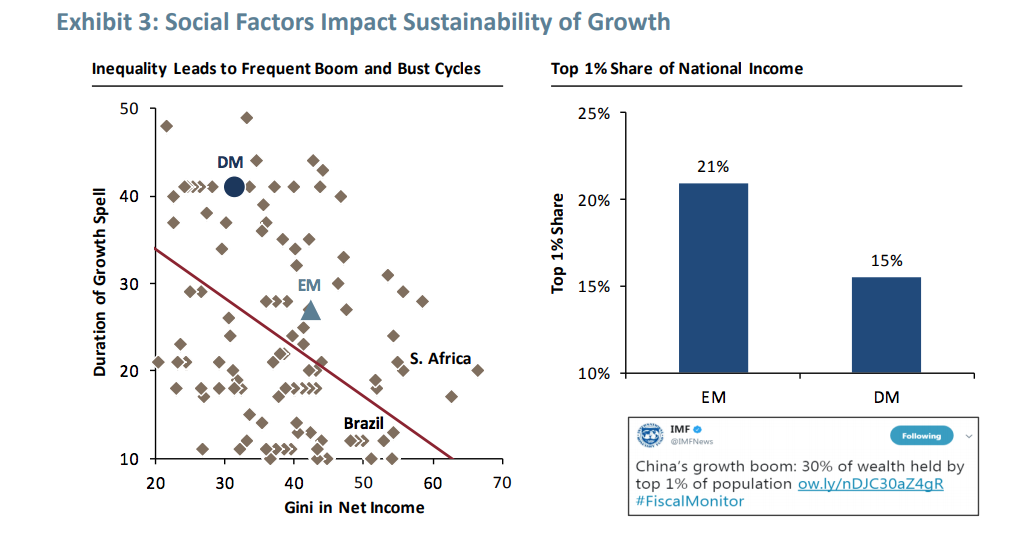

Social equity matters for EM countries too, the authors argue, and perhaps more than it does for richer countries. Unequal countries, the authors note, tend to have lower growth rates and more volatile economies than more equal countries. And as EM countries have larger gaps between the rich and poor, they're particularly exposed to the dampening effects.

"Income inequality is inversely correlated to the longevity of growth cycles in an economy. A longer and more stable growth spell gives companies and individuals more confidence to plan and invest for the long term," it says.

The evidence that ESG can help boost corporate financial performance is robust, the report says. It fires a volley against "non-believers" who question the value of integrating ESG into investment decisions. The Arab Spring is taken as an example of how companies and countries ignore ESG at their "peril".

The report ends with a call for investment managers to develop their own understandings of ESG issues, as "third-party ESG rating agencies serve a wide variety of clients and try to be "all things to all people."