ETF trading costs are set for a substantial increase due to the European Securities and Markets Authority’s (ESMA) proposal to introduce progressive penalty rates for settlement fails under the Central Securities Depositories Regime (CSDR), Jane Street has warned.

In a research note, seen by ETF Stream, the liquidity provider called on ESMA to split out ETFs as a distinct asset class due to the wrapper’s additional considerations that require settlement flexibility.

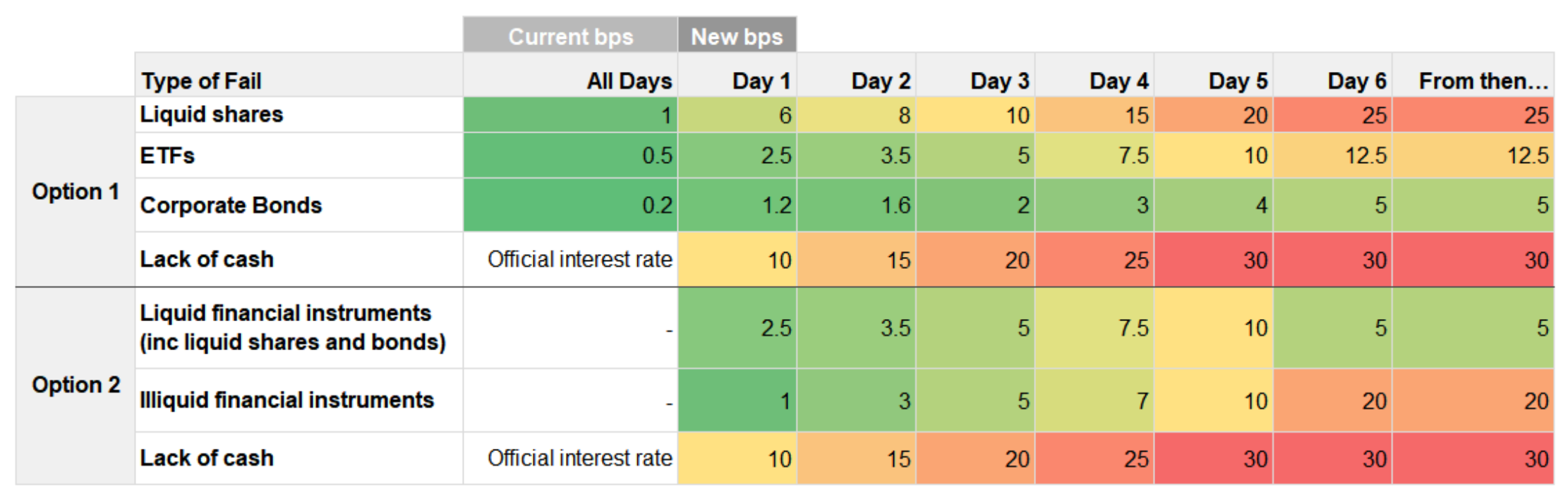

Last December, Europe’s financial regulator issued a consultation to address settlement fails which included proposals to raise penalties in line with the duration of the failed settlement.

In the proposed penalty models, ESMA introduced penalty rates that increase to 12.5 basis points per day if ETFs fail to settle six days after the intended settlement date (ISD).

Chart 1: Illustration of current and proposed penalty models for days after ISD

Source: Jane Street

Peter Whitaker, head of EMEA market structure and regulation at Jane Street, and author of the report, said: “For ETFs, the changes could introduce unnecessarily higher costs for end-investors into the market without an accompanying benefit and potentially generate new unanticipated issues.

“There may be further impacts to the potential innovation, adoption and growth of new ETF products.”

ETF settlement considerations

Jane Street explained there are structural reasons why ETFs require settlement flexibility which ESMA’s proposals do not recognise.

For example, many ETFs have exposure to Asian market securities which makes an ETF’s standard creation settlement timeline longer than T+2, a portion of an ETF’s underlying assets are closed due to a public holiday or the sale occurs after an ETF’s primary market has shut for the day.

“Changes to the CSDR penalty regime would not change the fact that ETF liquidity providers may still need to source liquidity in the primary market to satisfy investor demand,” Whitaker warned.

“However, in the future, the cost incurred by liquidity providers for failing to settle the ETF with the client by ISD would be significantly larger. That cost would have to be reflected in the quotes provided, significantly widening spreads.”

Furthermore, Jane Street added ESMA’s proposals could damage the attractiveness of Europe’s capital markets due to increased uncertainty around more opaque ETF trading costs.

“Any [CSDR] reimbursements [to investors for settlement fails] would be invisible to the wider market, who would only see the increased costs from the spread,” the report explained. “This could impact the attractiveness of European ETFs, versus other regions, and act against the wider strategic objectives of European policymakers.”

Finally, there are times when liquidity providers can quote a tighter bid-ask spread due to sourcing liquidity in the secondary market, however, this can take time and delay the settlement of the trade.

For example, Jane Street said buyside traders often want to delay settlement in order to fulfil their own best execution obligations.

“Higher CSDR penalties would make this kind of workflow more costly, meaning liquidity providers would be more certain to have to create in the primary market, even where this is at a higher cost to clients.”

Final word

ETF settlement challenges look set to become further exacerbated as Europe gears up to follow the US to a T+1 regime.

This consideration, combined with the introduction of CSDR, has created a challenging settlement landscape for the EU’s ETF market.

“While the consultation suggests ESMA and the European Commission are currently convinced that higher penalty rates are required, for ETFs further thought may be beneficial in order to protect end investors' outcomes and ensure the region’s ongoing competitiveness,” Whitaker concluded.

“This could involve further data-driven analysis on the root-cause issues for fails as well as investigating specific new rules for ETFs, the role of market makers or potentially even maintaining the current status quo.”