Morgan Stanley approached the turn of the century as co-founder of the now-largest ETF brand, owner of the second-largest index provider and primed to define the European ETF story. Little over two decades later, it is a fresh face in US ETFs and the future of its UCITS range hangs by a thread.

Last December, the firm’s six ETFs capped off a difficult year by ranking bottom in Europe by relative asset gathering, with a comparatively mild €10m leak equivalent to 29% of their remaining €25m assets under management (AUM).

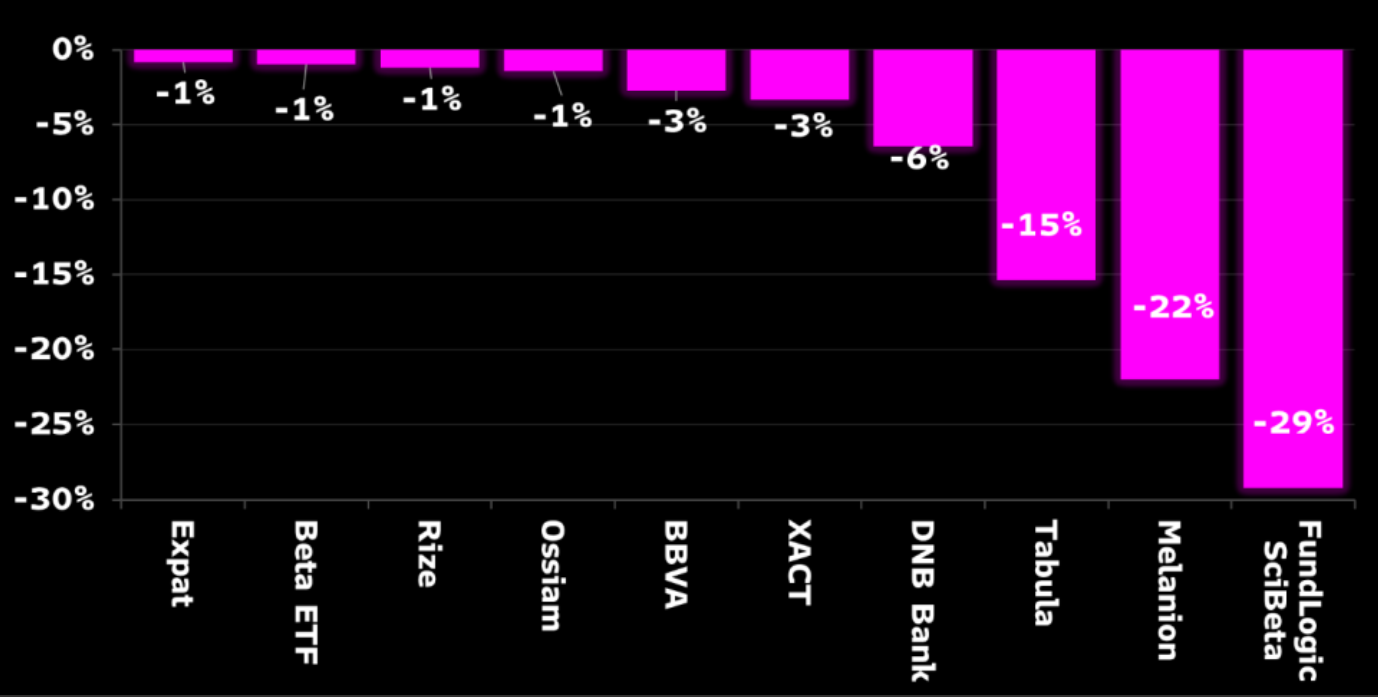

Chart 1: Bottom 10 European ETP issuer relative flows December 2023

Source: Bloomberg Intelligence

The six quantitative investing ETFs, in partnership with Scientific Beta, amassed €300m in their first five years, only to shed 91.7% of these assets through 2023. This leaves the future of the Fund Logic range “in the air”, according to Henry Jim, ETF analyst at Bloomberg Intelligence.

Kenneth Lamont, senior fund analyst for Morningstar, noted the products have been plagued by underperformance, lagging their respective Morningstar benchmarks since inception.

“If you are paying for alpha and you are not getting it over a five-year period, I can understand why investors may begin to look elsewhere.

“Scientific Beta multi-factor strategies are some of the most complex equity strategies available and they are therefore mostly suitable for more demanding sophisticated investors,” he said.

However, Morgan Stanley’s current state of floundering in the footnotes of European ETFs would have been unthinkable to any sitting on the bank’s asset management or indexing desks at the end of the twentieth century.

A decade after licencing the rights to Capital International’s indices in 1986 and rebranding them Morgan Stanley Capital International (MSCI) benchmarks, the firm co-developed a series of World Equity Benchmark Series (WEBS) ETFs with Barclays Global Investors (BGI), which acquired the ETF range four years later and rebranded it as iShares.

With Morgan Stanley choosing to spin off MSCI through an IPO in 2007 and BlackRock acquiring BGI’s ETF arm in 2009, the two businesses fed into each other’s rise to passive dominance. By 2021, BlackRock ETFs comprised 12.2% of all MSCI revenues, with many committed to tracking the firm’s indices until at least 2030.

A passive tragedy

The idea of such a mutually assured ETF and indexing growth story having occurred within Morgan Stanley was also far from a pipe dream.

Deborah Fuhr, founder of ETFGI and former head of investment strategies at Morgan Stanley, said the firm was within touching distance of being the first to break ground on European ETFs in the year 2000.

“If Morgan Stanley had entered the ETF industry when I was still working there – when they were thinking about it back in 2000 – with a family of real ETFs, I think we would have been the largest manager of ETFs in Europe,” Fuhr told ETF Stream.

“We had a set of ETFs ready to go, a marketing campaign and regional products which would have launched in the first round. We even had these little cardboard single use cameras to give away, with ‘instant exposure in a single clip’ as a campaign tag.”

However, Fuhr noted alignment between the bank’s asset management division and MSCI – which would have been the index provider for the ETFs – “just did not happen”.

“You can only surmise what might have happened, but if you have a look at what has been successful, I do think they would have been a successful set of products back in the day,” she added.

European comeback on the cards?

Despite a misfire with the first roll-out of its UCITS ETFs, Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, suggested Morgan Stanley may not look to end its European journey after entering the US ETF market last year.

“While I am frankly shocked its Fund Logic range is still around, with Morgan Stanley launching a US business I think they will keep these ETFs open, even if just for optics as a global issuer,” Psarofagis said.

More optimistic, Fuhr suggested the firm may be looking to coordinate and plot its global strategy for ETFs.

Morgan Stanley did not respond to a request to comment on future plans for its European business.

However, following the launch of its first six ETFs in the US, Anthony Rochte, global head of ETFs at Morgan Stanley Investment Management, said: “We are in the initial steps of building out a global ETF platform. There is client demand for both mutual funds and demand for ETFs. We are going to where our clients are.”

Fuhr added the acquisition of Calvert ETFs and Eaton Vance ETFs in the US position Morgan Stanley’s focus on ESG and active ETFs. The former has greater traction in Europe than the US. The latter is among the key growth vectors for the industry on both sides of the Atlantic.

“It is probably fair to think that anyone developing products in the US, with a global footprint in the asset management industry, will eventually look at having UCITS ETFs, because US ETFs do not travel well outside of the US from a tax perspective.

“If you have a global footprint in the asset management industry, at some point you are likely to feel you should have some presence in the UCITS wrapper, which probably means being here in Europe,” Fuhr concluded.