A relatively new method of generating alpha in ETFs is starting to catch fire in Europe which could prove to be even more effective than securities lending.

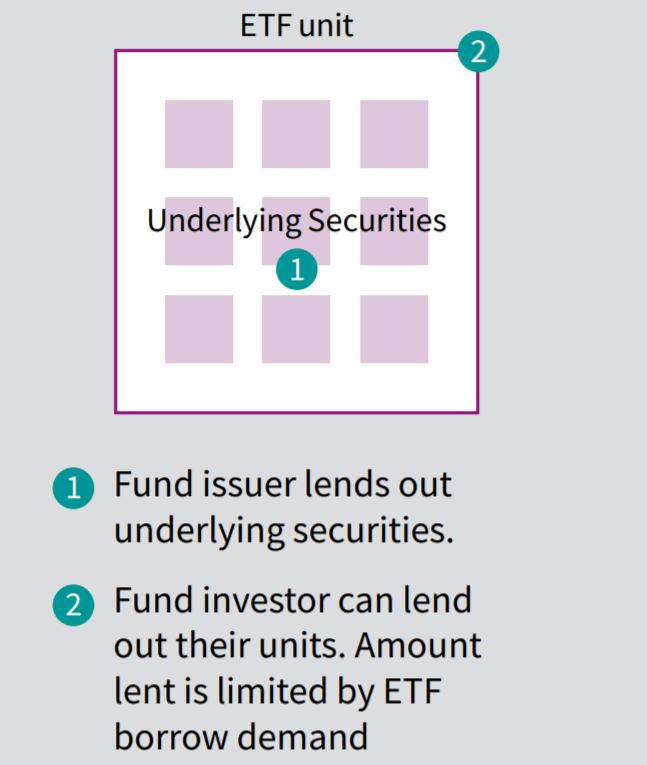

Instead of issuers lending the underlying assets of an ETF, the process of ETF lending is when an investor lends out their ETF units to the market, a move that can generate double-digit basis point returns.

The growth potential of this market is significant, according to IHS Markit, which argues there are numerous reasons why physical ETF units would want to be borrowed.

Chart 1: Lending opportunities vary based on the instruments used

Source: IHS Markit

These include investors wishing to hedge assets tracked by an ETF, market makers actively involved in pricing the ETFs and the growing number of derivatives that track ETFs.

“Although ETFs have been around for over two decades now, the asset class is still relatively underrepresented in the securities lending market, which means the growing pool of investors looking to borrow ETFs often struggle to get their hands on the most in-demand lines,” IHS Markit stressed.

The lack of ETF lending for market makers is also an issue as it can be a struggle to short many ETFs in Europe, especially compared to the US.

As one industry source told ETF Stream: "In many cases, the lack of borrow availability causes ETFs to trade at a premium until a market maker finally ends up creating the ETF to cover the shorts."

IHS Markit said revenues from ETF lending – which is done by the investors themselves – can “vastly outweigh” those earned from the securities lending programmes of issuers, a process that is more commonly associated with the ETF wrapper.

One such firm that has undertaken ETF lending is AJ Bell. According to the firm’s head of investment management Matt Brennan, AJ Bell began ETF lending around six months ago after three years of analysing the market.

Speaking atETF Stream’sBig Call: Fixed Income ETFsevent last month, Brennan said the ETF lending market in Europe has grown from around $30bn to $70bn in the time they have been monitoring the space.

Lending out their fixed income ETFs, in particular, has been a particularly lucrative process, Brennan said, especially in the low yield environment investors find themselves in.

“Searching for alpha never comes without risks but we feel engaging in ETF lending…is a good way to enhance returns,” he said.

“Our approach is to diversify counterparties and limit the amount we loan to 15% of the overall portfolio. High yield, euro corporates and US Treasuries are areas where returns have been strong.”

One area of focus for investors is the compatibility of securities lending in the ESG ETF space amid concerns this process facilitates short selling of the underlying assets and leaves issuers without a vote at resolutions.

On the issuer side, DWS has started securities lending on a number of ESG ETFs this year in a process the firm states complies with its ESG standards.

On the ETF lending side, Brennan said investors can earn double for loaning out ESG ETFs versus regular ETFs which can create “an even greater moral dilemma”.

“It is important to understand which counterparties you are lending to [with ESG ETFs] and the securities are not being used for ‘bad’ purposes,” he stressed.

The ETF lending market is no doubt going to develop rapidly over the next few years as more investors – lured by the promise of even greater returns than securities lending – start the process, however, questions around ESG and how the ETF units are used by the borrowers remain.