Currency moves have dominated headlines recently with the crash of sterling to record lows against the especially strong US dollar.

At this juncture, we thought it would be useful to release a blog explaining the moves and how the investment team have taken steps to minimise the impact of these moves on our client’s portfolio returns.

What caused the crash?

Chancellor Kwasi Kwarteng’s announcement of the most aggressive tax cuts in 50 years at the emergency 'mini-budget' on 23 September will go down as the main culprit for the currency crisis.

The tax cuts and increased borrowing for the UK government led investors to question their confidence in the government’s policies and wider UK growth prospects.

Arguably the root problems here stem back to the COVID-19 supply side shock and ensuing policy response which helped push inflation to over 10% in July on a year-on-year basis.

The massive tax cuts and increased borrowing were simplistically designed to stimulate growth and bolster demand. However, that growth comes with a price tag. That price tag is most notably over £160bn in lost tax revenue over the next five years from the tax policies alone, on top of Truss’s previously announced energy and stimulative measures.

Ultimately, this will worsen the UK’s capital account deficit (the balance between assets and liabilities), with the most recent data coming in at -4.33% of GDP in Q2, 2022.

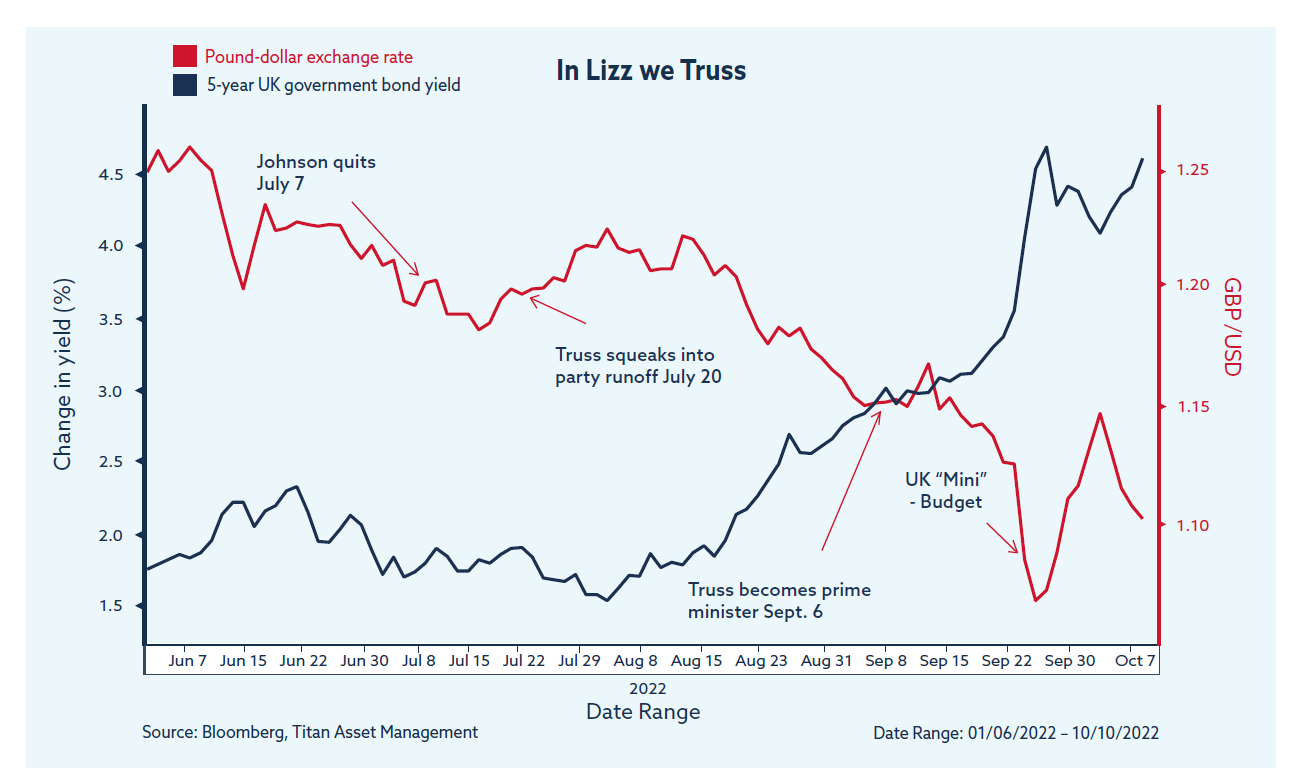

The above chart illustrates the dramatic rise in gilts over Truss's short tenure in office, and the detrimental impact higher gilt yields have meant for the pound.

Why was the sell-off so aggressive?

UK gilts sold off on the announcement as investors demanded greater yield for the perceived higher level of risk the debt now amassed, and with that the demand for UK pounds also plummeted, pushing GBP/USD down to an all-time low of 1.035.

In the words of Warren Buffet “only when the tide goes out do you discover who’s been swimming naked”, and the ones swimming naked in this scenario were the liability-driven pension funds.

These pension funds can hold part of the blame as they held leveraged positions on the typically sleepy gilt market in order to meet usually unattainable yield returns in the previous ultra-low yield environment.

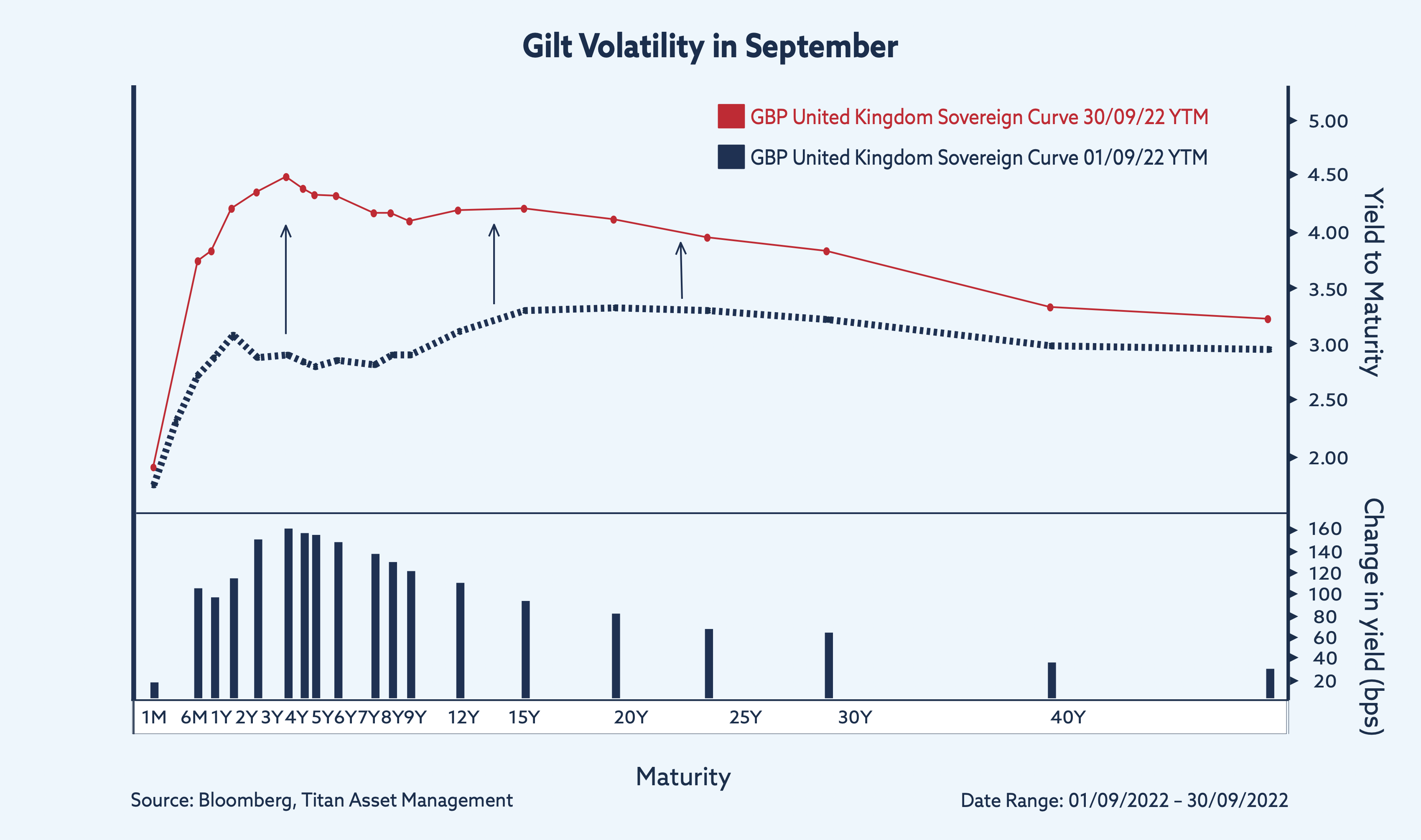

This came back to sting them as the move in rates was so unprecedented in size that the pension funds were forced to raise cash (margin) to cover the bond losses, forcing them to sell more of their gilt positions, pushing the gilt market down even further.

While the initial “mini” budget proved the catalyst, the volatile nature of the selloff is also attributable to pension fund positioning.

The gilt market selloff can be visualised above, showing the dramatic repricing of bonds across the entire curve from the beginning to the end of September.

What do these moves mean for portfolios?

For globally diversified portfolios, currency management is an important aspect to consider when making investment decisions.

Many investors may choose to leave this currency exposure unhedged, which can impact investment returns and volatility.

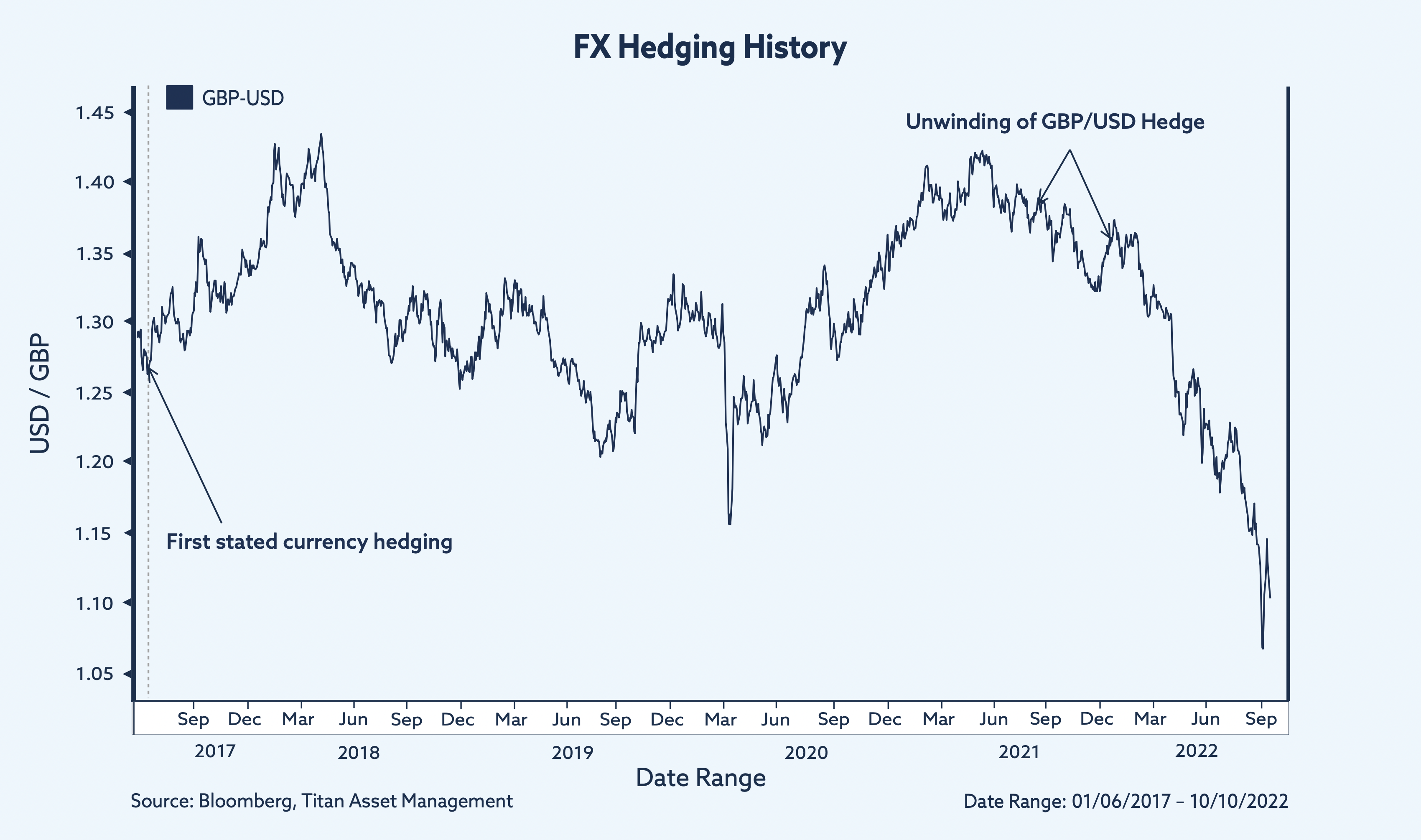

We actively-manage FX risk across the proposition, on a longer-term strategic basis and via shorter-term tactical views.

We estimate that active currency management has contributed to around 4% of performance, on average across the range.

Zooming out in Chart 3, it is clear to see the timely nature of these currency calls and how they have helped add to outperformance.

We expect further US dollar strength across the remainder of 2022 and have positioned the investment proposition accordingly.

Looking forward, once relative growth expectations have stabilised, rate differentials have adjusted and as the peak-inflation narrative evolves, we see additional opportunities for us to differentiate our proposition against the peer group.

It has never been more important to take an active stance on currency management.

Alex Livingstone is head of trading and FX at Titan Asset Management

Related articles