Gold is becoming more mainstream, according to the World Gold Council, aided by new investment vehicles made available to investors such as gold-backed ETFs.

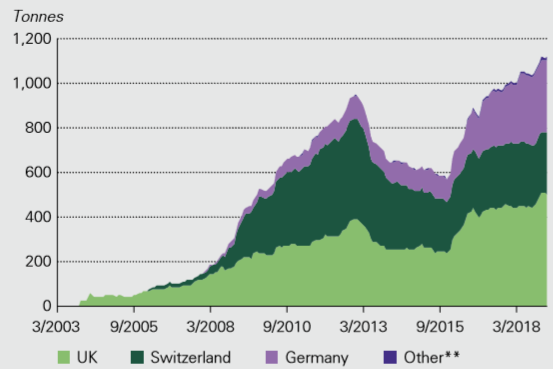

Since the launch of gold-backed ETFs back in 2003, the products have amassed more than 2,500t of gold, worth £83bn. UK investors were a key driver for this growth over the last decade as UK-listed gold ETF holdings grew from 12% of the global market to 20%. This equates to an increase of £12bn.

More recently, assets in European gold ETPs have seen accelerated growth since 2016, hitting a record high of 1,121t ($48bn) in Q1 2019. Europe now accounts for 45% of the global gold ETP market. Issuers will be overjoyed with such a large volume of assets currently sitting in gold ETFs, as nine of these products sit in the top 100 largest revenue making ETFs.

European gold-backed ETP Assets Under Management – Source: World Gold Council

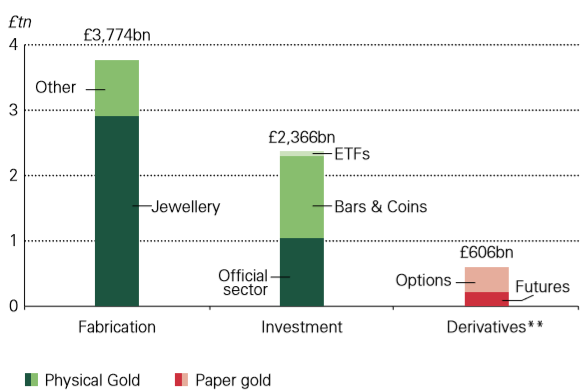

World Gold Council estimates there is approximately 193,000t of gold above ground worth more than £6.1tn. The majority (48%) of this gold is held in jewellery with 38% of it being held in investment. There is £2.4tn worth of assets in gold investments in the form of the official sector, bars & coins, and ETFs. Gold-backed ETFs account for 1% of the world’s available gold with 2,490t accounted for.

Value of above-ground gold and gold derivative – Source: World Gold Council

It is well known gold is seen as a safe haven for investors though times of volatility. This is one purpose for the commodity with other including a luxury good or a component for high-end electronics. The 10-year average gold demand for ETFs account for 3%, the smallest of any recorded source. Jewellery is responsible for majority of the demand in gold, accounting for 51%. Next is bar and coins, another investment method, with 27% and central banks with 10%.