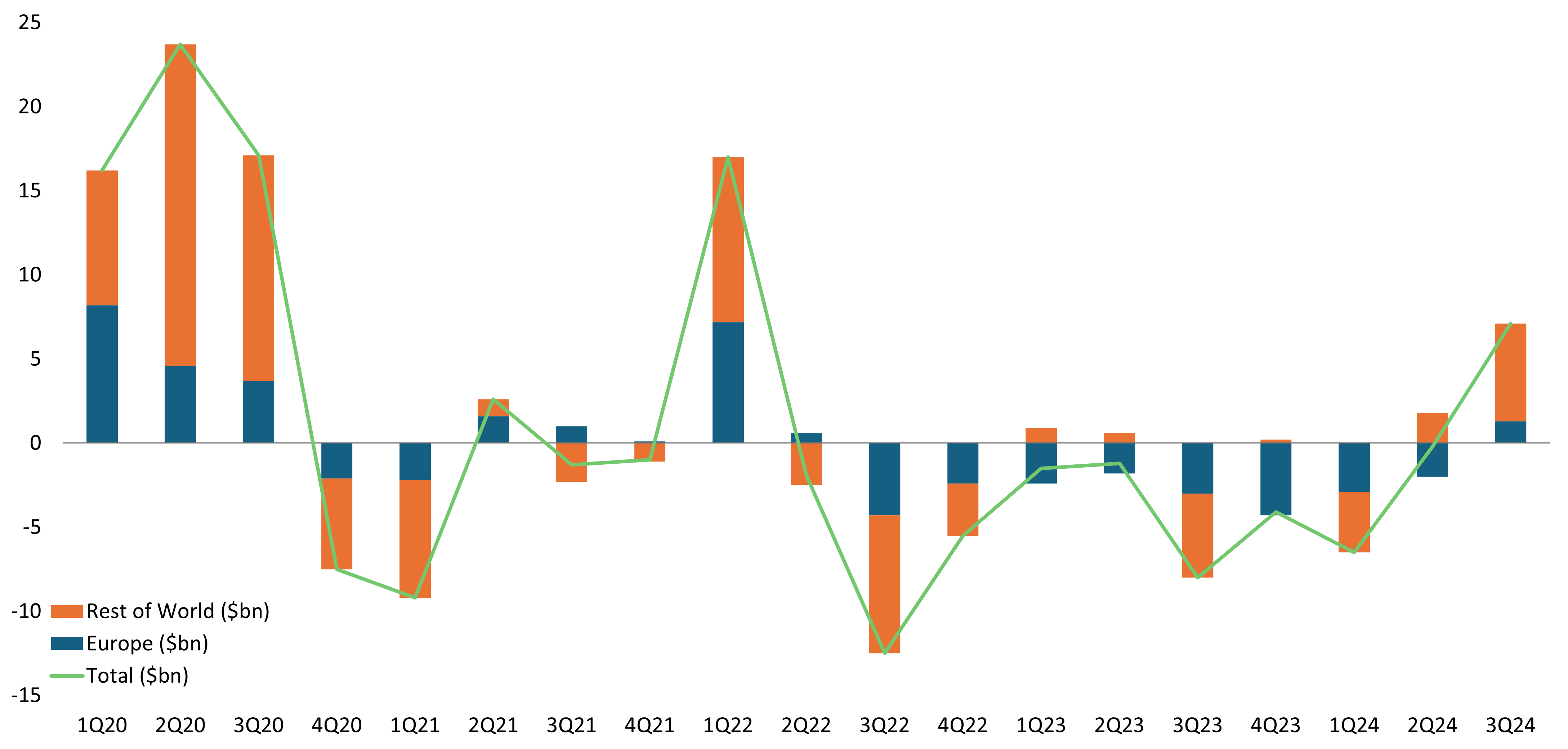

Quarterly gold ETP flows turn positive for the first time since Q1 2020 as interest rate cuts and the fear of missing out attracted investors to the precious metal.

According to World Gold Council figures, the North America region made up most of the global inflows in the third quarter, but European investors added to their gold holdings for the first time in over two years.

Chart 1: Gold ETP flows flip positive in Q3

Source: World Gold Council

ETPs offering exposure to gold, which does not pay a yield, have struggled to retain assets in recent years as inflation took off after the COVID-19 pandemic and central banks were forced to raise interest rates.

Although flows have been negative at a global level, investment appetite for the metal has varied widely by region.

“Localised concerns and rising geopolitical risks ensured relatively healthy demand for gold ETPs in Eastern markets,” said Krishan Gopaul, EMEA senior analyst at the World Gold Council, but those flows failed to outweigh the very weak demand in Western markets.

Despite the ETP outflows since Q1 2022, the gold price is up around 72% in US dollar terms.

Much of the gains have come since the beginning of 2023 on the back of sustained demand from central banks looking to diversify their reserves.

The strong price action sparked fears of missing out and investor sentiment for the metal improved in Q3, particularly as developed market central banks began to cut interest rates.

Renewed enthusiasm has continued into Q4, according to Gopaul.

“Initial data for October shows that we continue to see inflows into gold-backed ETFs, not just from Asian markets but also from Western investors.

“A lot of that stands to reason if you think about how geopolitics and the global economy have shifted. We’re also on the cusp of a US election and there’s a huge amount of uncertainty about how that’s going to play out,” he said.