New study finds that the overwhelming majority of ETFs are actively managed

It claims ETFs are enhancing price discovery and making markets more efficient

The trend to active management within ETFs is getting stronger, and ETF selection is replacing stock picking

Almost all ETFs are actively managed, an explosive new study has claimed.

Many ETFs are offering closet active management via an index, much like many active managers are offering closet index tracking, the study, titled The Active World of Passive Investing, found.

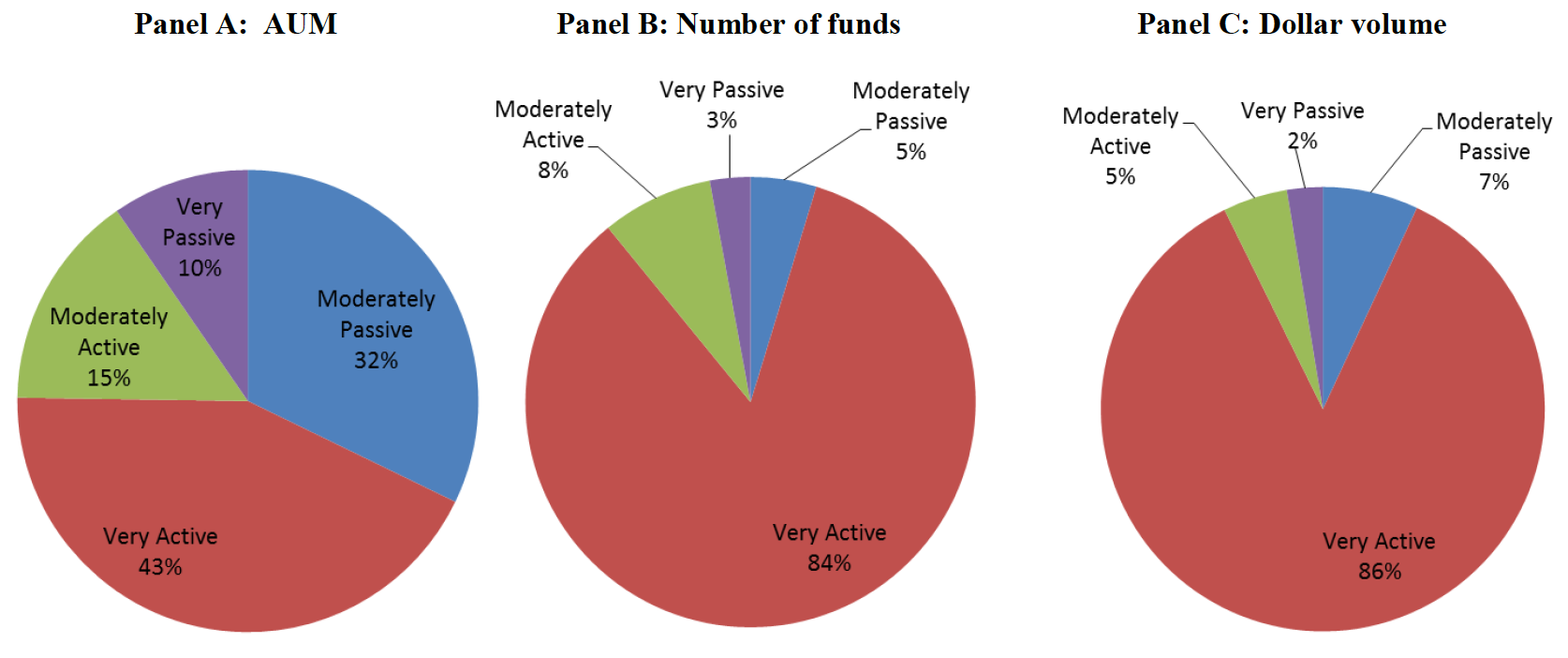

"Most ETFs are highly active with a median active share of 93.1% and median tracking error of 8.8% [a year]," it found.

"We find that more active ETFs are gaining market share at the expense of less active ETFs, whereas the opposite is true for mutual funds.

"Much as mutual funds rely on manager ability to pick stocks, the new generation of ETFs rely on skill in designing indices and trading algorithms to generate returns."

The study was conducted by Professors Talis Putnins and David Michayluk at the University of Technology Sydney, together with their colleagues Professors Maureen O'Hara and David Easley at Cornell University. It is the first review of its kind.

Measuring active management

To investigate how active ETFs are, the professors compared every US ETFs' holdings, trading patterns and performance with a passive total market portfolio.

They defined "passive" ETFs as only those that held the same stocks in the same weights as the total stock market, like the Vanguard Total Stock Market ETF (VTI:US).

They then measured the "activeness" of ETFs by looking at the extent to which they deviate from the total stock market. ETFs holdings, weightings, tracking errors and performance were all measured and compared with the benchmark.

They concluded: "Most ETFs have an Active Share above 50%, indicating that if their holdings were decomposed into a holding of the market portfolio (the passive part of their holdings) and a holding in a zero-investment long-short portfolio (the active part of their holdings), the value of the active bets would make up more than 50% of the ETF's value.

"Furthermore, most ETFs have returns that deviate substantially from [the market]. Many have annual tracking errors greater than 7%."

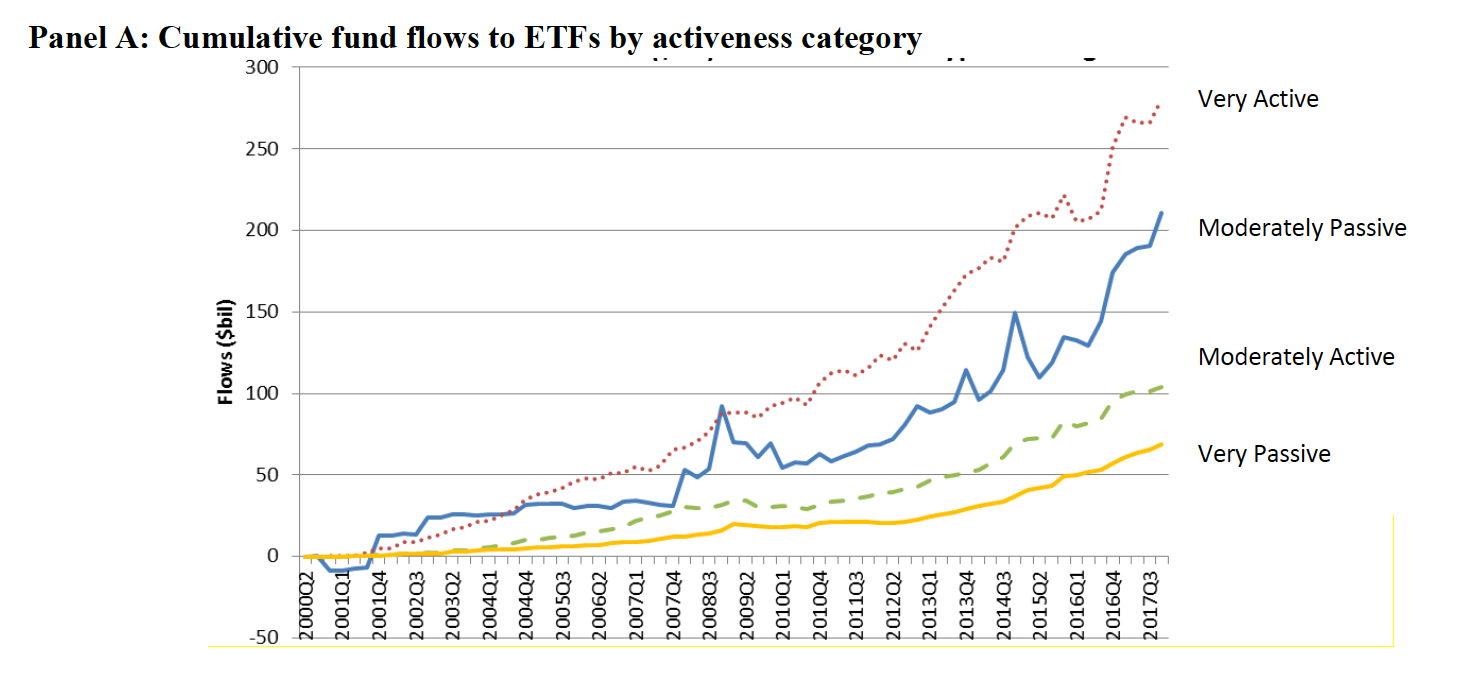

They noted that the trend to active management in ETFs was getting stronger, with the more active ETFs taking in more assets in recent years. These include smart beta ETFs, which weight indexes based on factor exposures. Thematic ETFs, which weight indexes by theme - i.e. artificial intelligence and millennial consumer behaviours. And active ETFs that are unconstrained by benchmarks.

The argued that the celebrity of Vanguard's VTS is partly to blame for the misperception that all ETFs are passive.

Myths busted: Price discovery freeloading and increasing correlations

The authors extended their findings to debunk several ETF myths. They dismissed the claim that ETFs are parasitic ("worse than Marxism") and freeload off the hard work and price discovery of active managers.

"ETFs are not simply "free-riders" in the market—investors are still betting on the outperformance of segments of the market, factors, or individual stocks, albeit now these bets are placed via active ETFs and index products," the report found.

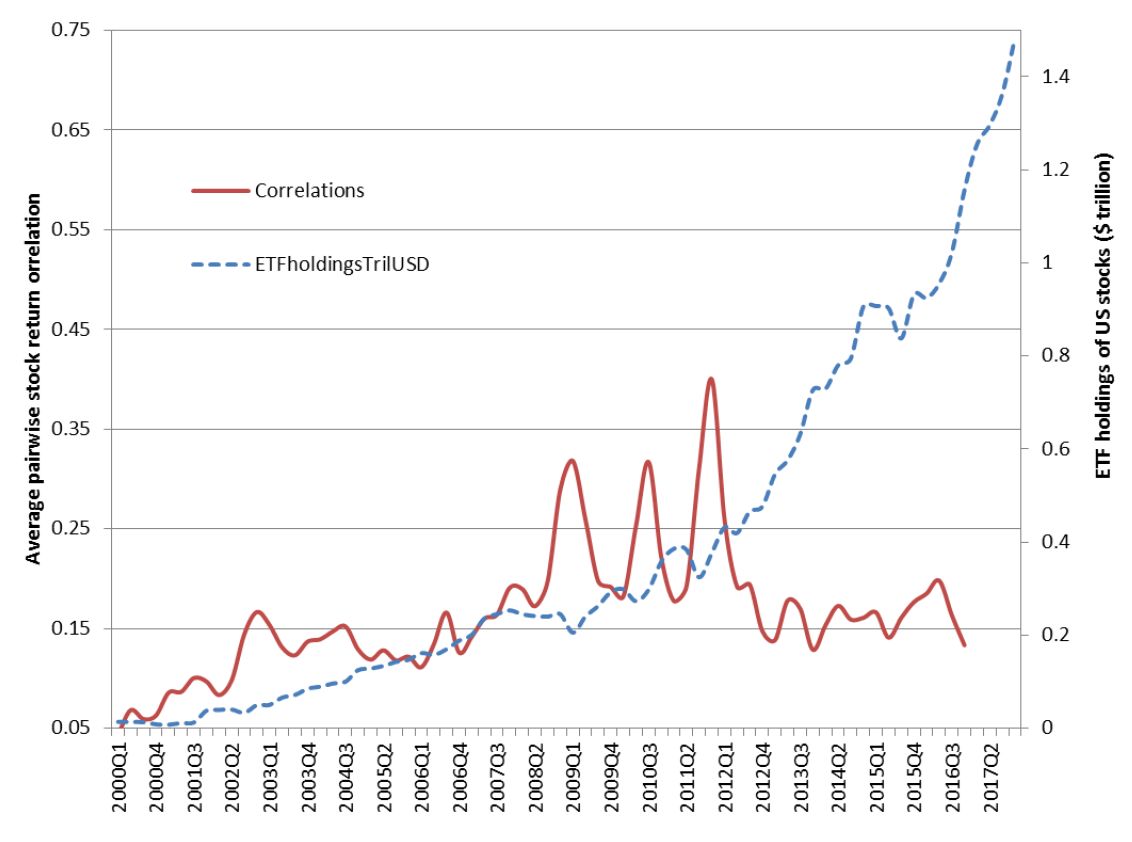

They also threw out the idea that ETFs were distorting capital markets and increasing stock correlations.

"Correlations have not followed the same trend as ETF holdings," it said.

"While correlations [rose]… from 2000 to 2010 and spike during the financial crisis years, they have steadily declined since that time despite ongoing and accelerating growth in ETFs."

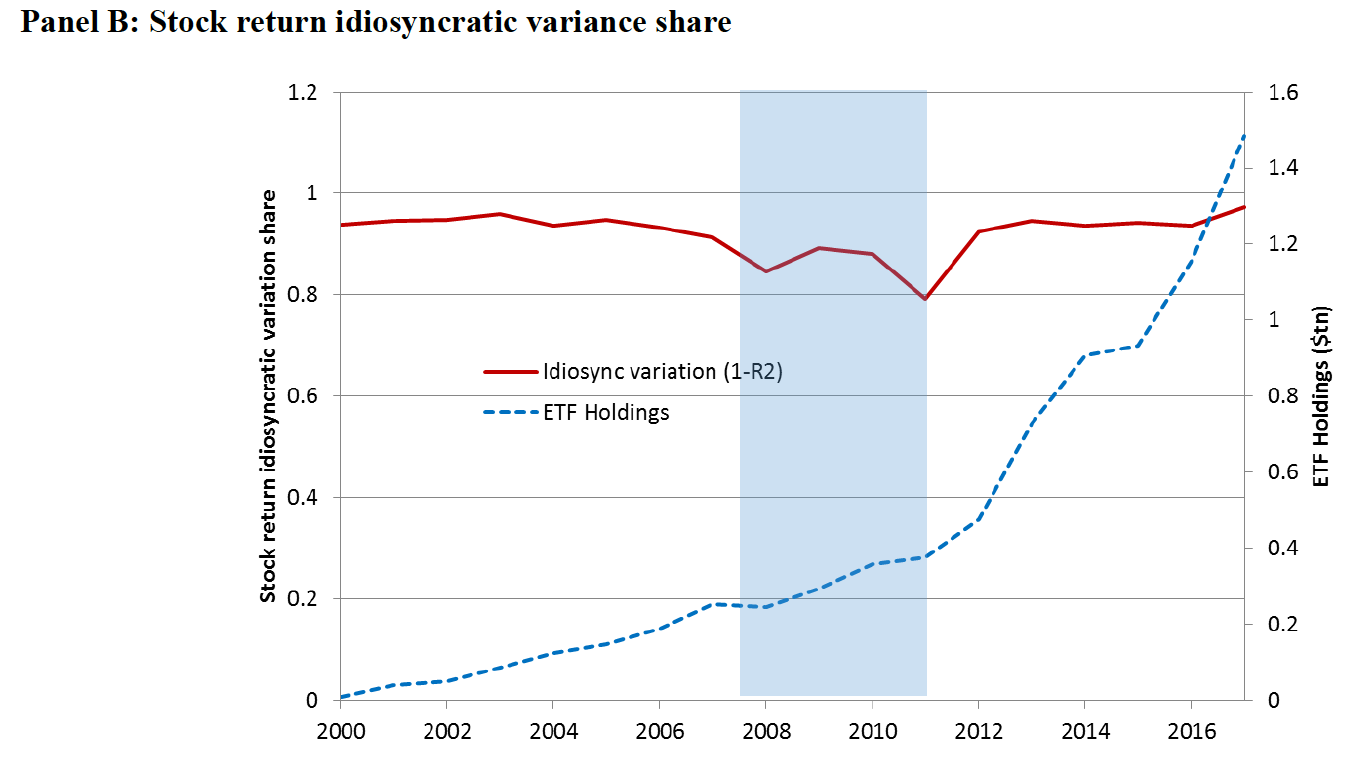

They noted that the amount of company-specific information built in stock prices had increased as ETFs got more popular.

Conclusions: ETF strategists replacing stock pickers

The study concluded with several forecasts including that there will only be one or two truly passive ETFs in the near future as such funds are functionally indistinguishable. It suggested Vanguard and BlackRock would provide these two.

ETF selection would continue to replace stock selection in portfolios too, it claimed, citing the fact that there are only 43,000 publicly listed companies globally, yet more than 3.3 million indexes.

"This staggering disparity reflects the new reality of investing: for many investors, the building blocks of their portfolios are index vehicles, not individual stocks."