The development of the ETF ecosystem and the growing adoption of fixed income ETFs are helping to drive the overall liquidity of the bond market, according to a report from Flow Traders.

The report, titled New Frontiers in Fixed Income Liquidity, the liquidity provider said the growth of credit ETFs and increased electronification of trading are the two key factors driving liquidity improvements.

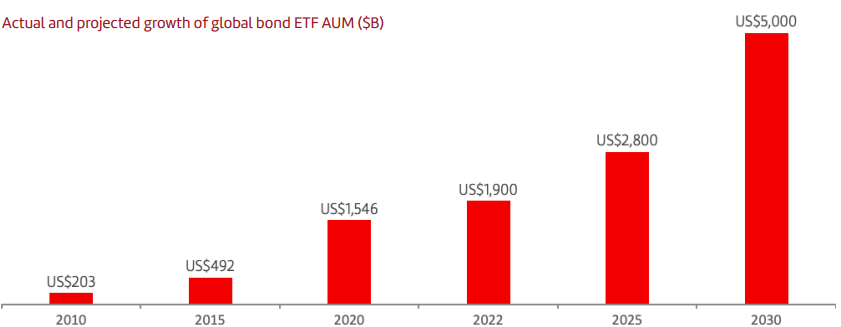

Global fixed income ETFs have grown from $729bn to $1.7trn over the past five years and BlackRock predicts it could hit $5trn by 2030, equivalent to 5% of the entire fixed income bond market.

Source: BlackRock, data from May 2022

During the first half of 2022, BlackRock said secondary trading volumes in euro-denominated investment grade and high yield ETFs were equivalent to almost 8% of underlying bond market volumes, up from 4% in 2018.

Flow Traders said part of the increase is due to investors turning to ETFs to manage credit risk in their bond portfolios with the wrapper proving to be a reliable instrument for hedging credit risk.

It noted how this was a role previously played by single-name credit default swaps (CDS) prior to the implementation of the European market infrastructure regulation (EMIR) in 2012.

“All of these factors drive the growth of fixed income ETFs and we expect that this trend will persist in the coming period due to this additional layer of liquidity and price transparency they add to the credit markets,” Ramon Baljé, head of fixed income for EMEA at Flow Traders, said.

“This nurtures the natural growth of the underlying credit markets with ETF APs and market makers playing the catalyst role in this symbiosis.”

The increased use of algorithmic trading with ETFs has also enabled bond investors to consolidate pricing information quickly and efficiently, boosting liquidity.

“ETF market makers are the main drivers of this development,” Baljé continued. “They have been utilising algorithmic strategies for ETF liquidity and have been adjusting these mechanisms to achieve the same efficiencies in the underlying bond markets.”

The report noted how ETFs are also a cost-effective trading tool. In particular, the most liquid ETFs are more cost-effective to trade versus underlying bonds, with growing interaction between the two markets having a positive impact on liquidity.

Source: BlackRock and Market Axess

An example of the two markets interacting is in portfolio trading, allowing ETF issuers and other asset managers to automate their rebalancing processes, build portfolios quickly and change position swiftly while minimising information leakage, according to the report.

“The growth of the ETF market has driven the adoption of portfolio trading as a protocol and the result is that portfolio trading volumes have increased over the last few years, especially in Europe,” Baljé said.

“ETF market makers embrace this relatively new protocol, as it is very close to their core business of creating and redeeming baskets with issuers.

“In this way, portfolio trading supports the interoperability and interaction within fixed income markets by bringing together traditional RFQ activity and ETF primary markets.”

He added the increased interaction between the ETF ecosystem and the bond market will increase with better transparency, “allowing more diversified participants to enter the market”.

Baljé said: “We are excited to be part of the evolution of the ecosystem and believe 2023 will be a year in which the fixed income markets experience significant developments and further growth. Electronification including automation and availability of data contribute as new drivers of liquidity.”