The established shift from mutual funds to ETFs was cemented this year with ETFs enjoying €180bn more inflows than their rival structure and active mutual funds booking a second year of considerable outflows.

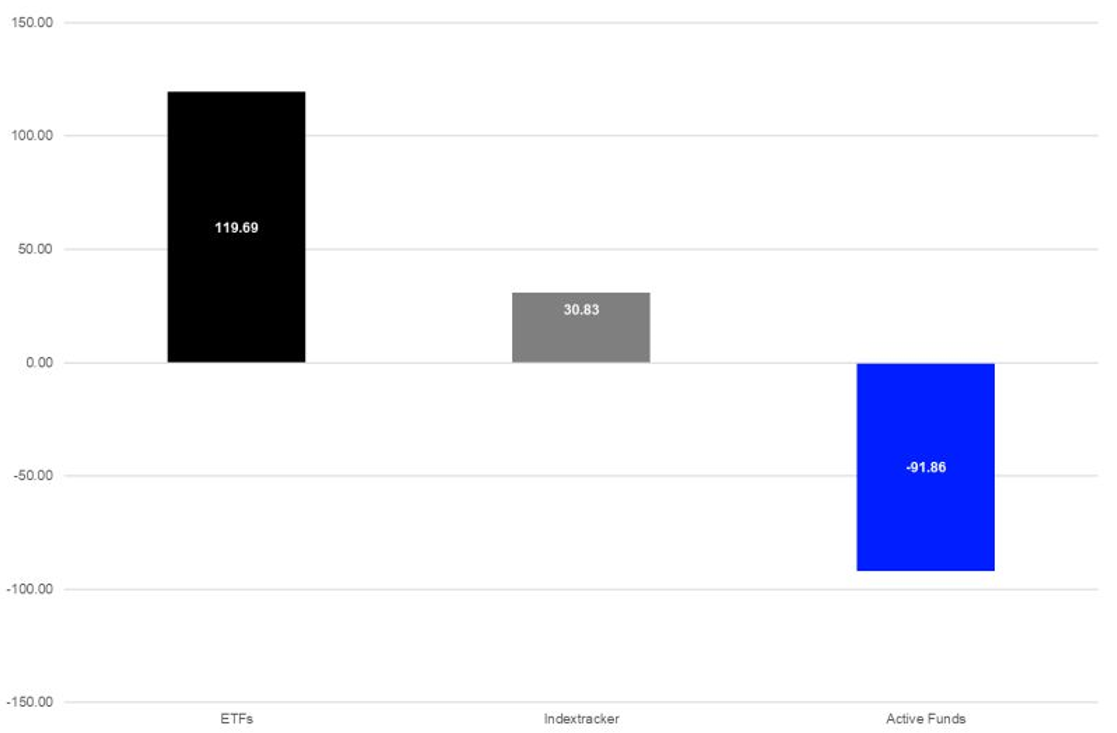

According to data from Refintiv, ETFs booked €119.7bn inflows between the beginning of 2023 and 1 December while mutual funds suffered €61.1bn outflows.

While index tracking mutual funds welcomed €30.8bn new assets, their gains were wiped out by active mutual funds racking up a €91.9bn asset exodus in the first 11 months of the year.

Chart 1: ETF versus mutual fund inflows YTD 2023 (€)

Source: Refinitiv

ETFs’ clear headway this year can be attributed to several structural and macro components.

As investors looked to implement the ‘bonds are back’ narrative within portfolios, ETFs have been a key tool for nimble and diversified asset allocation.

According to data from Morningstar, Europe-listed fixed income ETFs booked €47.9bn inflows during the first three quarters, accounting for 49% of all ETF inflows over the period and punching above their 23% market share of European ETF assets under management (AUM).

ETFs have also been the instrument of choice for burgeoning digital platforms seeking to offer low-cost investing solutions to Europe’s growing retail investor base.

Detlef Glow, head of Lipper EMEA research at Refinitiv, argued ETF savings plans “have played a vital role” in the continued success of ETFs.

“ETFs democratise investing because they offer retail investors cheap access to all kind of investment strategies,” he said.

However, Glow warned it is difficult to gauge whether retail adoption of ETFs in leading countries such as Germany can be replicated elsewhere, especially once the EU implements a ban on payments for order flow (PFOF) at the end of June 2026. “Since free of charge saving plans, where transaction costs were subsidised by the platforms with PFOF were the main reason why ETFs became so popular in Germany. It remains to be seen how the industry and the investors will react once these payments are gone,” he added.

Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, agreed the rise of retail continues to be an important story to watch, but suggested ETFs are becoming the preferred implementation across the board.

“I am sure there is some retail participation in this shift, but they do not have that kind of muscle,” he said.

“Some of the shift is driven by investors selling local exposure – in the form of European active funds – and shifting to US-focused exposure, relying on ETFs to do this.”

Monika Calay, director of passive research at Morningstar, noted the retrocession fee model “remains a hurdle” for ETF adoption and distribution challenges remain, as evidenced with Vanguard shutting its German direct-to-consumer platform in under two years.

Instead, Calay argued the main driver of continued ETF uptake remains the underperformance of active funds and the rift in costs between the structures.

This chimes with the same pattern appearing in European fund flows during the challenging macro environment of 2022.

Exchange-traded product (ETP) inflows outpaced mutual fund flows in every month last year, with generally lower-cost ETFs welcoming €62bn net new assets by 15 November, while UCITS vehicles saw €198bn outflows collectively over the first eight months of last year, according to data from the European Fund and Asset Management Association (EFAMA).

The slow climbdown of active mutual funds mirrors the equivalent story playing out in the US. Interestingly, in both continents, active management has not lost its lustre within ETFs.

In Europe alone, active ETF assets have boomed almost five-fold since the start of 2015, from $6.1bn to $29.1bn by the end of Q3 this year, according to data from ETFbook.

In the first 10 months of 2023, more than a tenth of all new UCITS share class launches were actively managed products.