Deutsche Bank has published its latest

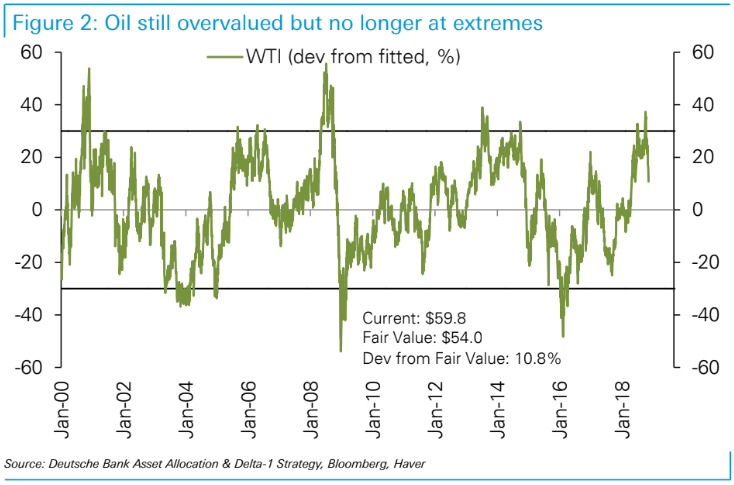

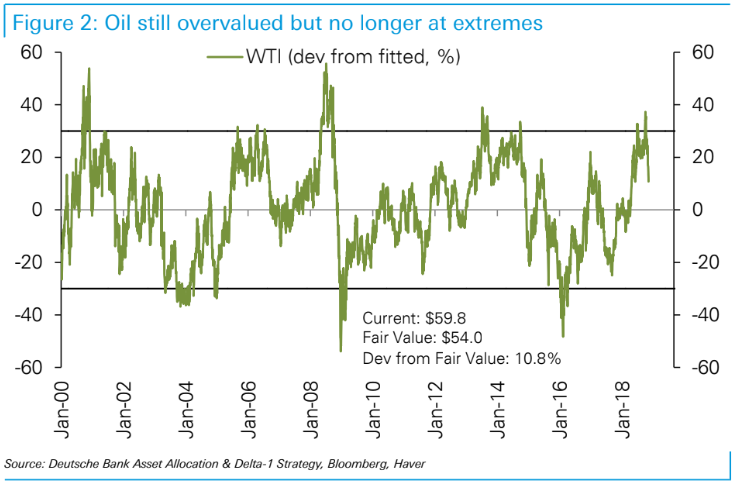

on the rise and fall of oil prices throughout 2018. It was only April when oil prices were rising following strong results from the US dollar and moderating global growth. At its peak, the price of the oil benchmark, West Texas Intermediate (WTI), tipped over the 30 per cent overvaluation band, as seen in the figure below. When the price creeps above this 30 per cent bracket, an overcorrection usually follows causing a substantial drop in value.

As a result to the steady decline in oil price, US and European equities suffered significant outflows. US and European equities faced $0.9bn and $2.6bn worth of outflows in contrast to the Asian markets where Japan and China relished in inflows of $2.4bn and $1.7bn this week, respectively. Specifically, Japan has been receiving significant attention with $17bn worth of inflows in the last month, the highest on record according to Deutsche Bank. Funds from South Korea and Latin American have also been receiving significant inflow over the last two weeks.

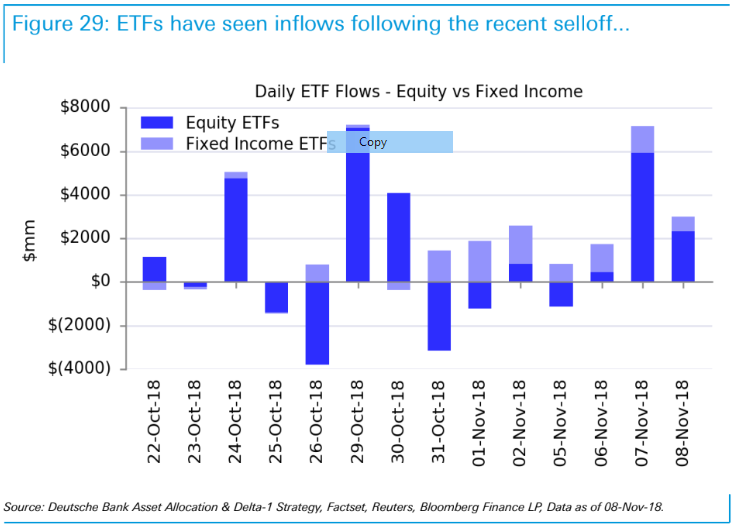

Whilst US and European equities might be struggling, the ETF market has been picking up the pieces over the last four weeks. Since late October, both equity and fixed income ETFs have faced spikes of inflows as a result of the major sell off within the securities market. While there has been several days where equity ETFs faced large outflows, the cause for this is most likely being driven by pseudo-futures rather than asset allocation. Pseudo-futures being the most liquid ETFs within its asset class.