The merge marks the most significant upgrade that Ethereum or any large-scale blockchain has ever undergone and will set the stage for future scaling features, including sharding.

The merge may also set the foundation for best practices to run a proof-of-stake (PoS) network, especially as Ethereum becomes the most prominent and soon-to-be battle-tested PoS blockchain.

This event is also notable for the crypto industry as proof-of-work systems will cease representing the lion’s share of the total market value for the first time in history.

Let’s dive into the basics with the similarities and differences between PoW and PoS.

What are PoW and PoS?

Proof-of-work (PoW) and proof-of-stake (PoS), designed to prevent sybil attacks and reach network consensus, are the vital functioning of crypto assets.

PoW

Bitcoin and Ethereum, accounting for nearly 60% of crypto’s global market cap, utilise a PoW algorithm, which relies on energy and computationally-intensive mining machines.

In a PoW blockchain, miners must submit the solution to a computationally-expensive puzzle to be able to propose a block of transactions.

PoS

However, Ethereum’s option to move away from PoW to PoS has been a consideration since 2014, before the network’s official launch on 30 July 2015.

In a PoS blockchain, “miners” are replaced by “validators” and fulfil the same role; the difference is that they do not have to run supercomputers and pay high capital expenditures upfront.

Instead, they must commit a portion of their capital in ether (ETH), called the “stake”, to validate transactions and submit them on the Ethereum blockchain.

Both PoW and PoS represent a set of rules determining three essential elements:

Miners or validators’ revenue: Issuance of new tokens, plus transaction fees as a reward to miners or validators.

Transaction verification and settlement: Settlement occurs once a block of transactions complies with the network’s rules.

Blockchain security against spam attacks: Security is measured by computing power with PoW and total capital invested with PoS.

The merge

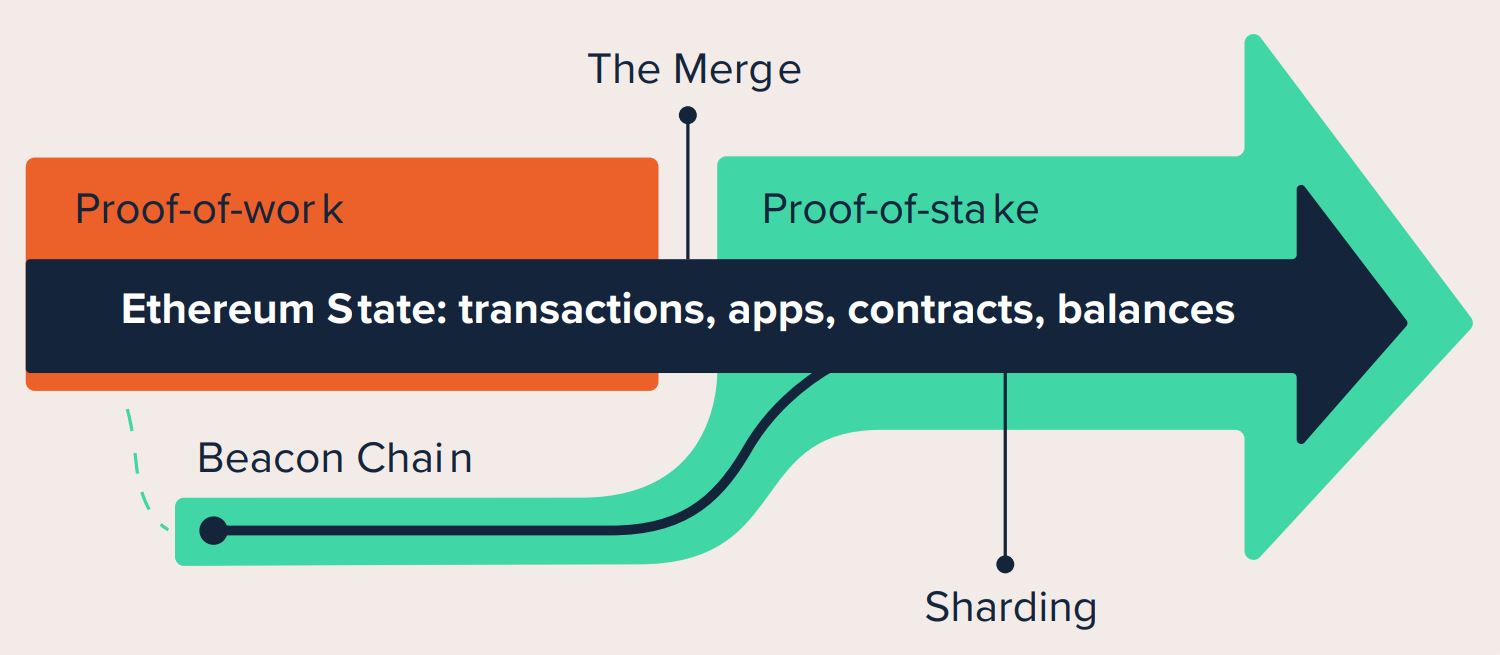

In this regard, on 1 December 2020, developers launched a parallel PoS blockchain dubbed the beacon chain, which runs separately from the PoW blockchain (Mainnet) to battle-test feasibility. The merge, which took place on 15 September, is when these two systems finally come together and PoS permanently replaces PoW.

Source: The Ethereum Foundation

In Ethereum, a code adjustment dubbed the “difficulty bomb” makes it exponentially harder for miners to verify transactions until mining becomes economically unfeasible to dissuade them from continuing the PoW chain.

The significance of this event cannot be overstated, here are the ramifications:

Reduction in energy consumption: Ethereum’s energy consumption reduces by approximately 99.95%. Current estimates suggest that Ethereum has a total annualised power consumption of ~94 TWh3, which is approximately equivalent to Finland’s. As a result, the merge will help Ethereum reduce its carbon footprint from that of a developed country to that of a small town.

Staking makes ETH a capital asset, with an APR increase of 50% post-merge: ETH will become a capital asset after the merge. In PoS blockchains, the native asset is a prerequisite to validating and settling new transactions. Staking is analogous to owning a perpetual bond, as validators receive a constant stream of cash flows with no maturity date. However, it should be clear that staking is not a form of debt. The staking annual percentage rate (APR) is expected to increase by approximately 50% above the current APR. This increase is due to a reallocation of transaction fees, which will start going to validators instead of miners.

The monetary policy of Ethereum will change as the inflation rate decreases by 90%: One could argue that blockchains are like digital nations. For instance, Ethereum users must pay a transaction fee denominated in the native currency of the network – ETH – every time they perform a transaction, similar to how citizens of a nation must use a legal tender to participate in their economy. In addition, just like “sound money” in the context of a country is mainly a function of monetary policy, the monetary supply programmed into a blockchain is highly relevant if the asset has aspirations of a store of value. Currently, mining rewards in Ethereum amount to ~13,000 ETH per day, which translates to a yearly inflation rate of ~4%. However, post-merge, mining rewards will disappear, and staking rewards will amount to ~1,600 ETH per day, an almost 90% reduction in issuance. What is more, with the London upgrade of August, a fee-burning feature (EIP-1559) went live, enabling the destruction and permanent removal of a portion of ether used for transaction fees. If Ethereum maintains its adoption rate, this feature will convert ETH into a deflationary asset.

Ethereum will become more secure with a diversified set of software to validate transactions: Another crucial implication of Ethereum transitioning to PoS is increased security and decentralisation of the blockchain. Regarding security, the economic penalties for misbehaviour in a PoS network, known as slashing, make a 51% attack exponentially more costly for an attacker than in a PoW network. Regarding decentralisation, to participate as an Ethereum validator, a user must deposit 32 ETH into a deposit contract and run three separate pieces of software: an execution client, a consensus client, and a validator. However, staking pools have emerged to make it easier for individuals to participate in securing the network without having 32 ETH, which, coupled with reduced hardware requirements, represents a lower barrier of entry and reduced centralisation risk for the network. In other words, PoS should lead to more nodes securing Ethereum.

What are the misconceptions and risks with the merge?

Withdrawals of ether will not occur between 6-12 months post-merge: Validators will not be able to withdraw staked ETH immediately after the merge occurs. It is estimated that ETH withdrawals will not happen until 6-12 months post-merge after the Shanghai upgrade. Also, complete validator exits will be limited by the Ethereum rules; only six may exit per epoch (~43,200 ETH per day out of over 10 million staked ETH) to prevent a “bank run” that would leave Ethereum vulnerable to attacks.

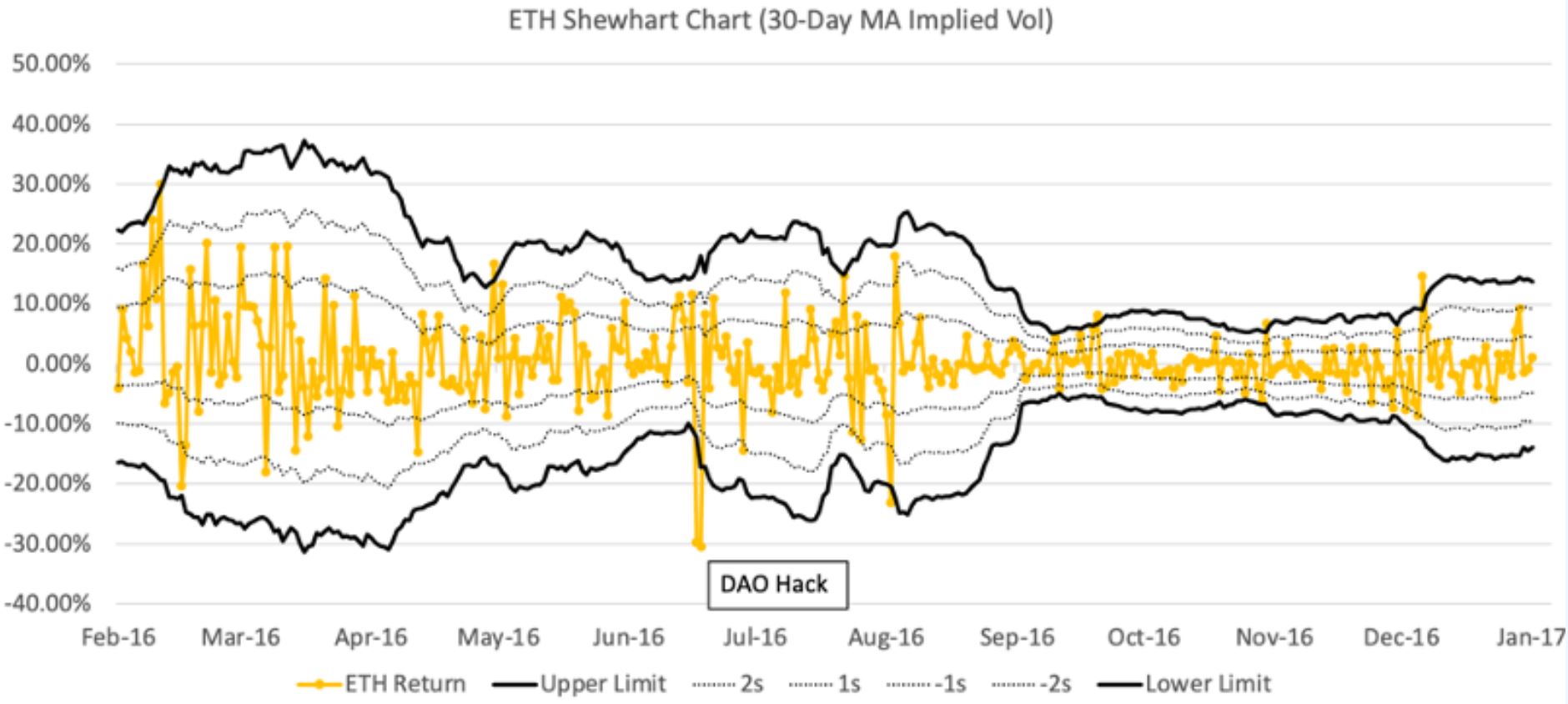

Miners want to keep the PoW system and initiate a network bifurcation away from POS, also called a fork: The risks of a fork are significant, as stakeholders, such as Ethereum applications, must choose which blockchain they will support. Hard forks have historically hurt the price of the native currency of the resulting blockchains as people worry about the consequences of a divided community. For instance, in July 2016, a hard fork took place on the Ethereum blockchain due to the DAO hack, giving birth to Ethereum Classic. In the two days following the DAO hack, there were two moves above three sigma (standard deviations from the mean), representing an almost 50% decrease in price from $20.64 before the hack to $11.30. For the rest of 2016, ETH’s price did not recover and closed the year at $8.09, down 61% from its all-time high price before the DAO hack and subsequent hard fork. Notwithstanding, history may not repeat itself as circumstances are very different today.

While miners are incentivised to run the PoW blockchain, it will be challenging for them to develop a community and provide value to developers and users.

That is because there is no real support for the Ethereum PoW blockchain outside miners and a handful of exchanges. For instance, Circle (USDC) and Tether (USDT), the largest stablecoin issuers in the world, have pledged sole support for the merge.

Conclusion

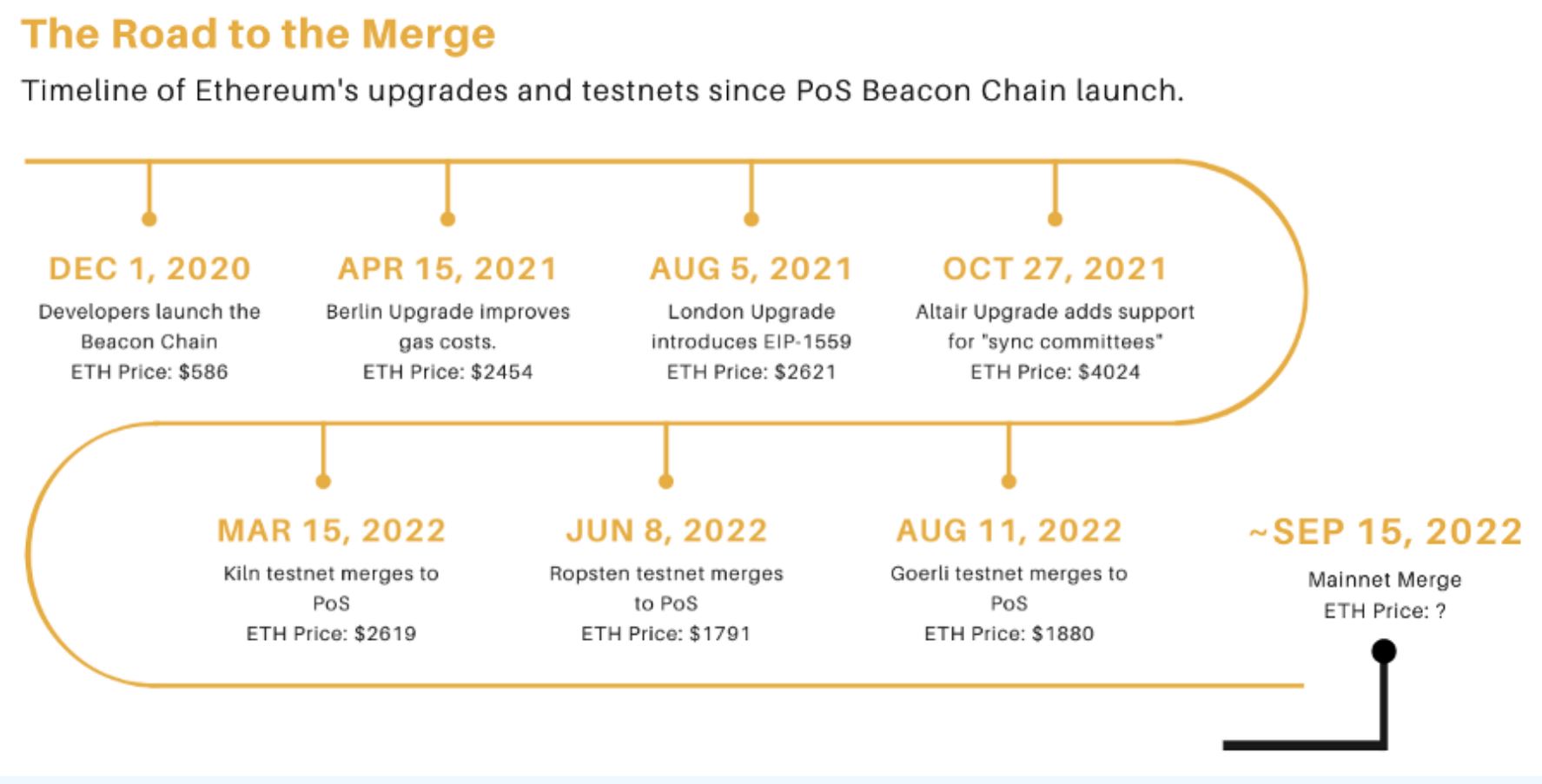

Regarding the timeline, core developers have decided on a date for Bellatrix, the pre-merge upgrade, which occurred on 6 September.

Source: 21Shares

Then, the merge was triggered on 15 September by terminal total difficulty (TTD), a cumulative measure of the total mining power built into the chain. Only then, did PoS replace PoW.

This article first appeared in Crypto Unlocked: In the bleak midwinter, an ETF Stream report. To access the full issue,click here.