Achieving a strong balance between defence and attack is vital for a portfolio's success in any market environment.

This year, markets have been largely unpredictable, with the Federal Reserve pencilling in only one rate in 2024, a significant reduction from the seven rate cuts forecasted by markets at the start of the year.

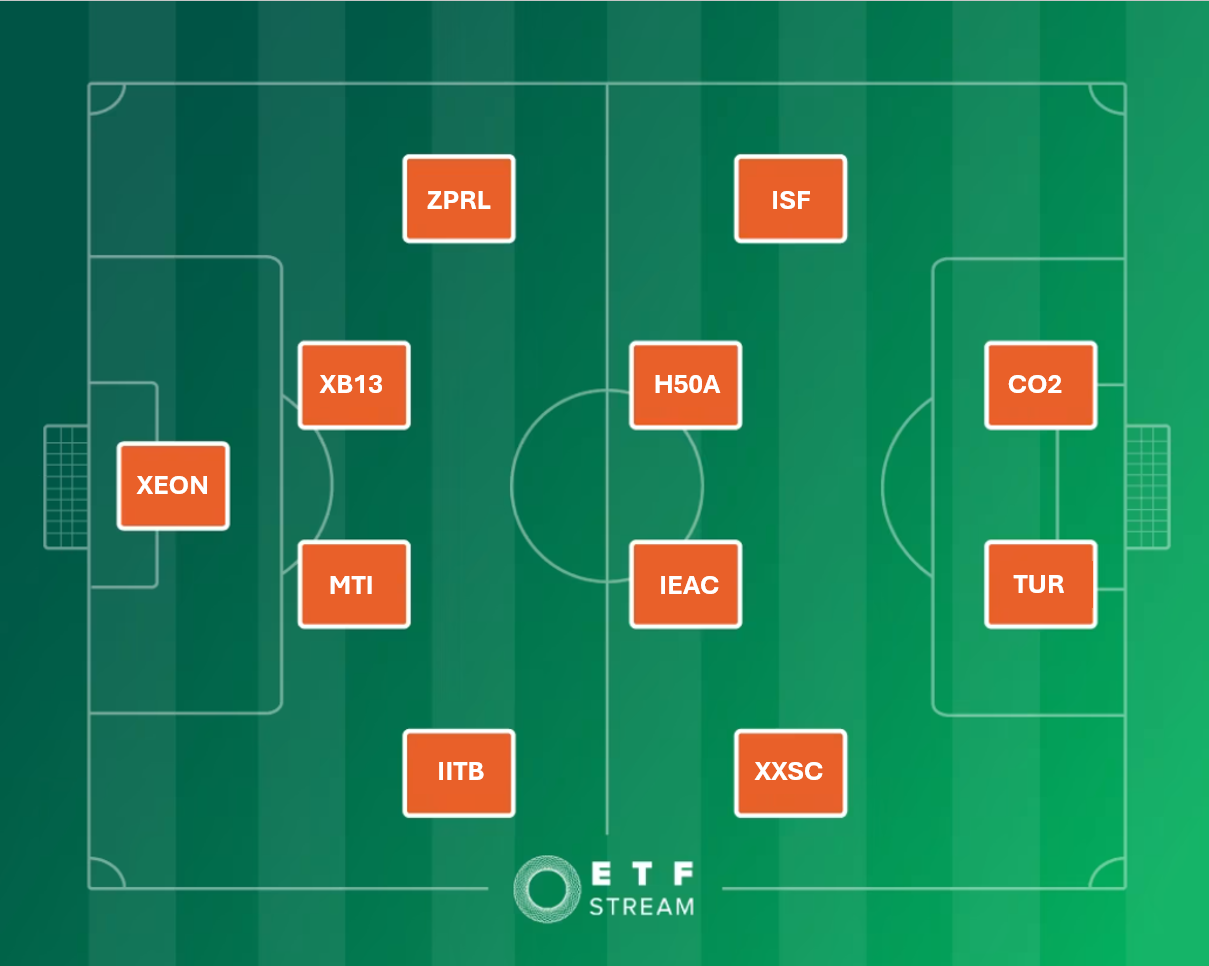

With the Euro 2024 kicking off in Germany on 14 June, ETF Stream has assembled a selection of ETFs that ETF Stream believes are a sure bet to outperform any portfolio in today's market environment.

GK – Xtrackers EUR Overnight Rate Swap UCITS ETF (XEON)

XEON is the ultimate defensive position. As the last line of defence, tracking the Solactive €STR +8.5 Daily Total Return index – reflecting the performance of a deposit earning interest at the euro short-term rate – XEON ensures the portfolio is in safe hands.

XEON is primarily made up of government bonds (50%) with the top three country weightings being Belgium (25.3%), France (25.2%) and Spain (19.8%).

RB – iShares Italy Govt Bond UCITS ETF (IITB)

IITB, which tracks the Bloomberg Italy Treasury Bond index, offers a bit of flair on the right of defence and is riskier than a traditional fixed income allocation.

While still a government bond position, European peripheries such as Italy can add a little extra zip in attack.

CB – Amundi Euro Government Inflation-Linked Bond UCITS ETF (MTI)

While market volatility persists, providing inflation protection in an unpredictable market landscape is crucial.

The MTI stands out as a robust choice for centre-back – a defensive and solid position, providing balance to the portfolio, especially if inflation stays higher-for-longer.

CB – Xtrackers Germany Government Bond 1-3 UCITS ETF (XB13)

Much like MTI, XB13 mirrors the qualities of a dependable centre-back.

By concentrating on short-term German government bonds, XB13 ensures steady performance and low-risk exposure, offering a strong defensive backbone to the portfolio.

LB – SPDR STOXX Euro Low Volatility UCITS ETF (ZPRL)

The defensive characteristics of low volatility present a neat solution to persistent market volatility, geopolitical tensions and high interest rates.

Tracking the EURO STOXX Low Risk Weighted 100 index, ZPRL has returned 4.4% over the last six months, with its defensive qualities well suited to full-back.

RM – Xtrackers MSCI Europe Small Cap UCITS ETF (XXSC)

For our right midfield position, we are looking for plenty of flair to ensure the portfolio captures upside when markets are soaring.

Enter XXSC, which has returned 8.9% so far in 2024 and $1.7bn assets under management (AUM), confirming this ETF as a fan favourite.

CM – iShares Core € Corp Bond UCITS ETF (IEAC)

For the centre of midfield, XBLC is our obvious choice, providing a huge boost to the portfolio at the right time.

Tracking the Bloomberg Euro Corporate Bond index, XBLC has amassed $13bn AUM since launching in March 2009.

CM – HSBC EURO STOXX 50 UCITS ETF (H50A)

As its partner in the centre of the part, H50A, which offers exposure to large-cap European equities, is the engine room of the team.

With an ongoing charge figure (OCF) of 0.05%, H50A brings both strong growth potential and balance, anchoring the portfolio with stability and performance.

LM – iShares Core FTSE 100 UCITS ETF (ISF)

Looking for a bit more solidity on the left versus our right midfield, ISF provides some much-needed solidity.

ISF, which offers exposure to the UK’s blue-chip index, also complements our slightly more bullish left back – the SPDR STOXX Euro Low Volatility UCITS ETF – and has returned a comfortable 8.3% so far in 2024.

ST – SparkChange Physical Carbon EUA ETC (CO2)

Providing some punch to the portfolio, CO2 is an extremely volatile strategy that can deliver strong returns as highlighted by the 33.4% jump over the last three months.

CO2 offers physical exposure to EU carbon allowances (EUAs) which helps prevent emissions by withholding carbon allowances from polluters.

ST – Amundi MSCI Turkey UCITS ETF (TUR)

While Turkey is not technically a European country, the nation’s presence at Euro 2024 makes TUR an exciting wildcard attacking option for this team.

Tracking the MSCI Turkey index of 17 stocks, TUR has soared 34.8% so far this year amid heavy exposure to financials, industrials and consumer staples.