European ETF issuers have criticised BlackRock for launching a synthetic ETF after the US giant spent the years following the Global Financial Crisis campaigning about the dangers of this product structure.

Following its acquisition of iShares from Barclays in 2009, BlackRock was critical of synthetic ETFs, which use swaps to follow their indexes, with CEO and chairman Larry Fink even calling out rivals SocGen at a conference in New York for its use of synthetic ETFs.

Yet the asset manager's decision to launch the iShares S&P 500 Swap UCITS ETF (I500) on the London Stock Exchange last week has caused many to question its original motivation for campaigning against synthetic ETFs.

“They created investor fear around synthetic ETFs after the GFC. Yet now they are issuing their own,” said Hector McNeil, chief executive of HANetf.

“It held the European market back and I think it is one of the reasons AUM is a fifth of the US market. It gained BlackRock market share at the expense of Lyxor and DWS, but stalled the market.”

Swaps had fallen out of favour with investors following the GFC. Many bank and insurers’ swap divisions – such as AIG – were bailed out by the US government. Meaning that BlackRock’s criticisms of swap-backed ETFs chimed with the times.

But synthetic ETFs were also riddled with problems independent of BlackRock. The most crucial of which was vertical integration and the conflicts of interest it caused. In the early days, the same bank that provided the synthetic ETF – mostly Deutsche Bank for DWS's Xtrackers range and SocGen for Lyxor – was also the exclusive swap provider.

This conflict meant the ETF manager had no incentive to drive a hard bargain or shop around to get swap fees down. More problematically, it meant that ETF managers had no incentive to get a good deal on the insurance the swap provider offered – called “collateral”, in finance jargon.

European ETF issuers worked to fix these problems, by bringing in iron-clad collateral arrangements. They also brought in other banks to provide swaps – meaning there was a backup should one bank go bust. Changes like these suggest BlackRock’s campaigning may have helped Europe produce higher quality synthetic ETFs.

However, there was a self-serving element to BlackRock’s crusade. Synthetic ETFs were popular in Europe, where BlackRock was trying to swell its market share. Its top European competitors offered synthetic ETFs. By turning investor sentiment against synthetic ETFs, BlackRock, which exclusively offered physical ETFs, stood to benefit. Physical ETFs buy shares and bonds directly. They do not use swaps.

According to Stuart Forbes, co-founder of Rize ETF, an independent ETF provider, there was a dash of hypocrisy in BlackRock’s position. This is because physical ETFs lend out the shares that they own to short sellers who may never return them. This introduces risks similar to swaps.

“They spent a lot of time trying to convince the market that synthetic ETFs were riskier than physical ETFs,” Forbes continued.

“However, they had risk in their own physical ETFs in the form of securities lending. Under both respective, you have collateral in place to mitigate the counterparty exposure so it really was not objective or fair of them to say that synthetic ETFs were the riskier of the two.”

Right or wrong, evidence suggests the aggressive campaigning paid off. Synthetic ETF providers widely reported being nagged by clients about the possible dangers of swaps. Regulators – such as the IMF and Financial Stability Board – joined the dogpile. DWS and Lyxor turned tails, and converted many of their synthetic ETFs into physical ETFs.

But the volte-face has also caused some to ask why BlackRock’s view of synthetic ETFs has changed. And ask why they are choosing to list one at this moment in time.

Source: Invesco

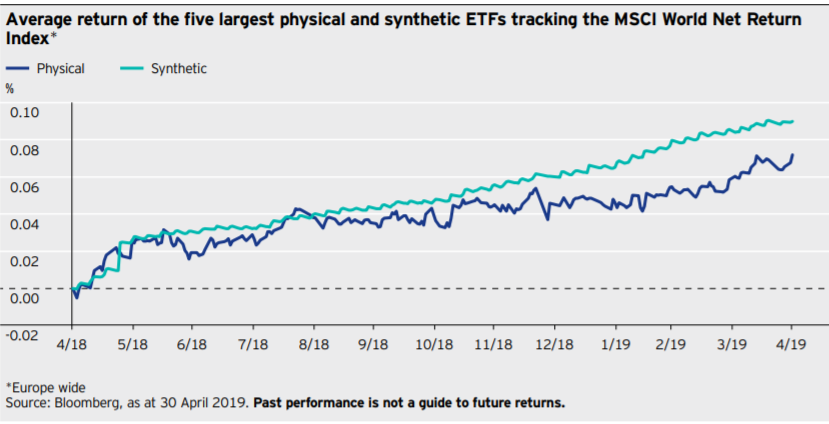

One answer may be performance and investor preferences. Thanks to their tax and transaction cost dodging abilities, synthetic ETFs have outperformed their physical competitors. Their ability to give US dividend taxes the slip could prove particularly useful for income-minded investors, as low interest rates cause yields to dry up.

Physical ETFs are safer than synthetic ETFs – a misconception?

The outperformance has led to a resurgence of investor interest, with more money flowing into synthetic S&P 500 ETFs than their physical rivals. According to Townsend Lansing, head of product at CoinShares, the industry should move on from the synthetic versus physical ETFs debate.

“The synthetics are bad, physical are good debate back in 2011 was largely led by BlackRock as a marketing ploy. It was always an oversimplification of a variety of issues that arise when structuring ETP.

“To be honest, BlackRock’s synthetic ETF launch did not really surprise me.”