Bond investors have endured a whipsaw environment in interest rates that has introduced more unwanted volatility to portfolios. And with continued uncertainty over the Federal Reserve rate policy, inflation and a recession, fixed-income investors are looking for stability.

Therefore, it is no surprise we have seen interest in defined maturity ETFs and how they can be used to build efficient bond ladders.

Bond ladders for some income predictability

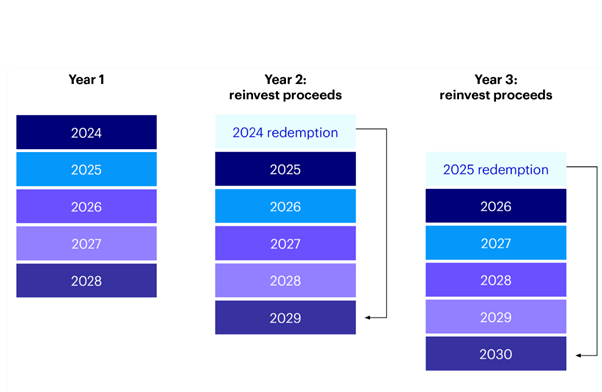

Defined maturity ETFs can be used to build bond ladders designed to help create income stability regardless of the direction of interest rates. Bond ladders are portfolios of bonds with sequential maturity dates.

As bonds reach maturity, the proceeds can be used to fund a specific expense, such as saving for a house or retirement, or reinvested into new bonds with longer maturities. Bond ladders that hold bonds to maturity may be particularly appealing to investors looking for some income predictability involatile interest rate environments.

First, ladders can be customised to target specific maturity and duration profiles, giving investors more control over the portfolio’s sensitivity to changes in interest rates.

Chart 1: How bond ladders work – a hypothetical example

Source: Invesco

Most traditional fixed income mutual funds, including ETFs, typically have a perpetual duration target, making them more sensitive to changes in interest rates.With bond ladders, when interest rates are rising, investors reinvest any proceeds from bonds maturing from the ladder into new bonds with higher rates.

Meanwhile, if rates fall, investors can choose to reinvest less of the maturity proceeds into new bonds with lower rates. And when rates are falling, investors may have the benefit of existing bonds that were potentially purchased at higher rates than currently.

Using BulletShares ETFs in bond ladders

BulletShares defined maturity ETFs can help investors build bond ladders more efficiently because they combine the potential benefits of individual bonds and ETFs.

BulletShares ETFs let investors avoid the trading costs,research and time of building bond ladders with hundreds of individual bonds. Defined maturity ETFs like BulletShares have termination dates like individual bonds and they also combine the advantages of ETFs such as diversification, liquidity and transparency.

Our BulletShares ETFs provide targeted exposure to US dollar and euro investment grade corporate bonds, with maturity ranges from 2026 to 2030. Whatever you are looking to accomplish with your bond portfolio, Invesco’s range of BulletShares UCITS ETFs can offer convenient, cost-effective solutions to help meet your potential income goals.

Related insights

● Fixed income investing with ETFs. We work hard to make sure our fixed income ETFs work hard for you. From leveraging our global resource and expertise to working on individual trade requirements, we aim to provide you with our best outcomes.

● Using maturity-targeted ETFs to manage curve exposure. Income investors are often looking to achieve a yield-related objective, for ex-ample delivering a target yield relative to cash or inflation, or wanting to manage their credit, currency, duration or any other risks inherent with the asset class.Here, we look at how maturity-targeted ETFs can help investors manage exposure to the yield curve.

Investment Risks

For complete information on risks, refer to the legal documents. The value of investments, and any income from them, will fluctuate. This may partly be the result of changes in exchange rates. Investors may not get back the full amount invested. The creditworthiness of the debt the Fund is exposed to may weaken and result in fluctuations in the value of the Fund. There is no guarantee the issuers of debt will repay the interest and capital on the redemption date. The risk is higher when the Fund is exposed to high yield debt securities.

Changes in interest rates will result in fluctuations in the value of the fund.

The Fund may be exposed to the risk of the borrower defaulting on its obligation to return the securities at the end of the loan period and of being unable to sell the collateral provided to it if the borrower defaults.

The Fund intends to invest in securities of issuers that manage their ESG exposures better relative to their peers. This may affect the Fund’s exposure to certain issuers and cause the Fund to forego certain investment opportunities. The Fund may perform differently to other funds, including underperforming other funds that do not seek to invest in securities of issuers based on their ESG ratings.

The Fund might be concentrated in a specific region or sector or be exposed to a limited number of positions, which might result in greater fluctuations in the value of the Fund than for a fund that is more diversified.

The term of the Fund is limited. The Fund will be terminated on the Maturity Date. During the Maturity Year, as the corporate bonds held by the Fund mature and the Fund’s portfolio transitions to cash and Treasury Securities, the Fund’s yield will generally tend to move toward the yield of cash and Treasury Securities and thus may be lower than the yields of the corporate bonds previously held by the Fund and/or prevailing yields for corporate bonds in the market. The issuers of debt securities (especially those issued at high interest rates) may repay principal before the maturity of such debt securities. This may result in losses to the Fund on debt securities purchased at a premium. The Fund may be terminated in certain circumstances which are summarised in the section of the Prospectus titled “Termination”. Important Information

An investment in these funds is an acquisition of units in a passively managed, index tracking fund rather than in the underlying assets owned by the fund. Data as at May 2024, unless otherwise stated. By accepting this material, you consent to communicate with us in English, unless you inform us otherwise. This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. Views and opinions are based on current market conditions and are subject to change. For information on our funds and the relevant risks, refer to the Key Information Documents/Key Investor Information Documents (local languages) and Prospectus (English, French, German), and the financial reports, available from www.invesco.eu. A summary of investor rights is available in English from www.invescomanagementcompany.ie. The management company may terminate marketing arrangements. UCITS ETF’s units / shares purchased on the secondary market cannot usually be sold directly back to UCITS ETF. Investors must buy and sell units / shares on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying units / shares and may receive less than the current net asset value when selling them. For the full objectives and investment policy please consult the current prospectus. Index: “Bloomberg®” and the indices referenced herein (the “Indices”, and each such index, an “Index”) are trademarks or service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the Index (collectively, “Bloomberg”) and/or one or more third-party providers (each such provider, a “Third-Party Provider,”) and have been licensed for use for certain purposes to Invesco (the “Licensee”). To the extent a Third-Party Provider contributes intellectual property in connection with the Index, such third- party products, company names and logos are trademarks or service marks, and remain the property, of such Third-Party Provider. Bloomberg is not affiliated with the Licensee or a Third-Party Provider, and Bloomberg does not approve, endorse, review, or recommend the financial products referenced herein (the “Financial Products”). Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the Indices or the Financial Products.

Germany: German investors may obtain the offering documents free of charge in paper or electronic form from the issuer or from the German information agent (Marcard, Stein & Co AG, Ballindamm 36, 20095 Hamburg, Germany).

Italy: The publication of the supplement in Italy does not imply any judgment by CONSOB on an investment in a product. The list of products listed in Italy, and the offering documents for and the supplement of each product are available: (i) at etf.invesco.com (along with the audited annual report and the unaudited half-year reports); and (ii) on the website of the Italian Stock Exchange borsaitaliana.it.

Switzerland: The representative and paying agent in Switzerland is BNP PARIBAS, Paris, Zurich Branch, Selnaustrasse 16 8002 Zürich. The Prospectus, Key Information Document, and financial reports may be obtained free of charge from the Representative. The ETFs are domiciled in Ireland.

Issued by Invesco Asset Management (Schweiz) AG, Talacker 34, 8001 Zurich, Switzerland (+Rep and paying agent), Invesco Investment Management Limited, Ground Floor, 2 Cumberland Place, Fenian Street, Dublin 2, Ireland, regulated by the Central Bank of Ireland.

EMEA 3601294/2024