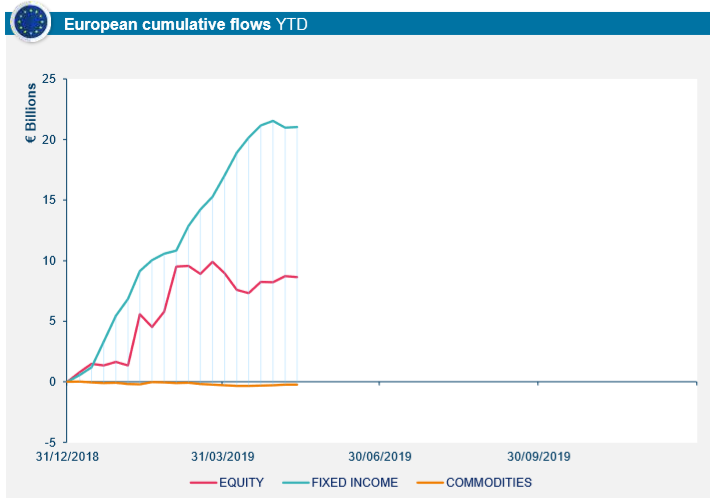

In April, European fixed income ETFs maintained their steady inflows month-over-month, according to Amundi’s monthly flows report. By the end of April, fixed income ETFs in Europe had year-to-date cumulative flows of €21.3bn, significantly higher than equity ETFs with €8.4bn.

Source: Amundi

In comparison, the gap between the two asset classes is far smaller in the US but is still in the favour of fixed income. US equity and fixed income ETFs over the same period pulled in €40.5bn and €41.9bn, respectively.

The month of April saw a significant push for European fixed income ETFs with inflows of €4.3bn which accounts for 20.2% of the YTD flows.

Despite European investors buying €1.2bn worth of emerging market ETFs and €1.5bn of smart beta ETFs, equity ETFs were in the red for April with outflows of €618m. This was caused by Eurozone and North America ETFs losing a total of €3.9bn in April.

Furthermore, commodity ETFs had a difficult time in the US in April as investors sold off €2.1bn worth of ETFs. This left the region’s YTD flow for commodity ETFs €-2.3bn. Globally, the YTD flow is €-2.9bn when including Europe and Asia’s product flows as well.