Since our ancestors first discovered fire millennia ago, civilisation’s continued expansion has been dependent on finding cheap and plentiful energy sources. While much of human history has been dominated by the use of biomass as the primary fuel source, coal during the Industrial Revolution, and oil in the last century, have played a bigger role in meeting our energy needs.

We have doubled our energy consumption over the past 40 years, something that took us a century to do during the 1800s.¹ This growing energy demand, combined with a heavy dependence on non-renewable sources, has been the norm until recently.

Increased climate change awareness and rising levels of greenhouse gas emissions have driven a call to action to curb our dependence on fossil fuels. The current energy transition we are witnessing is driven by our goal to reduce our carbon emissions, whereby innovative technologies are being embraced with an explicit purpose of diversifying our fuel sources.

Diversification within transition

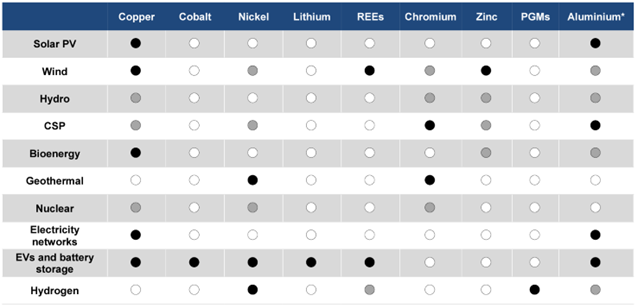

One feature of the IEA’s Energy Transition strategy is the use of metals in various technology solutions to reduce our dependence on fossil fuels. Diverse technologies at play in the shift to low-carbon energy sources require a diversified group of minerals (see Exhibit 1).²

Electrification³ entails demand for metals used in battery technology (lithium, cobalt, nickel), in electric vehicles (copper, aluminium) and in various industrial applications. Increasing use of renewables in our electricity generation requires the input of metals in solar cells (copper, aluminium), wind turbines (copper, rare earth elements) and geothermal power plants (nickel, chromium).

Exhibit 1: Critical mineral needs for clean energy technologies

Notes: Shading indicates the relative importance of minerals for a particular clean energy technology (= high; = moderate; = low). CSP = concentrating solar power; PGM = platinum group metals. *In this report, aluminum demand is assessed for electricity networks only and is not included in the aggregate demand projections.

Source: International Energy Agency

The S&P Global Essential Metals Producers index

The recently launched S&P Global Essential Metals Producers index aims to measure the performance of stocks engaged in the mining or manufacturing of metals essential to the energy transition technologies. In developing this index, we collaborated with the metals and mining group in the S&P Global Commodity Insights (GCI) division.

Index construction

The index selection process targets stocks that use these essential metals in their mining or manufacturing process. We use the FactSet Revere Business Industry Classification System (RBICS) to determine companies that have at least 25% of their revenue generated from businesses linked to these essential metals.

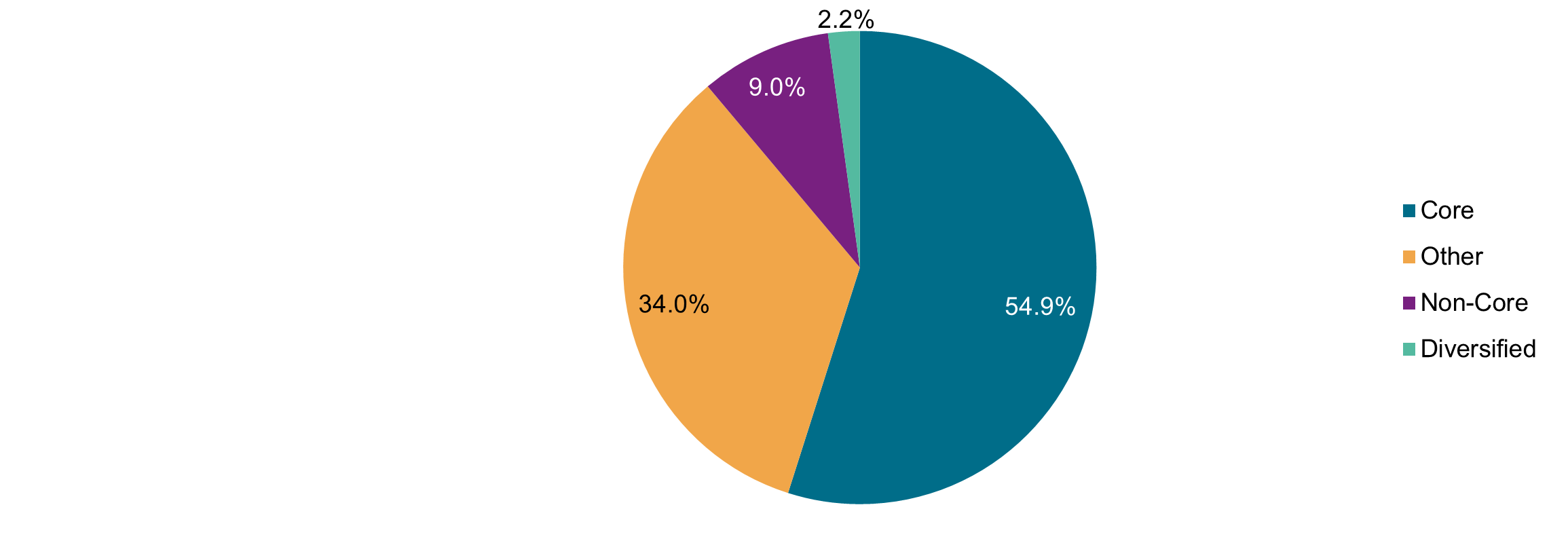

The core focus group of metals – which are expected to see substantial growth in their demand – includes cobalt, copper, lithium, nickel, platinum, palladium and rare earth elements. Revenue segments linked to the core focus group are assigned a revenue adjustment factor of 1 to signify their importance to the theme.

Non-core metals are those considered important inputs to clean energy technologies but are expected to have less demand growth than the core metals group and are comprised of aluminum, molybdenum, manganese, zinc and silver. Their related revenue segments are given a revenue adjustment factor of 0.5.

Metals mining is a capital- and energy-intensive process, and some metals are recovered as a by-product of mining for another metal. The index also captures revenue segments related to these diversified metals producers, where individual metal production is not clearly delineated.

The revenue adjustment factor for these diversified revenue segments is also set to 0.5. To quantify these diversified revenue segments for a company, we employ the S&P GCI dataset that gives us a granular breakdown of a company’s revenue across different metals. Furthermore, the dataset also provides the annual production value of each metal mined by a firm, a unique attribute that helps us better identify specific metal producers even if revenue from these metals might not be accrued for the specific year (e.g. market conditions and price volatility etc.)

Every company in the eligible universe is given a revenue score that is calculated by taking the weighted sum of its revenue percentages in each RBICS segment multiplied by that segment’s revenue adjustment factor. This revenue score in turn is used to assign an exposure score to each company. All companies that have an exposure score of at least 0.5 are included in the final index basket. The index applies a modified float-market-cap weight to its constituents, where each stock’s float market cap is adjusted by its exposure score to arrive at its final index weight.

Additional capping mechanisms are also implemented to reduce concentration risk and enhance the index basket’s liquidity profile.

The following exhibits display some of the key exposures of the index constituents’ basket:

Exhibit 2: Category weight

Source: S&P Dow Jones Indices. Data as of 29 September 2023. The “Other” category includes revenue segments not associated with essential metals-related activities.

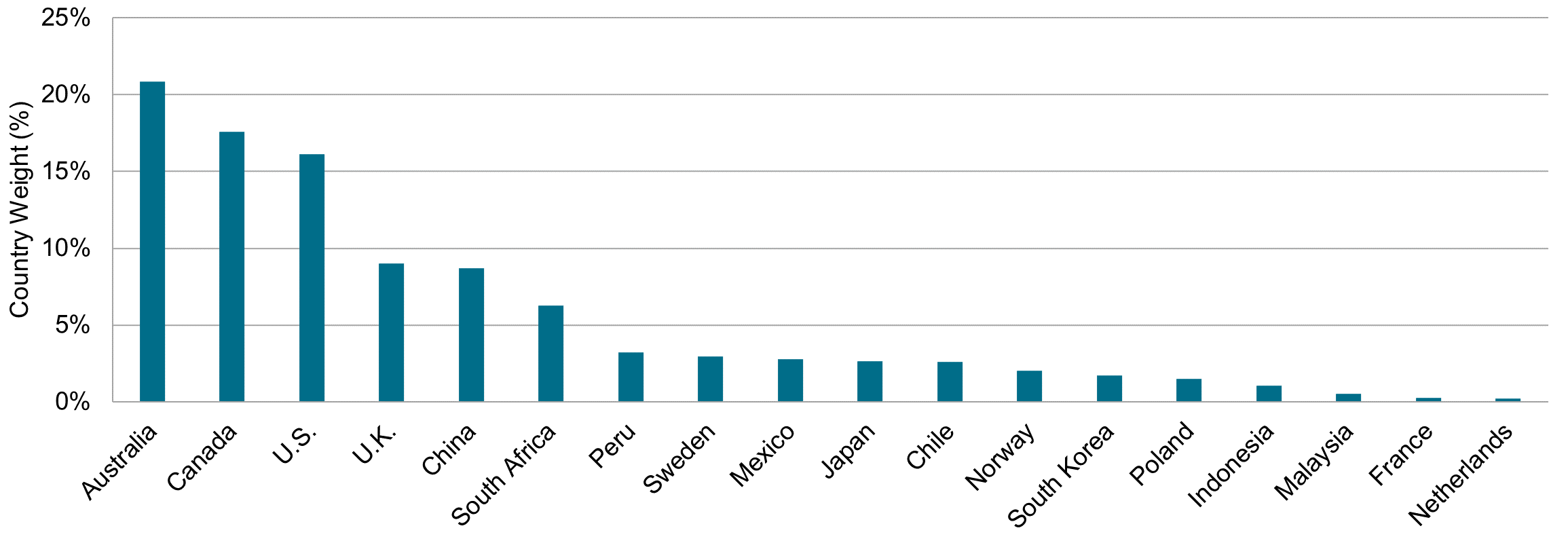

Exhibit 3: Country weight

Source: S&P Dow Jones Indices. Data as of 29 September 2023.

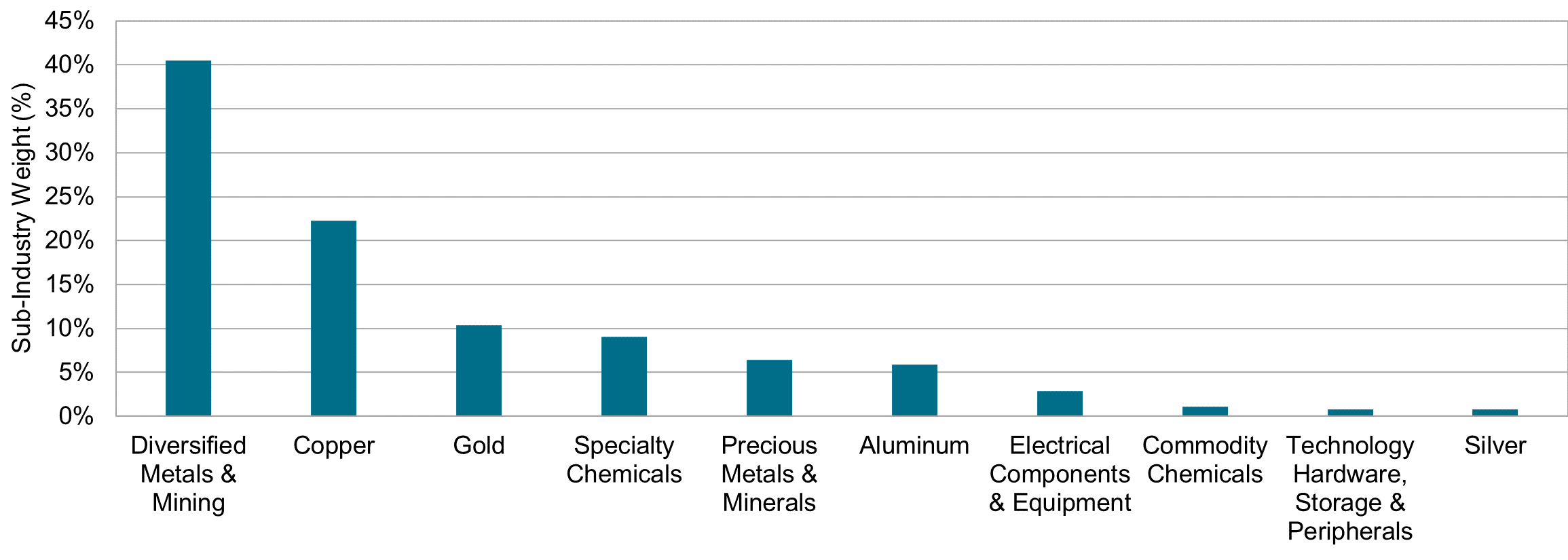

Exhibit 4: GICS Sub-Industry Weight

Source: S&P Dow Jones Indices. Data as of 29 September 2023.

Conclusion

The push toward expanding renewable sources of energy is a unique opportunity that harnesses innovative technologies to address environmental challenges. Metals that are integral to renewable energy technologies are expected to see massive growth in demand.⁴

The S&P Global Essential Metals Producers index tracks and brings together the producers of these diverse metals fueling the energy transition.

Srineel Jalagani is senior director, thematic indices, at S&P Dow Jones Indices

1 Ritchie, Hannah Ritchie, "How have the world’s energy sources changed over the last two centuries?" OurWorldInData.org, 21 December 2021, https://ourworldindata.org/global-energy-200-years

2 "The Role of Critical Minerals in Clean Energy Transitions." International Energy Agency (IEA). May 2021. https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf

3 To learn more about electrification, see https://www.iea.org/energy-system/electricity/electrification

4 "Mineral requirements for clean energy transitions," IEA, May 2021 https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions/mineral-requirements-for-clean-energy-transitions