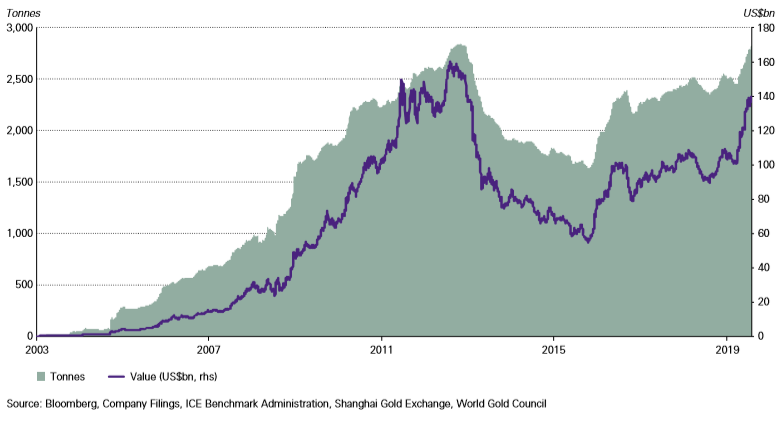

Gold-backed ETF holdings grew by 258 tonnes in Q3, the largest quarterly inflows since Q1 2016, while demand from central banks and physical gold buyers weakened, according to the World Gold Council (WGC).

In comparison, gold ETFs saw outflows of roughly 100 tonnes in Q3 2018 as investors remained bullish before markets turned sour in Q4.

Gold investments, both physical and physically-backed funds, pulled in 408 tonnes for the quarter this year, more than doubling the figure from Q3 2018. Gold ETFs accounted for 63.2% of the quarter’s inflows with gold bars and coins receiving only 150 tonnes.

Despite the value of gold falling slightly below $1,500/oz by the quarter’s end, assets under management in gold ETFs grew by $136m.

The price of gold reached a six-year high in September as a result of overall sentiment towards gold remained positive for the quarter, said WGC.

This has been driven by ongoing global monetary policy, most notably, the Federal Reserve cutting rates and the European Central Bank announcing it would resume quantitative easing.

State Street brings gold MiniShares ETF to Japan

The majority of the funds' inflows came from North America. Funds domiciled in the region saw their assets grow by 185 tonnes for the quarter, accounting for over 70% of the global growth in holdings.

In Europe, holdings rose by 56 tonnes, with UK and German funds receiving the majority of the cash. This was driven by the UK's prospect of a hard Brexit becoming even more likely and the German economy on the brink of a recession.