Passive ownership can cause volatility in underlying securities of an ETF, especially towards the end of the trading today, according to a Goldman Sachs report.

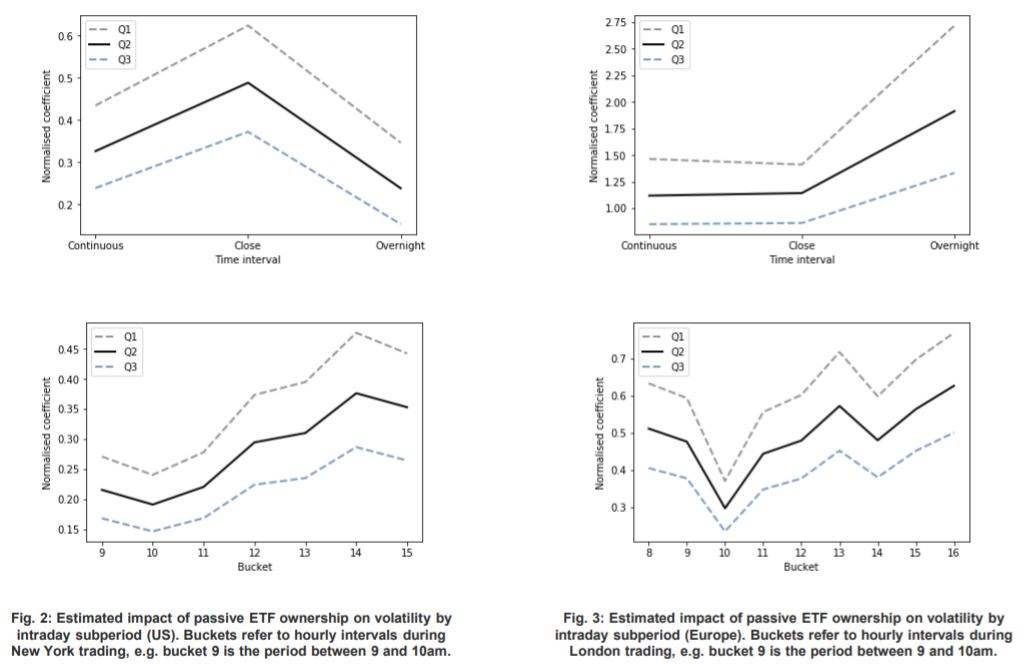

The Goldman report, entitled The Shift from Active to Passive and its Effect on Intraday Stock Dynamics, found the relationship between passive ownership and volatility grew stronger throughout the trading session and became “statistically significant” in the hours prior to the closing auction and in the auction itself.

Outside of continuous trading hours, the report noted US and European markets displayed different traits with US markets showing little relationship between the level of passive ownership and volatility while European equities exhibited a “significant relationship” in overnight trading.

The report explained: "We attribute this difference to the large proportion of over-the-counter trading that characterises European ETF markets and the different mechanics of the closing auction in the two regions.

"Liquidity provision in the close in Europe needs to be compensated by an overnight reversal whereas in the US it occurs during the last minutes of continuous trading on the day."

Furthermore, because the US market remains open for 4.5 hours after the European close, Goldman analysts said this could have an impact on assets managed by European securities as the US ETF market is far larger.

ETF Insight: The rise of ETFs has an unintended consequence

The report also measured the impact of ETF inflows on the volatility of underlying securities.

It found the ETF flow ratio showed a positive correlation for all intraday intervals with the highest correlations reached in the hours before the closing auction.

It concluded: "The finding is that flows into ETFs are positively related to subsequent volatility and the effect becomes increasingly significant towards the end of the trading day.

"Taken together, our results suggest that passive ownership tends to propagate liquidity shocks to the underlying securities and the effect is concentrated at the end of the trading session and in the closing auction."