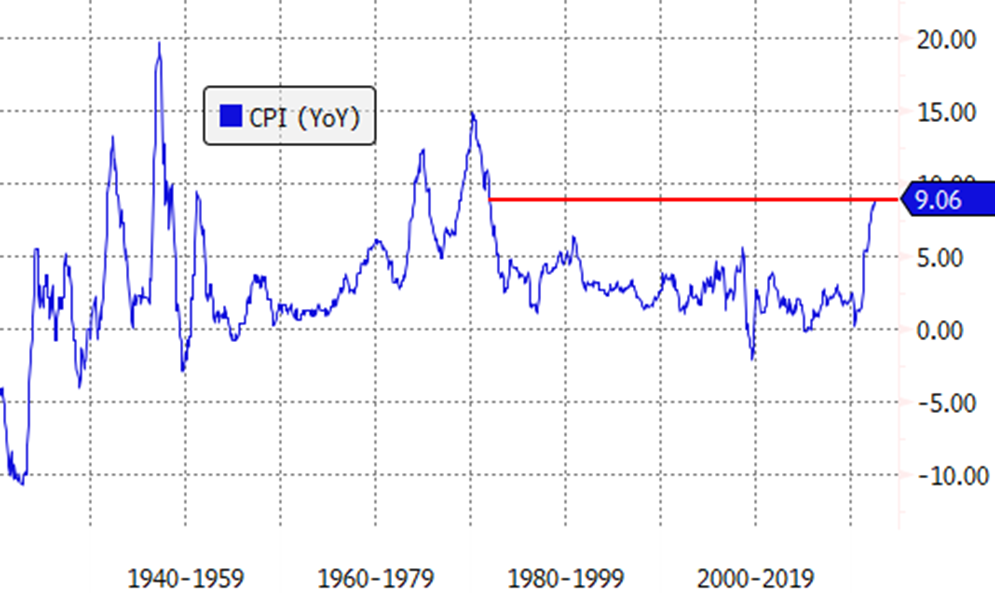

The latest data on US inflation released Wednesday was even worse than what analysts had estimated.

Energy prices were a major culprit for the higher-than-expected number, as gasoline prices alone increased by more than 11% from May to June. Compared with last year, the prices are up 60%.

Food prices were also a contributor, rising 1% from May to June, and 10.4% from last year.

The Labor Department said the Consumer Price Index (CPI) grew 9.1% compared with a year ago in June, accelerating from the 8.6% rate in May, and another 40-year high. The rate was higher than the 8.8% the economists were looking for.

Source: ETF.com

This data will likely keep pressure on the Federal Reserve to hike rates more to try and keep inflation under control.

As Richard Carter, head of fixed interest research at Quilter Cheviot, said: “This disappointment means that a 0.75% hike from the Federal Reserve at their next meeting is an absolute certainty and there may even be pressure from some quarters for them to do more.

“Central banks are clearly struggling to get a handle on inflation and if this number continues to grow or hover around this level then more will be required to drive it down, regardless of the economic consequences this may have.”

Markets were largely unfazed by the data. Though stocks declined sharply, the iShares Core S&P 500 UCITS ETF (CSPX) recovered to finish the session down only 0.5%. The Invesco EQQQ Nasdaq 100 UCITS ETF (EQQQ) fell by 0.2% and the SPDR Russell 2000 US Small Cap UCITS ETF (R2SC) shed 0.09%.

Investors digested the hotter-than-expected print much more easily than last month, when a similar CPI report caused a 3% decline in broad market ETFs. The more muted reaction this time around is likely a reflection of the steep losses that stocks have already suffered. The S&P 500 fell into a bear market in June, days after the previous CPI report was released.

Core prices rise more than expected

When you strip out volatile food and energy prices, the inflation picture does not look much better. The CPI was up 5.9% from last year, which is more than the 5.7%, according to Bloomberg consensus estimates.

The biggest culprit there was the price of shelter, which is the consumer’s biggest expense, increasing 0.6% month over month and 5.6% compared with a year ago.

Probabilities based on fed funds futures suggest the Fed is most likely to hike rates by a full 1% when it makes its next interest rate decision on July 27, which would be the biggest rate increase since the 1980s.

However, most bond ETFs rallied after the CPI data came out, as yields on longer-term Treasuries declined amid fears of a recession.

The iShares US Aggregate Bond UCITS ETF (SUAG) gained 0.36% on Wednesday.

The 10-year US Treasury bond yield sagged 5 basis points to 2.92% while the two-year Treasury bond yield jumped 8 basis points to 3.13%, further inverting the yield curve.

Silver linings

As bleak as Wednesday’s CPI report was, there were a couple of silver linings to consider.

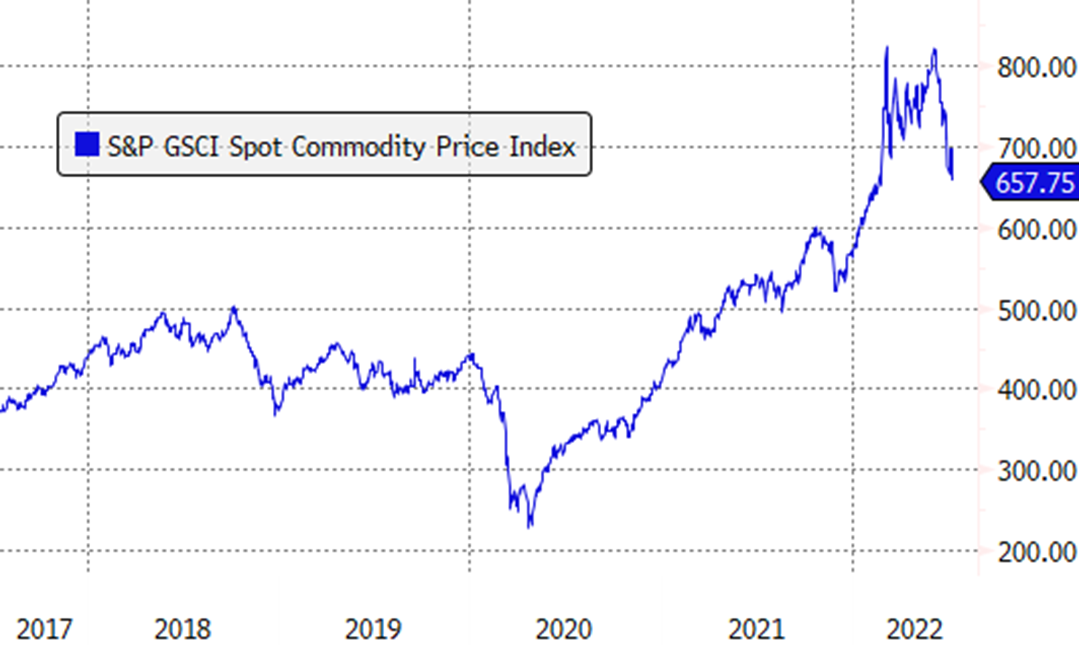

For one, commodity prices have started to come down, so in the coming weeks, that should filter through to the prices consumers pay for energy and food.

Source: ETF.com

Second, the core CPI – which strips out food and energy prices – decelerated for a third month in a row, from a peak of 6.5% in March to 6.2% in April, 6% in May and now 5.9% in June.

That is not much comfort for consumers, investors and the Fed – all of who want to see inflation closer to 2% than 6%. But it is at least a step in the right direction.

This story was originally published onETF.com

Related articles