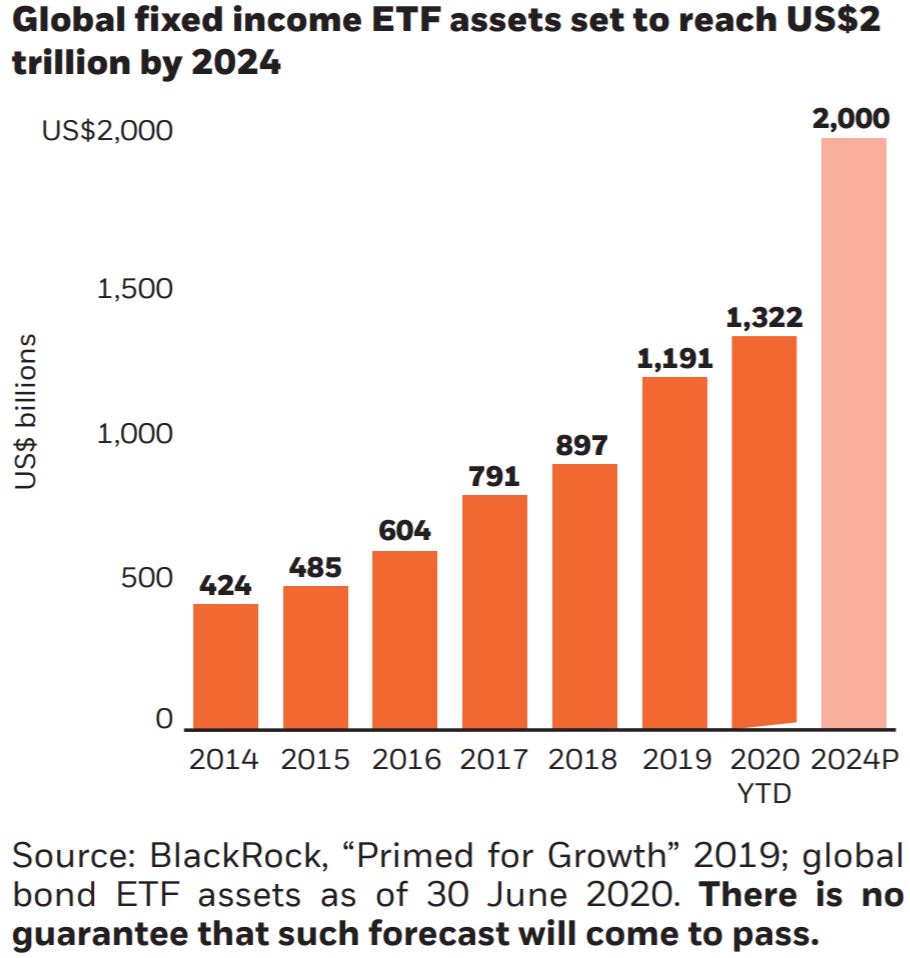

Global fixed income ETFs saw a 30% increase in assets under management (AUM) over the past year as institutional investors accelerate their adoption of the wrapper.

Fixed income ETFs have jumped to $1.3trn AUM, as of 30 June, however, the growth potential remains huge with ETFs accounting for just 1% of the $100trn bond market.

BlackRock has doubled down on last year’s prediction that global fixed income ETFs will hit $2trn by 2024.

According to the world’s largest asset manager, some 60 pension funds, insurers and asset managers were first time buyers of iShares bond ETFs, adding around $10bn assets.

The reason for this, the firm said, is institutional investors are starting to recognise the benefits of ETFs in the fixed income space from a liquidity, transparency and efficiency perspective.

Salim Ramji, global head of iShares and index investments at BlackRock, commented: “The versatility and resilience of the largest and most heavily traded fixed income ETFs, especially through market stresses this year, have made them more central to the construction of institutional investors’ portfolios.

“Accelerated institutional adoption is further recognition that ETFs are modernising the bond markets by increasing overall transparency, improving liquidity, and lowering trading costs.”

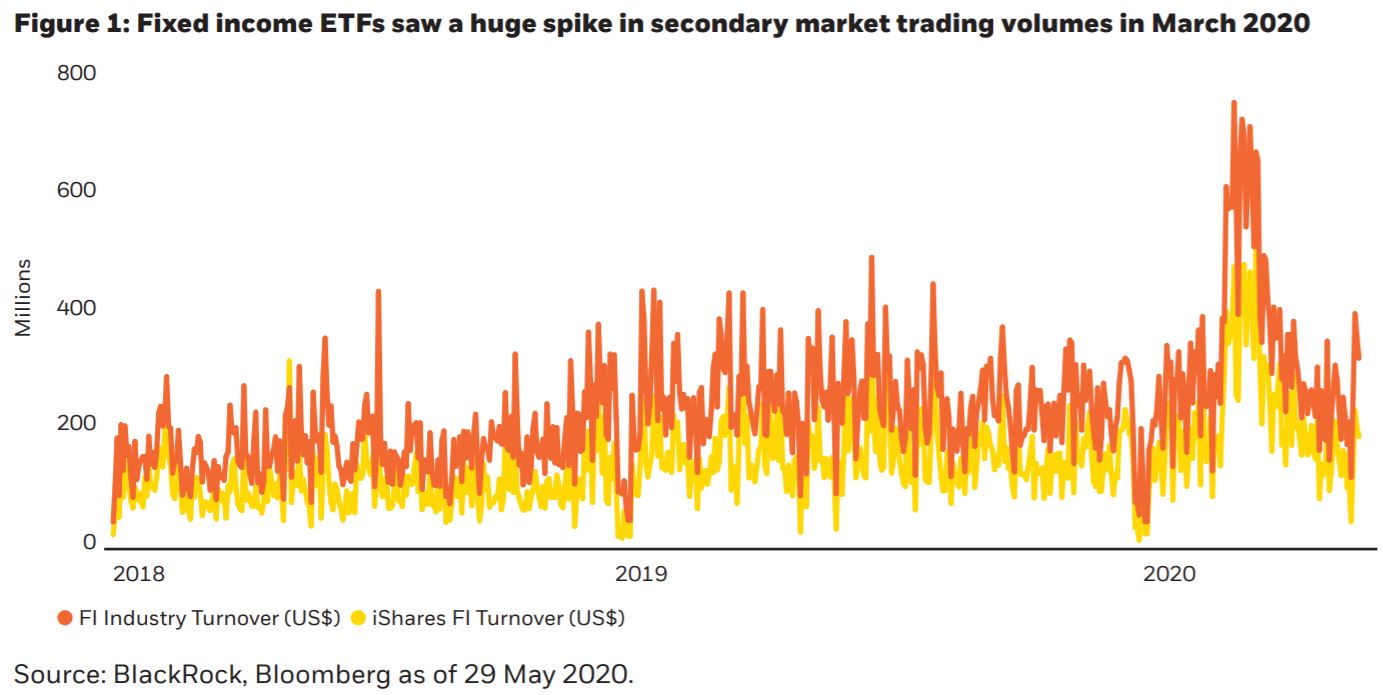

Another factor that has helped drive in the increase in fixed income ETF adoption is how they behaved during the extreme volatility seen in March.

Discounts to net asset values (NAVs) on bond ETFs widened to all-time highs with market participants raising questions about whether ETFs would be able to withstand continuous selling pressure.

However, the discounts seen highlighted the price discovery role ETFs play during periods of market stress compared to the stale NAV prices that were being calculated at end of day.

For institutions, Carolyn Weinberg, iShares global head of product at BlackRock, and co-author of the report, said the episode highlighted that over-the-counter bond trading remains relatively opaque and fragmented.

“By contrast, the largest and most heavily traded fixed income ETFs illustrated the important role that they play in both normal and stressed market conditions by providing invaluable price discovery and liquidity.

“These attributes helped institutional investors understand and navigate rapidly changing market conditions at a time when it was needed most.”

Furthermore, secondary market trading volumes spiked across fixed income ETFs as investors turned to ETFs for liquidity management and tactical allocation purposes, BlackRock said, in a report entitled Turning point: How volatility and performance in 2020 accelerated institutional adoption of fixed income ETFs.

According to BlackRock, investment grade corporate ETFs saw average trading volumes reach $1.67bn in March, versus just $740m in 2019.

Somewhat interesting, Enrico Bruni, head of Europe and Asia at Tradeweb, said the firm saw sustained higher trading volumes in fixed income ETFs following the March volatility.

“There has been a greater understanding and acceptance that fixed income ETFs provide efficient access to the underlying cash bond markets for pricing, data and analytics and trading.”

Weinberg added: “High trading volumes support the notion that fixed income ETFs provided actionable prices for investors at a time when the underlying bond market was challenged.

“The on-exchange market prices for fixed income ETFs reflected both absolute and relative value and helped enable investors to understand rapidly changing market conditions.”

Sign up to ETF Stream’s weekly email here