Corporate fundamentals: Entering 2023 in a position of strength

Early 2022 saw levels of revenue growth that were high to the point of being unsustainable. In both Europe and the US, earnings returned to a more moderate run rate of 9% and 8% year-on-year (y/y) respectively in Q3 2022. Positively, the overall growth rate is still above long-run averages. Despite an inflationary environment, margins have remained stable in Europe at 13%, triggering further improvements with net leverage falling to 1.7x, below the pre-COVID-19 level of 2.1x. Operating margins for US investment grade (IG) declined slightly to 14% and net leverage has risen slightly to 1.9x but remains below its pre-COVID-19 high of 2.2x.

On a sector-by-sector basis, the number of industries where the fundamental outlook is negative is exceeding those with a positive view for the first time since before COVID-19, suggesting some caution is warranted as we move into the new year. Despite this, we see opportunity in a number of sectors and have conviction in high-quality names.

Looking forward, IG corporate health remains in a relatively robust position. Historically in the later parts of the cycle, corporate debt growth begins to rise sharply, creating challenges for credit investors as they attempt to navigate the downturn. Since the COVID-19 pandemic, company managers have continued to adopt a conservative approach to managing balance sheets and have subsequently limited overall debt growth. Regardless of the economic reality of 2023, IG corporates have entered this year in a position of strength with some of the lowest gross debt growth since the Global Financial Crisis.

Dodging downgrades

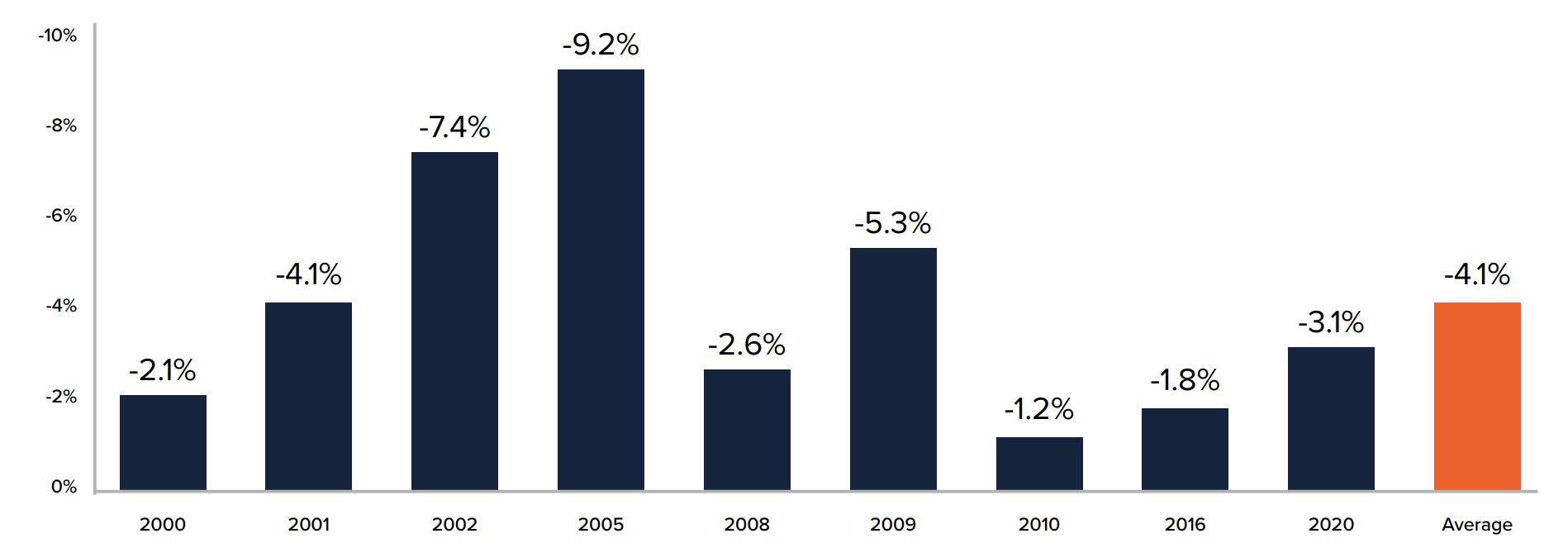

During recessionary periods, investors need to be mindful of potential “fallen angels” – issuers that are downgraded from investment grade to high yield following a deterioration in their credit fundamentals. Since 2000, IG credit has undergone nine credit bear markets. Historically during credit bear markets, on average 4% of the US investment grade universe has been downgraded to high yield. However, not all downgrade cycles are made equally.

During 2020, the level of downgrades has been relatively muted as loose monetary policy and generous fiscal programmes have helped mitigate the impact on credit markets. In the coming downturn, the total number of downgrades could look closer to the long-run average of 4% as stubbornly high inflation prevents policymakers from significantly easing financial conditions. However, strong corporate balance sheets are likely to make IG credit more resilient to an economic downturn despite limited policy support.

A technical glimmer of hope

A theme with potential to continue into Q1 is the return of inflows to the asset class, as some of the highest all-in yields since the summer of 2009 offer an attractive entry point.

Over the course of 2022, US IG has experienced total outflows amounting to $157bn over the year, according to EPFR, as of 31 December 2022. Since 2010, there has been significant relationship between retail flows and returns. When returns turn negative outflows typically follow but when returns begin to look positive again investors typically come back to the asset class.

However, as of mid-December 2022, inflows have shown some signs of bucking this historic trend as the attractive all-in yields have offered investors a more interesting entry point into the asset class. If this trend continues, it should offer a more stable technical backdrop for IG corporates in 2023.

Chart 1: Percentage of US IG index downgrade to high yield during credit bear markets

Source: JPMAM, Barclays

More spread widening to come?

While all-in yields do look historically attractive, investors need to be mindful of volatility in spreads as we approach the later part of the economic cycle. Once the US Treasury curve inverts (typically measured by the 2s10s spread), corporate spreads can trade within a wide range, but they typically do not peak until the economy is in recession. Currently, spreads in the US IG market are pricing in a relatively low probability of recession suggesting that as growth slows, spreads may widen further from here, but it may take some time for markets to adjust to the economic reality.

In this environment, opportunities might also lie in taking advantage of the current shape of the yield curve to implement carry-and-roll trades.

In Europe, the 10-year and shorter portion of the euro corporate bond market look attractive. Meanwhile in US IG, the five-10-year part of the curve screens particularly well. Moving into 2023, we think there are opportunities to be found in IG corporates.

Enhance your core: JPM Corporate Bond Research Enhanced Index (ESG) ETFs

Our JPM Corporate Bond Research Enhanced Index (ESG) ETFs* (CREIs) focus on efficiently replicating the risk profile of the credit investment universe whilst adding value predominantly through security selection. By systematically incorporating our proprietary security rankings produced by our credit research analysts, we aim to tilt the portfolios towards issuers we believe will outperform away from those we think will underperform, particularly issuers at risk of being downgraded. This approach can help investors navigate these challenging markets by avoiding the losers rather than just picking the winners.

The CREI range includes three exposures investing in EUR, EUR 1-5yr and USD Corporate Bonds*. Our credit scoring approach incorporates financially material, environmental, social and governance (ESG) considerations into its assessment of individual issuers. The JPM Corporate Bond Research Enhanced Index (ESG) ETFs* are classified as Article 8 under the SFDR regulation, due to the exclusion of controversial industries and integrating financially material ESG factors throughout the investment process.

This article was first published inFixed Income Unlocked: After The Storm, an ETF Stream report

Disclaimer

* FOR BELGIUM ONLY Please note the acc share class of the ETF marked with an asterisk (*) in this page are not registered in Belgium and can only be accessible for professional clients. Please contact your J.P. Morgan Asset Management representative for further information. The offering of shares has not been and will not be notified to the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten/ Autorité des Services et Marchés Financiers) nor has this document been, nor will it be, approved by the Financial Services and Markets Authority. This document may be distributed in Belgium only to such investors for their personal use and exclusively for the purposes of this offering of shares. Accordingly, this document may not be used for any other purpose nor passed on to any other investor in Belgium.

JPMAM defines ESG integration as the systematic inclusion of financially material ESG factors amongst other factors in our investment decisions with the goals of managing risk and improving long-term returns. ESG integration does not change a strategy’s investment objective, exclude specific types of companies or constrain a strategy’s investable universe.

FOR PROFESSIONAL CLIENTS/ QUALIFIED INVESTORS ONLY – NOT FOR RETAIL USE OR DISTRIBUTION.

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. There is no guarantee that any forecast made will come to pass. The latest available Prospectus, the Key Investor Information Document (KIID), any applicable local offering document and sustainability-related disclosures are available free of charge in English from your J.P. Morgan Asset Management regional contact or at www.jpmorganassetmanagement.ie. A summary of investor rights is available in English at https://am.jpmorgan.com/lu/investor-rights. J.P. Morgan Asset Management may decide to terminate the arrangements made for the marketing of its collective investment undertakings. Purchases on the secondary markets bear certain risks, for further information please refer to the latest available Prospectus. Our EMEA Privacy Policy is available at www.jpmorgan.com/emea-privacy-policy. This communication is issued in Europe (excluding UK) by JPMorgan Asset Management (Europe) S.à r.l. and in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority.

09j1231801094014