As we near the halfway point of 2023, we consider some very interesting ideas for investors in light of the most recent developments both on a geopolitical level and within financial markets.

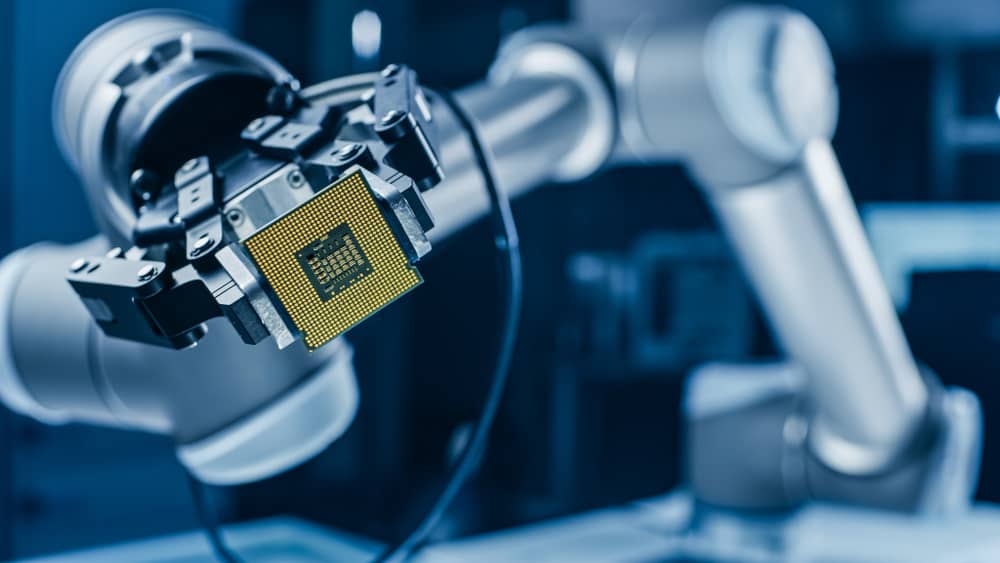

The first opportunity that we see is represented by semiconductors, which could propel the so-called fourth industrial revolution. The recent news about AI tools such as ChatGPT growing rapidly boosted semiconductor stocks, which look poised to benefit from such an evolution.

This was remarked by Nvidia CEO Jensen Huang after its latest earnings report that displayed strong company results and sent the stock soaring. Semiconductors are in fact the key enablers of digitalisation and AI solutions should increase their demand further.

They also remain vital parts of smartphones, laptops and cars as well as security and defense applications. It is not an overstatement to say the modern digital economy depends on them, just like national security does.

A strategy focused on semiconductors, offering exposure to the largest and most liquid players in the space, could represent an interesting way to play this trend, keeping a diversified and pure-play approach.

This means that only companies that derive a significant portion of revenue from the theme are included. Semiconductors remain in their nature cyclical and subject to the economic cycle; accordingly, investors should expect drawdowns during periods of economic slowdown.

Another interesting investment opportunity lies in gold. Although rates might remain high for a prolonged time, as signaled on multiple occasions by the Federal Reserve and other central banks, and the US dollar still shows signs of strength on an historical basis, there are other factors to consider.

High interest rates might provoke other systemic risks, such as with the pension funds in the UK in October and in March with the US banking systems. Other black swan events cannot be excluded.

Furthermore, significant geopolitical risks stemming for example from the Russia-Ukraine conflict are still well present. We believe investors could consider an allocation to gold miners who display a high correlation with gold’s price movements and, thanks to the use of leverage, tend to amplify its movements.

Clearly, this applies in both directions and should be carefully considered by investors. A strategy on the gold mining sector could provide such an exposure.

Moreover, the more mature and stable companies have carried out regular distributions to shareholders in the form of dividends or share buybacks. After the per-ounce production costs spiked in 2022, receding inflation could help miners expand margins and profitability metrics again.

Risks to be monitored by investors include sector concentration risk and risk represented by companies involved in the basic materials sector.

The last idea we would like to present focuses on dividend leaders, namely companies characterised by an established and proven track record of distributions. A strategy focused on dividends, that screens such companies with a more sophisticated approach than simply looking at the dividend yield, could prove useful.

Other factors like payout ratio and years of dividend growth play an important role in identifying dividend leaders and avoiding the so-called dividend traps. Clearly, there is no guarantee that companies that paid dividends in the past will keep doing so in the future.

Important Disclosures

For informational and advertising purposes only.

This website originates from VanEck Asset Management B.V., a UCITS Management Company incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck Asset Management B.V. and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. All indices mentioned are measures of common market sectors and performance. It is not possible to invest directly in an index.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck Asset Management B.V.