The S&P 500 is a household name, often referenced by advisers, clients and investors when we talk about “the market”.

In turn, it is likely to be their frame of reference when assessing their portfolios’ returns. But this does not mean it is the most appropriate yardstick to measure your portfolio’s performance.

The S&P 500 is diversified in the sense that it holds equity from 500 or so different companies that fall all across the value and growth spectrum. But when it comes to the universe of investable assets, it is only a small slice of the market.

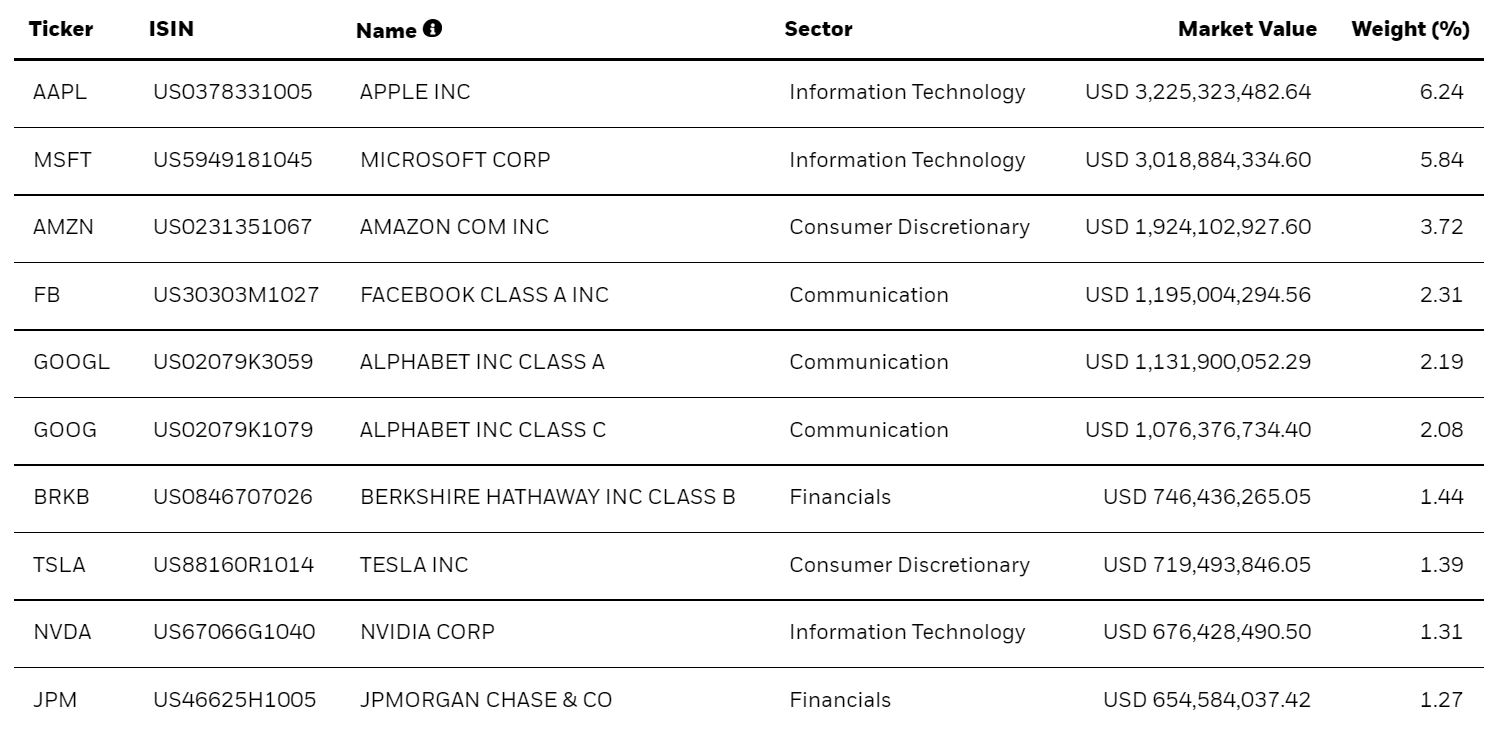

It offers exposure to domestic, large-cap names – that is it. And since it is market cap weighted, performance is mostly driven by the mega-cap names that have the largest weighting in the index.

Chart 1: Top 10 holdings of the iShares Core S&P 500 UCITS ETF (CSPX), as at 16 August

Source: BlackRock

The S&P 500 does not include mid or small-cap equities, international equities, fixed income or commodities. These are all asset classes that could be part of a client’s portfolio – and for good reason.

Modern portfolio theory tells us that risk-adjusted returns can be maximised through diversification. It is the investing equivalent of the saying “do not put all your eggs in one basket”.

Why we diversify

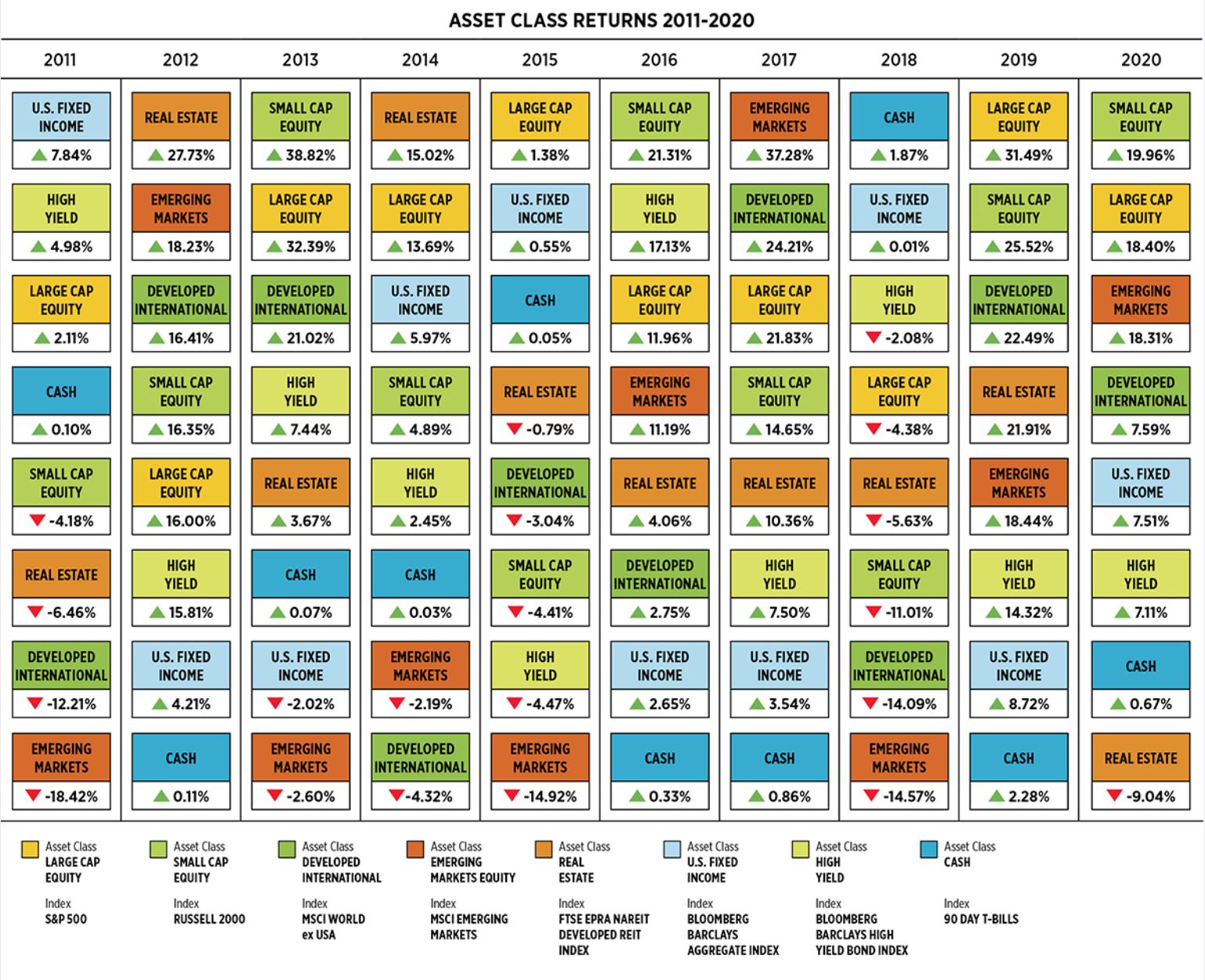

Though large cap equities – as represented by the S&P 500 – have had a good run as of late, they are not always the best-performing asset class. The following chart shows returns for all major asset classes over the last 10 years.

Source: ETF.com

The S&P 500 was the best-performing asset class in 2015 and 2019. But in other years, it has been bested by several other asset classes. In 2017, for example, the MSCI Emerging Markets index outperformed the S&P 500 by 15.5%.

Along with the disparate returns experienced on an annual basis by various asset classes, the other thing to keep in mind is that nobody can predict what will happen in the markets. And as we all know, past performance is no guarantee of future returns. As evidenced by the chart above, today’s winner could be tomorrow’s loser.

Even the smartest asset managers and investment strategists can offer their best guesses on how to allocate a portfolio. But at the end of the day, building a diversified portfolio is the best way to smooth out returns and offer the best chance of meeting investment goals in the long run.

Diversified benchmarks needed

Except for the youngest, most aggressive investors, it is likely that at least some of the portfolio is invested in something other than equity. By using an equity benchmark such as the S&P 500 as your yardstick, it is difficult for a portfolio with any fixed income to keep up in environments where domestic stocks are generally trending up.

On the other hand, such portfolios will often outperform when these stocks experience a downturn. But this outperformance will be driven by asset allocation – it is not necessarily an indication that the funds within the portfolio are performing well, an important consideration if these funds are active.

To truly assess the performance of a diversified portfolio, you need to compare apples to apples. You need a diversified benchmark.

S&P 500 alternatives

There are several different options when considering a diversified benchmark for your portfolio. Investors should give consideration to their unique objectives and needs when planning how to evaluate performance.

There is no single index that investors can use to get a feel for how a portfolio of domestic stocks, international stocks and fixed income is performing. But investors can create their own blended benchmark, aligning with the asset allocation of the portfolio.

While there are tools that can be used to create these blended benchmarks that will also bring things like rebalancing frequency into account, it is also possible to use a simple weighted average.

For example, a portfolio that is 40% domestic large cap stocks, 30% international equities and 30% fixed income could be assessed by taking a weighted average of the S&P 500, MSCI EAFE and Bloomberg Barclays Aggregate.

Weight

Benchmark

2020 Return

40%

S&P 500

18.40%

30%

MSCI EAFE

8.30%

30%

Bloomberg Barclays Aggregate

7.50%

Weighted Average

12.10%

Apples to apples

The weighted average of 12.1% is a more appropriate guideline for how the portfolio should have performed in 2020 rather than the 18.4% performance by the S&P 500 during that year.

Another option is to use an ETF that has a similar asset allocation, such as the iShares Core Growth Allocation ETF (AOR). AOR is approximately two-thirds equity, split among various cap ranges and regions. The remaining third is allocated to fixed income.

The ETF’s 11.4% return for the calendar year 2020 would be a fairer yardstick against which to measure a portfolio with a similar allocation, rather than the S&P 500 return.

Though there are many different routes one could take in selecting a benchmark for a portfolio, the bottom line is that investors should take care that they are not comparing apples to oranges.

A large-cap equity benchmark should not be the guidepost for assessing their diversified portfolio, even if it is the index most often referenced in the news.

This story was originally published on ETF.com