Regardless of a nuclear fusion reactor achieving net positive energy for the first time, which could make uranium-based nuclear fission obsolete within decades, the Sprott Uranium UCITS ETF (URNM) remains my ETF launch of the year.

Commercial-scale fusion power will not be available until the mid-2030s at the earliest. In the meantime, we have more than a decade of green transition to enact amid an inflection point for Europe as it pivots away from Russian oil and gas reliance.

URNM’s launch was perfectly timed to capture the convergence of these macro events which pushed the case for expanded nuclear capacity in the near term.

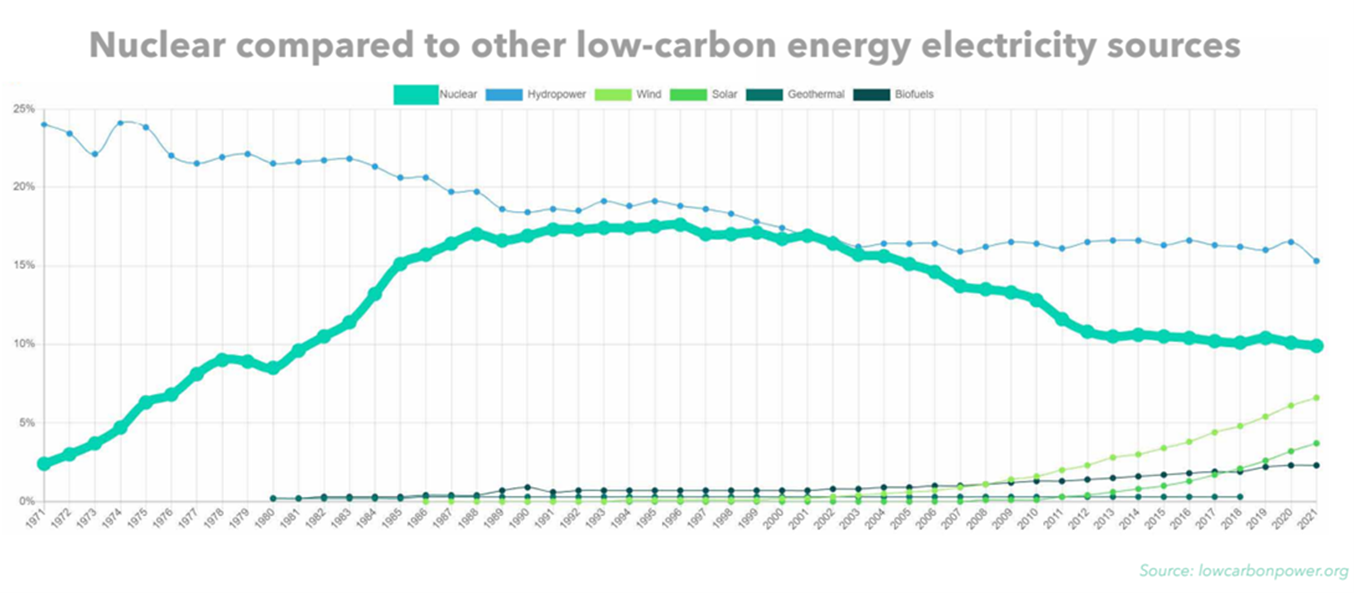

In fact, the International Energy Agency said nuclear capacity needs to double for Net Zero 2050 targets to be met while BNP Paribas Wealth Management CIO Edmund Shing previously told ETF Stream Europe must adopt nuclear or face “energy rationing” to achieve base load energy in line with climate goals.

European regulators have already been quick to act in shaking up the continent’s energy mix, with the €315bn REPowerEU package setting out the role of nuclear fission as an important interim source to 2030, while playing a longer-term role in fossil-fuel-free hydrogen production.

From January 2023, nuclear industries will also be included in the EU’s Taxonomy of sustainable activities, meaning some sub-sectors will be categorised under the green segments of the Sustainable Finance Disclosure Regulation (SFDR), making them eligible for ESG investment products.

Action is also taking place on a single-country level, with France and the UK committing a total of more than €70bn to new reactors while Germany and Belgium are considering extending the lifespans of their existing plants.

Outside of Europe, the US offered tax credits to existing reactors as part of the $385bn Inflation Reduction Act in August and in a surprising turn of events, Japan is planning to restart its reactors for the first time since the Fukushima disaster more than a decade ago.

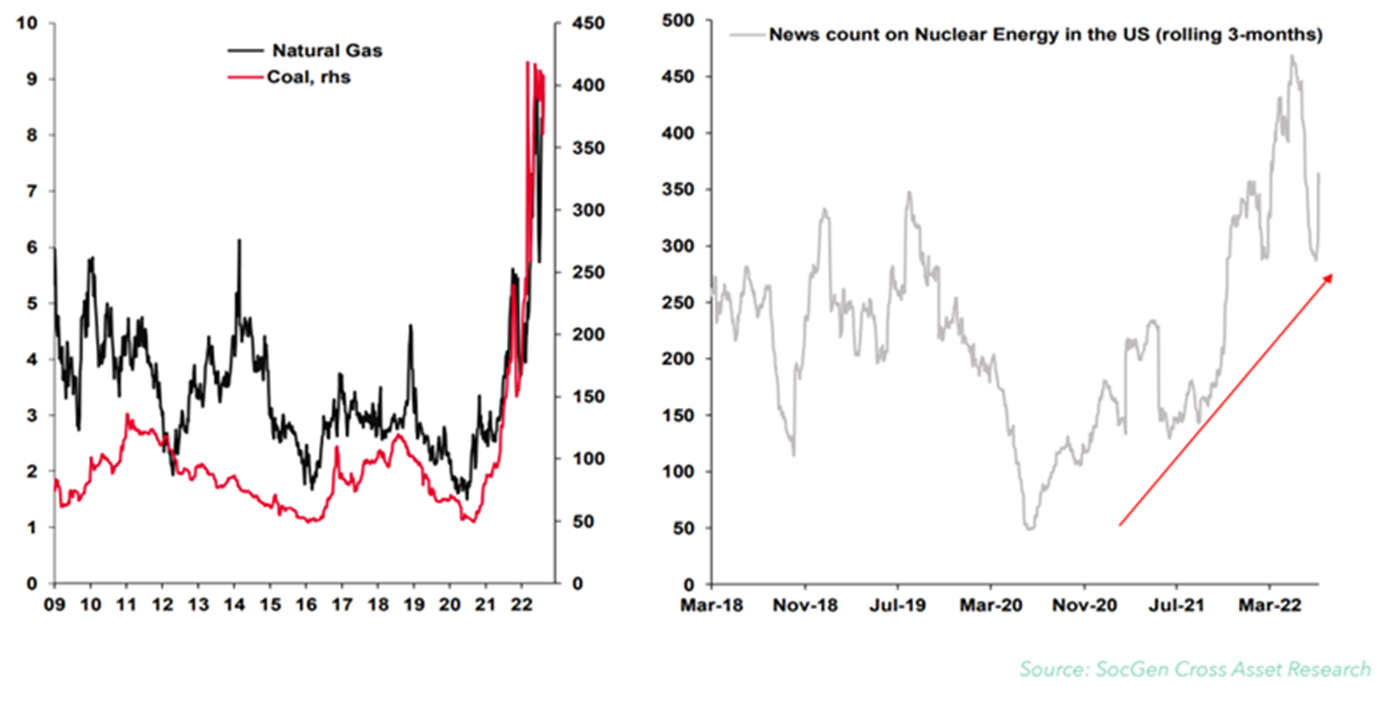

After a decade of being shunned by many countries, this sudden burst of demand prompted by surging energy costs instantly creates a deficit in the supply of uranium.

In a recent ETF Stream webinar on the nuclear investment opportunity, Sprott Asset Management CEO John Ciampaglia said: “The world’s 434 nuclear reactors need 180 million pounds of uranium every year for fuel and last year, all the mines globally only produced 130 million pounds.

“That number will slowly go up as mines come back online but we still have a supply deficit. This is where the investment thesis comes into play,” he continued. “The only way you are going to feed these nuclear plants with more fuel is to produce more uranium which is bringing capital flows into the sector.”

At $48.4 a pound on 14 December, the price of uranium has shot up 9.8% in a year incentivising mining companies to reopen mines and sell contracts to utility companies, shoring up supply agreements in the longer term.

While just shy of decade-highs, the current price of uranium is little over a third of the brief highs of $140 a pound hit back in 2007, meaning further upside is not outside the realms of possibility as nuclear capacity expands from currently low levels.

Until eight months ago, there was no ETF with exposure to this investment trend in Europe, since the ETFS WNA Global Nuclear Energy GO UCITS ETF (NUKE) closed in 2014. That changed in April with the arrival of the Global X Uranium UCITS ETF (URNU) and Sprott’s UNRM shortly after.

While UNRU was first to market, URNM has the edge for pure uranium exposure, given Global X’s strategy offers a nuclear value chain play, capturing stocks involved in engineering and utilities such as Mitsubishi Heavy and Daewoo Engineering and mining companies which “do not derive a significant percentage of revenues” from uranium, including BHP and Rio Tinto.

URNM, meanwhile, tracks the North Shore Sprott Uranium Miners index of 36 companies, 82.5% of which are uranium miners and 17.5% physical uranium trusts tracking the metal’s spot price, giving it a pure-play exposure to uranium.

With an uncertain geopolitical picture, the need to decarbonise and energy storage facilities not scaled enough to meet demand, fossil fuels and renewables both have notable drawbacks for the coming years. If governments opt for the nuclear alternative, URNM allows investors to access the metal fuelling this atomic renaissance.

Related articles