Silver ETFs are powering towards all-time highs, thanks to WallStreetBets.

Silver ETFs trading in Japan and Australia opened 10% higher, as they became the latest target of the runaway Reddit forum.

In Japan, the Mitsubishi Japan Physical Silver ETF (1524) opened 9% higher. While in Sydney, the ETFS Physical Silver ETF (ETPMAG) opened 10% higher.

Mitsubishi's Tokyo-listed silver ETF has surged

In the United States, the major exchanges remain closed. However call options on the largest silver ETF – the iShares Silver Trust (SLV) – have flown off the shelf in recent days. Open interest in silver futures and options has also surged, according to data from CME Group.

Even shares in some silver mining companies have rocketed upwards.

The reasons driving WallStreetBets sudden interest in silver remain ambiguous. On the surface it seems like just another short squeeze: silver futures have been heavily short sold in recent months. (However some of the short-selling is just the result of dealer banks hedging--meaning short selling is not ipso facto an indicator of banks making downbeat wagers on the silver price.)

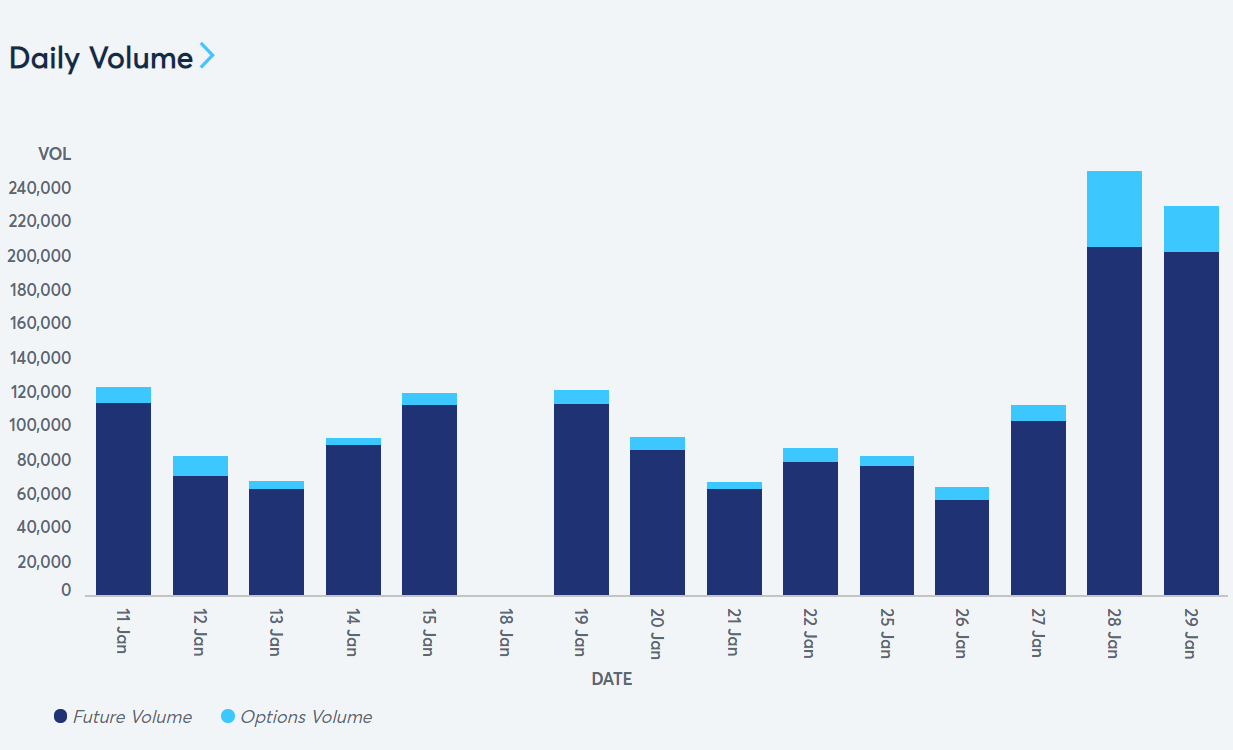

Open interest in silver derivatives has spiked. Source: CME

But some Reddit users claim that a silver surge is intended to punish investment banks like JP Morgan, who, they claim, have rigged silver prices in the past.

Examining GameStop's 'significant' impact on ETFs

Other Reddit users, meanwhile, caution against squeezing silver. They argue that Citadel, the hedge fund that pays Robinhood to trade against its retail investor clients and major “bad guy” in the eyes of some Reddit users, would benefit from a squeeze as they have a major holding in SLV.