There has been a considerable shift in the investing, trading and execution landscape since the Global Financial Crisis (GFC), according to a report by the Jeffries prime brokerage team.

The report, entitled When The Market Moves The Market, said a key driver of this change has been the fragmentation of exchanges over this period.

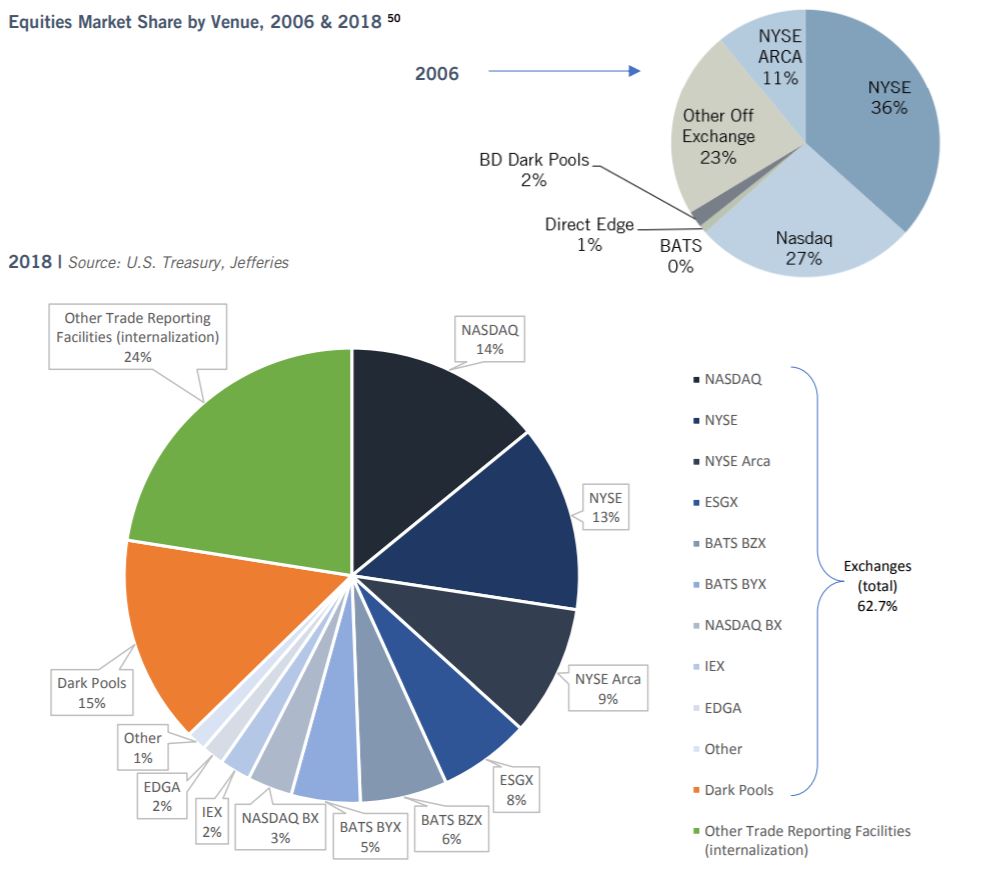

In 2006, the New York Stock Exchange accounted for 36% of equity trades while the NYSE ARCA and the Nasdaq was 11% and 27%, respectively.

Fast-forward to 2018 and the landscape is somewhat different. The NYSE’s market share has fallen to 13% while there has been a significant rise in the amount of dark pool trading, jumping to 15% in 2018 from 2% in 2006.

Furthermore, the introduction of MiFID II at the start of 2018 has led the launch of systematic internalisers, which deals on its own account when executing client orders outside a regulated market, an MTF or an OTF.

These changes, the report said, are having an impact on liquidity. “There are an increasing number of venues on which traders can seek or offer liquidity – resulting in potential ongoing siloing of where transactions can occur, as well as potential division of liquidity in periods of acute stress.

“While the vast majority of transactions still happen on the largest and most liquid exchanges, patterns of use vary across stressed or other acute periods,” it added.

Over this period, it is well documented the rise of passives. Since 2007, the number of passive managers has increased from 12% to 20% while active management accounts for 30% of the market, down from 53%. High frequency trading has jumped to 50%, from 35%.

Passive funds assets under management (AUM) has exploded to over $5trn globally.

This is in contrast to non-rules based participants which account for less than 30% of daily trading volume according to research and consulting firm Tabb Group.

“Much of this piece focuses on the global equity markets, but the changes in the currency, commodity, fixed income or derivative markets have been no less severe.

“We do not take a stand on whether these changes have been positive or negative; rather, that in aggregate they result in a considerable shift in investing over the last decade.”